Sui price on edge as its mainnet goes through a network stall

Sui price remained on edge on January 14 as the mainnet suffered a glitch and a network stall.

- Sui price rose despite the network suffering a major glitch.

- The glitch led to a network stall that affected its activity.

- Technical analysis suggests that it may be ripe for a bullish breakout.

Sui Coin (SUI) was trading at $1.8510, up by ~40% from the year’s lowest level, and is hovering near the highest point since November. Its market capitalization has increased to over $7 billion, making it the 17th-largest coin in the industry.

In a statement, the team reported that the mainnet experienced a network stall and was working on a solution.

This outage was the biggest event in the network after the Cetus Protocol hack that cost users between $223 million and $260 million. Over 62,000 users were affected.

Sui has become one of the biggest players in the crypto industry. Data compiled by DeFi Llama shows that the network has a total value locked of over $1.6 billion, up from the December low of $1.35 billion. Some of the biggest protocols in the network are NAVI Protocol, Suilend, Bluefin, and Haedal.

More data shows that Sui network has handled over $4.1 billion this month. This means that the volume will likely cross last month’s $6.6 billion. Also, its stablecoin market cap stands at nearly $500 milion, down from over $1.17 billion in October.

Sui price technical analysis

Sui Coin price chart | Source:

crypto.news

Sui Coin price chart | Source:

crypto.news

The daily chart shows that the Sui Coin price formed a triple-bottom pattern at $1.3214 and a neckline at $1.769. A triple-bottom is a popular bullish reversal pattern.

Sui has made a break-and-retest pattern, a common bullish continuation sign in technical analysis. It has moved above the 50-day Exponential Moving Average and is nearing the 23.6% Fibonacci Retracement level.

Therefore, the most likely Sui forecast is bullish, with the key target being at $2.50, the 38.2% retracement level. Such a move is a 30% jump above the current level.

On the other hand, a move below the support at $1.7693 will invalidate the bullish forecast. Such a move will indicate further downside, potentially to the support at $1.50.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP To Repeat Its 2017 Playbook? Analyst Points To 1,250% Rally

Bitmine Buys $65M in ETH Amid Market Momentum

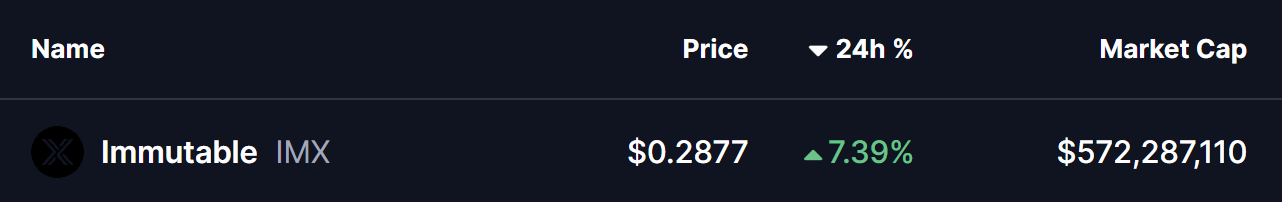

Immutable (IMX) To Rise Higher? This Emerging Bullish Pattern Hints at Upside Move!

XRP Confirms First Golden Cross of 2026, and Bulls Are Already Targeting 13% Upside