Chinese Antitrust Investigation Causes This Travel Stock to Tumble—Key Information for Investors

Main Points

- Trip.com’s stock price plunged on Wednesday following news that Chinese authorities are examining the company for alleged monopolistic practices.

- The online travel agency, headquartered in Singapore, stated it will fully cooperate with the regulatory inquiry.

News of a regulatory investigation in China led to a sharp decline in a major travel company’s shares on Wednesday.

Trip.com, which trades on U.S. markets under the ticker TCOM, saw its shares fall by nearly 17% after China’s State Administration for Market Regulation announced a probe into the company’s market dominance and potential anti-competitive conduct.

In response, Trip.com issued a statement affirming its intention to work with regulators and confirmed that its daily operations remain unaffected.

Investor Implications

This investigation highlights the increasing oversight of technology firms by Chinese regulators, sparking investor concerns about possible penalties or operational challenges for Trip.com.

In recent years, Chinese authorities have intensified their scrutiny of large tech companies. For example, last year, regulators determined that Nvidia (NVDA) breached antitrust regulations following an acquisition, after launching an antitrust investigation in December 2024.

Just last week, officials in China announced plans to review Meta Platforms’ (META) recent purchase of AI startup Manus, to ensure the deal aligns with the country’s export regulations.

After Wednesday’s drop, Trip.com’s stock has declined 14% so far this year, despite having gained around 5% earlier in 2025.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

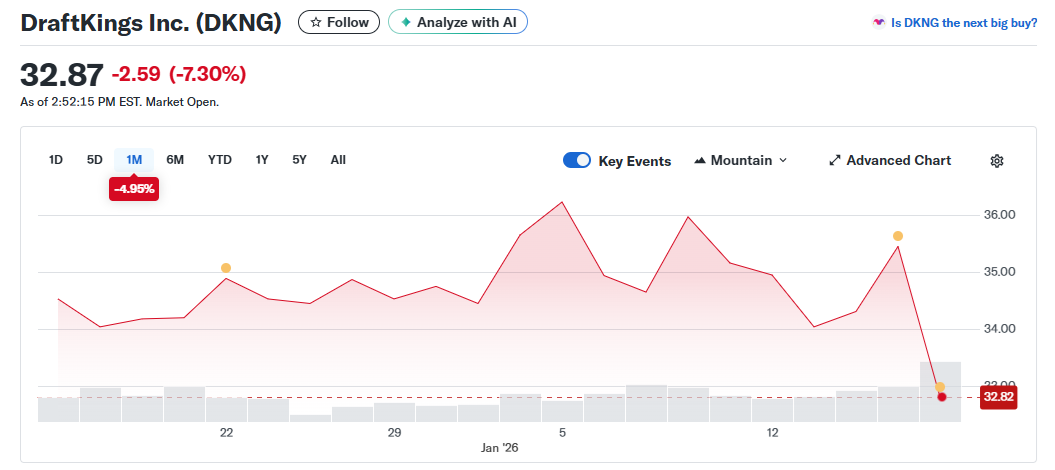

Gambling stocks tumble as platforms lose share to Kalshi and Polymarket

Clients Can Fund IBKR Accounts Via USDC

Barclays Upgrades This Leading AI Server Stock to 'Overweight,' Calling It 'Best in Class'

Riot Platforms opens up 13% on AMD data center deal