UK’s robust economic performance increases downside pressure on EUR/GBP – ING

Sterling Strengthens on Robust UK Economic Data

Stronger-than-anticipated figures for UK GDP and industrial output have boosted confidence in the pound, putting significant pressure on EUR/GBP support levels, according to Chris Turner, FX analyst at ING.

EUR/GBP Faces Pressure as Investors Rethink BoE Rate Cut Schedule

The UK released encouraging economic data today, with November's monthly GDP and industrial production both surpassing forecasts. Earlier, the housing sector also showed signs of improvement, as estate agents reported increased optimism regarding property sales.

These developments come while many asset managers still maintain substantial underweight positions in sterling. We believe the recent rebound in the pound, which began in November, could continue, particularly if next week’s UK CPI data for December surprises to the upside.

Given current market positioning, we see EUR/GBP support at 0.8645/55 as increasingly fragile, with a potential move down to 0.8600 possible in the coming week. Such a decline could present a strategic opportunity to hedge against potential pound weakness in March, when we anticipate the Bank of England will announce its next rate cut. While money markets currently expect the next cut in April and another by December, our forecast points to reductions in March and June.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

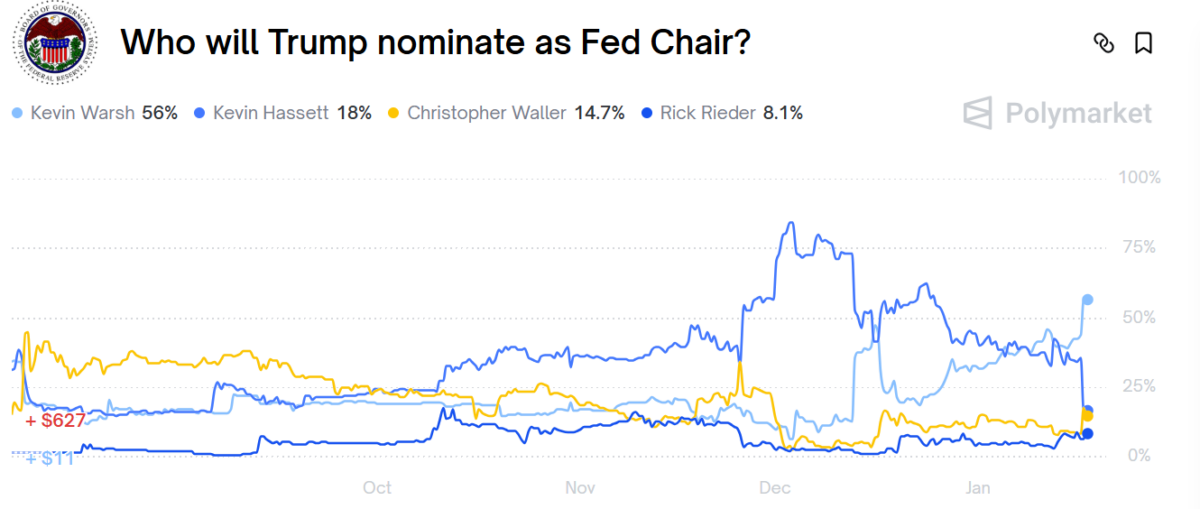

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA