Energy Companies Poised as Leading AI Investment Opportunity for 2026

AI Investment Trends Shift Toward Energy and Utilities

While enthusiasm for artificial intelligence remains strong among investors, BlackRock’s 2026 Investment Directions report reveals a notable shift: energy and utility companies are now viewed as the most promising avenues for expanding AI-related investments.

According to a recent survey of hundreds of BlackRock clients, confidence in the future of AI is high. However, many investors are looking to broaden their portfolios, moving beyond the dominant tech giants and hyperscale firms to include a wider range of sectors connected to AI.

Energy Providers Take Center Stage

More than half of those surveyed—54%—identified energy suppliers as offering the most attractive opportunities for AI exposure this year. Infrastructure followed, with 37% of respondents highlighting it as a key area, while only 20% pointed to large-cap U.S. technology companies as the top AI investment choice.

This trend doesn’t signal a retreat from AI; only a small fraction (7%) of participants believe the AI sector is experiencing a bubble. Instead, investors are seeking greater diversification, with energy and power supply emerging as the leading growth areas linked to AI’s expansion.

“As investors seek to tap into the AI trend, their focus is expanding from core AI technologies to the broader ecosystems that support them,” BlackRock notes in its report.

The report highlights that the surge in AI-driven electricity demand is drawing investor attention to the most critical constraint in the sector: the need for reliable and scalable power to support data centers.

Electricity Demand and Infrastructure Challenges

Goldman Sachs Research projects that by 2030, the power requirements of data centers will have soared by 175% compared to 2023, effectively adding the equivalent energy consumption of another major nation.

Goldman’s analysts emphasize that the reliability of both power and water will remain a central investment theme for years to come, given the combination of rising demand, outdated infrastructure, and the need to adapt to extreme weather conditions.

Grid Capacity and the Risk of Shortages

Goldman Sachs further notes that the U.S. power grid is struggling to keep pace with the rapid increase in interconnection requests. In some regions, aging infrastructure cannot accommodate all new demands, and investments in grid upgrades are lagging behind.

If current trends persist, the U.S. could face significant electricity shortages by 2030, according to Samantha Dart, co-head of global commodities research at Goldman Sachs. She warns that unless these challenges are addressed, the U.S. risks falling behind in the global AI race, particularly against China.

Goldman Sachs estimates that the growth in data center power consumption alone will push total U.S. electricity demand growth to 2.6% annually through 2030—the fastest pace since the 1990s.

“We’re not adding enough capacity,” Dart stated at a recent industry conference, underscoring the urgency of expanding the grid to meet future needs.

By Tsvetana Paraskova for Oilprice.com

More Top Reads from Oilprice.com

- Indian Oil Corporation Turns to Ecuador to Fill Russian Crude Gap

- China’s Imports of Venezuelan Oil Set to Crumble

- How Greenland Became the Most Dangerous Real Estate on Earth

Stay Ahead with Oilprice Intelligence

Oilprice Intelligence delivers expert analysis and early signals before they make headlines. Trusted by seasoned traders and policy advisors, this resource is available free twice a week—giving you an edge in understanding market movements.

Gain access to exclusive geopolitical insights, confidential inventory data, and market trends that influence billions. Subscribe now and receive $389 worth of premium energy intelligence at no cost. Join over 400,000 readers—sign up instantly here.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

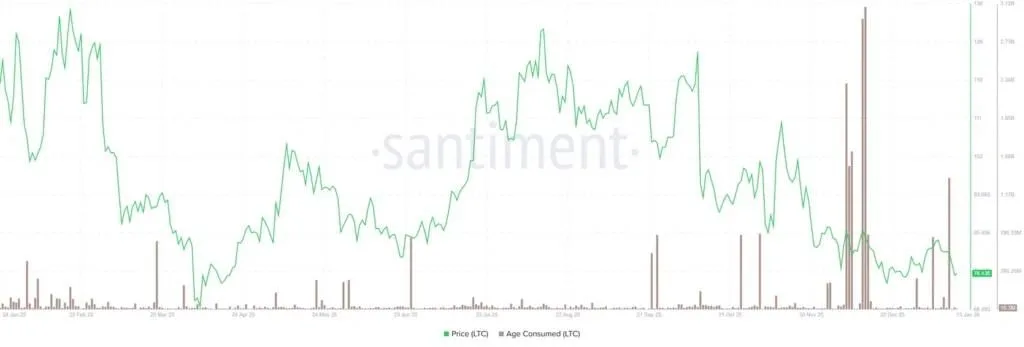

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch

FAA de EEUU advierte a aerolíneas sobre posibles acciones militares en Centroamérica y Sudamérica

Trump administration urges tech firms to purchase $15 billion in power plants they might never operate