Uber started, Rivian lowered: Leading analyst picks from Wall Street

By:101 finance

Today's Key Wall Street Analyst Actions

Stay updated with the most influential analyst moves and research notes making waves across Wall Street. Below is a summary of the top upgrades, downgrades, and new coverage initiations that investors should be aware of today, as gathered by The Fly.

Top 5 Analyst Upgrades

- Okta (OKTA): Stephens has raised its rating to Overweight from Equal Weight, increasing the price target to $120 from $97. The firm highlights a rising likelihood of accelerated growth in 2026 and sees a favorable risk/reward profile.

- Global Payments (GPN): Seaport Research has upgraded the stock to Buy from Neutral, setting a price target of $109. The analysts expect the Fintech sector to recover this year after a volatile 2025, noting that valuations are reasonable and fundamentals are solid for most companies in the space.

- Prologis (PLD): Scotiabank has moved its rating up to Outperform from Sector Perform, raising the price target to $146 from $133. The firm is now more optimistic about the Industrial REIT subsector ahead of Q4 earnings and has increased its earnings projections for Prologis due to improved occupancy forecasts.

- Fabrinet (FN): Barclays has upgraded Fabrinet to Overweight from Equal Weight, with a new price target of $537, up from $499. The firm believes Fabrinet offers the greatest revenue growth potential among distributors for 2026.

- Cintas (CTAS): Wells Fargo has boosted its rating to Overweight from Equal Weight, lifting the price target to $245 from $205. Despite share price compression in 2025, Wells Fargo expects Cintas to demonstrate strong fundamentals in 2026, supported by its pricing power.

Top 5 Analyst Downgrades

- Rivian (RIVN): UBS has lowered its rating to Sell from Neutral, though the price target rises to $15 from $13. The downgrade is attributed to what UBS sees as overly optimistic expectations for the upcoming R2 launch.

- Warner Bros. Discovery (WBD): Guggenheim has cut its rating to Neutral from Buy, raising the price target to $30 from $25. The firm cites uncertainty following the board's support for a Netflix (NFLX) offer and Paramount's (PSKY) legal action related to its $30 per share bid, which tempers confidence in further bids.

- Tapestry (TPR): Jefferies has downgraded the stock to Hold from Buy, with a reduced price target of $138 from $142. The change follows a shift in analyst coverage and reflects a more balanced risk/reward outlook after recent share gains.

- BlackRock (BLK): TD Cowen has moved its rating down to Hold from Buy, lowering the price target to $1,209 from $1,407. While the firm remains positive on BlackRock long-term, it notes a lack of near-term catalysts as 2026 approaches.

- KKR (KKR): TD Cowen has also downgraded KKR to Hold from Buy, with a new price target of $131, down from $146. The firm is adjusting its stance ahead of Q4 results, citing a more complex macro-to-fundamental outlook across the sector.

Top 5 New Analyst Coverages

- Uber (UBER): BNP Paribas has started coverage with an Outperform rating and a $108 price target. The firm considers Uber a leader in mobility and delivery, even as autonomous vehicles become more prevalent.

- DoorDash (DASH): BNP Paribas has initiated coverage with an Outperform rating and a $280 price target. DoorDash is seen as a major player in food delivery, and despite a high valuation, is expected to benefit from continued strong execution.

- Snap (SNAP): BNP Paribas has begun coverage with an Underperform rating and an $8 price target. The firm points to ongoing declines in the U.S. and weak growth in Europe, and is watching for signs that investments are boosting monetization.

- AppLovin (APP): Evercore ISI has initiated coverage with an Outperform rating and an $835 price target. AppLovin is described as the leading ad tech platform for mobile gaming, with a growing presence in e-commerce, and is expected to maintain strong revenue and EBITDA growth through 2028.

