Inflation Concerns Resurface as Officials Dampen Sentiment!

Is the economy too strong, and is good news always bad news?

Inflation, war, and banks—any one of these factors alone packs a punch, let alone all of them surfacing together today. So, does this mean that a storm is coming for the US stock market? Or is the forecast wrong again?

Let’s start with the macro data. Today, the Department of Labor and the Bureau of Economic Analysis both released November’s PPI and retail data. The forward-looking PPI and core PPI both saw a 3.0% increase, exceeding the expected 2.7%.

Data shows that in November, energy prices suddenly surged by 4.6%, contributing to more than 80% of the monthly goods price increase, with gasoline prices alone soaring 10.5% in a single month, becoming the top driver of inflation.

Excluding energy, core PPI showed zero growth month-over-month, but considering October’s data was constrained, the year-over-year change is more noteworthy. This time, it far exceeded expectations, unlike the recent positive performance in CPI.

Specifically, trade services in the core PPI cooled significantly, while prices for other service categories, such as wired telecommunications services, continued to rise. Most subcategories experienced increases, indicating that inflation is more widespread and potentially more stubborn than it appears, posing some resistance to the market’s view that inflation is cooling.

Additionally, intermediate goods rose by 0.6% month-over-month this month, indicating that upstream supply chain cost pressures are re-accumulating and will soon be passed downstream to final products, forcing companies to maintain high prices in the coming months and making the 2% inflation target harder to achieve.

So, can this upstream pressure be smoothly transmitted, resulting in continued inflationary surges? This mainly depends on whether downstream consumers are willing to buy. The good news is, they are; the US economy remains resilient. The bad news is, they are indeed buying, and buying a lot, so inflation may not come down anytime soon.

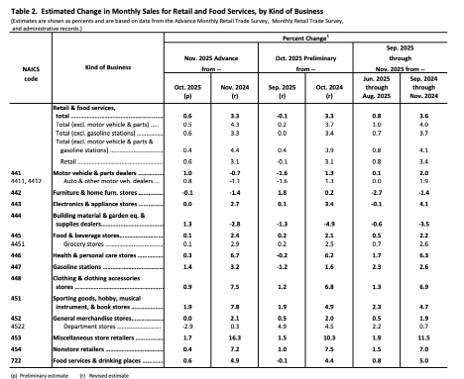

The report shows that November retail sales rose by 0.6% month-over-month, exceeding expectations. Out of 13 categories, 10 saw month-over-month growth. Notably, automobiles, which contribute significantly to consumption, saw substantial gains, while building materials, gas stations, and sporting goods also performed strongly. So why was November retail so hot?

I estimate that on one hand, this is driven by the Black Friday shopping season. On the other hand, it may be due to a large number of 2026 model cars being launched at once, sparking replacement demand. If this is the case, the widespread growth driven by new car effects and the discount shopping season (10 out of 13 categories increasing) is easy to understand.

Excluding automobiles, November core retail sales rose 0.5% month-over-month, also exceeding expectations. The retail control group, a key reference for GDP calculation, rose 0.4% MoM in line with expectations.

The stable growth of the core and control groups means that Q4 GDP growth is strongly supported; US consumption has not contracted but has shown resilience in non-essentials (sporting goods, apparel). This steady, slow expansion is likely to allow the US economy to achieve a soft landing, but at the same time, it also restrains further and larger stimulus policies.

Finally, looking at the overall PPI, on one hand, PPI is warning that cost pressures continue, while retail sales confirm that strong demand is persisting. This dual combination of cost-push and demand-pull forms the market’s biggest worry: the risk of re-inflation. Now, since the economy is not cooling but even showing signs of re-acceleration, the Federal Reserve loses its reason to cut rates in the short term. So, faced with such scorching data, it’s no wonder officials can’t sit still and are coming out to pour cold water on the market—leading us to the next topic: a barrage of hawkish comments.

First up is the new voting member, Minneapolis Fed President Kashkari, who bluntly stated that there is no reason for the FOMC to cut rates this month, advocating for a wait-and-see approach, and emphasizing that whoever becomes the next Fed Chair, policy must be based on data, not political directives.

Kashkari’s hawkish stance is consistent with his position since last year. As a new rotating voting member, his attitude is important. His claim of "no reason to cut rates" indicates that inflation remains too high and hasn't fallen to an appropriate level, and the labor market is currently in a balanced sideways move, requiring further observation before confirming a trend, so no proactive intervention is needed for now.

Next up is another new voting member, Philadelphia Fed President Harker. She stated today that she is cautiously optimistic about inflation and expects it to approach 2% by year-end, but also reiterated that if inflation cools and the labor market stabilizes, the Federal Reserve may cut rates once later this year.

For this relatively unfamiliar new face, the market originally hoped she might bring some dovish comfort. While she did express cautious optimism, her mention of only one rate cut cooled market expectations.

Jason believes that if the Federal Reserve really only cuts rates once this year, as Harker implied, it would compress stock valuations and hit investors betting on two rate cuts, and the market would face a correction of its previously optimistic pricing.

But what about the other side of the coin?

First, we must recognize the problem of lagging data. Both PPI and retail reflect the situation in November last year, which was influenced by Black Friday promotions and statistical disturbances from the government shutdown; this noise means a single month’s data may not represent the real trend for December or now.

Second, compared to interest rates, liquidity is more important. As long as liquidity policy is proactive and the financial system transmission remains smooth, market risk appetite will be supported and core asset valuations in the stock market can be maintained.

Finally, for the US stock market to enjoy a long bull run, it cannot always rely on Federal Reserve policy; it must depend on its own vitality, on the earnings of S&P 500 companies. And the source of those earnings is consumption. So long as consumption remains strong, companies’ revenues will grow steadily, and real performance will drive the US stock market upward in a healthy fashion.

Just as Trump said, news needs to return to normalcy—good news should be good news again, rather than hoping for an economic collapse just to get a rate cut.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Hyper Price Prediction: Slow Infrastructure Bet as Traders Chase DeepSnitch AI Last Minute 100x Setup

Bitcoin Rally Sees Late Buyers Lock In Gains, Analysts Warn of Exhaustion

Bitcoin Stalls Near $96K as ETF Inflows Fail to Boost Momentum

What is Zero Knowledge Proof? How this Blockchain is Turning Every Wall Socket into a Global Trust Hub