- Hyatt (H): Goldman Sachs has resumed coverage with a Buy rating and a $198 price target. The firm believes Hyatt is well-positioned to benefit from strength among higher-end consumers.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

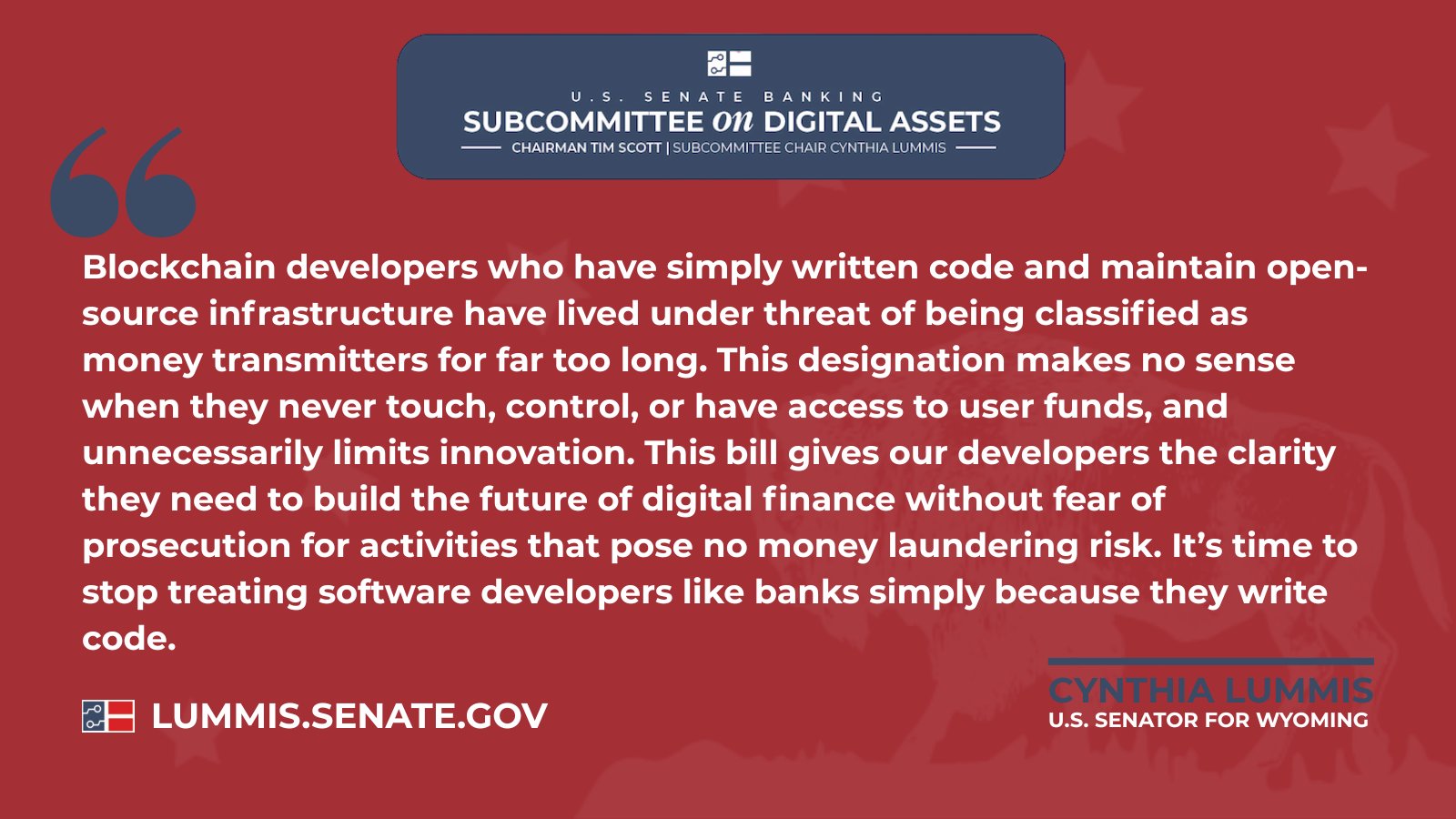

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

AMBCrypto•2026/01/17 10:03

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

BlockchainReporter•2026/01/17 10:00

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com

Kriptoworld•2026/01/17 09:51

TRON Holds Long-Term Ascending Channel as Weekly Trend Stays Firm

Cryptotale•2026/01/17 09:48

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$95,205.8

-0.33%

Ethereum

ETH

$3,298

-0.20%

Tether USDt

USDT

$0.9995

-0.01%

BNB

BNB

$942.37

+0.77%

XRP

XRP

$2.06

-0.09%

Solana

SOL

$144.51

+1.06%

USDC

USDC

$0.9997

-0.01%

TRON

TRX

$0.3111

+1.26%

Dogecoin

DOGE

$0.1374

-1.34%

Cardano

ADA

$0.3953

+1.06%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now