Silver jumps 25% at the start of 2026, continuing the upward momentum from mid-2025 – OCBC

Silver's Impressive Surge Continues

Since the beginning of 2026, Silver has climbed over 25%, building on the strong upward momentum that started in mid-2025. This sustained rally is supported by ongoing supply shortages, robust industrial consumption—particularly in sectors like solar energy, electric vehicles, and power grid upgrades—and increased interest fueled by Gold’s performance. However, analysts Sim Moh Siong and Christopher Wong from OCBC caution that the rapid pace of this recent advance calls for some short-term vigilance.

Gold-Silver Ratio Drops as Silver Outpaces Gold

The Gold-Silver ratio has plummeted from highs near 105 last year to the low-50s, highlighting Silver’s significant outperformance compared to Gold. Although this level is not unprecedented—historical lows reached around 30 in 2011—the swift decline suggests the market may be temporarily overstretched. Notably, this surge in Silver does not appear to be fueled by speculative leverage or ETF inflows. In fact, ETF holdings for Silver peaked at the end of December before retreating by about 2–3% into mid-January. The CFTC’s January 6 report indicated non-commercial net long positions at 29,271 contracts, a decrease from roughly 45,000 in mid-December, even as Silver prices soared by over 40% during that period.

This data suggests that market positioning is far from overcrowded, which strengthens the medium-term optimistic outlook and indicates a low risk of a sudden leveraged sell-off. Additionally, Silver lease rates remain low, and forward curves in the near term are in contango, implying that the recent price rally was not triggered by immediate physical shortages.

Overall, while the rapid ascent warrants some caution in the near term, the broader structural case for Silver remains strong and underappreciated. Silver is currently trading around 91.23. The daily chart shows bullish momentum persisting, though the RSI has entered overbought territory. Key resistance levels are at 98.70 (the 138.2% Fibonacci projection from the October low to December peak) and 103.20 (the 150% Fibonacci level). Support can be found at 84 and 75 (the 21-day moving average). The prevailing strategy favors buying on pullbacks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

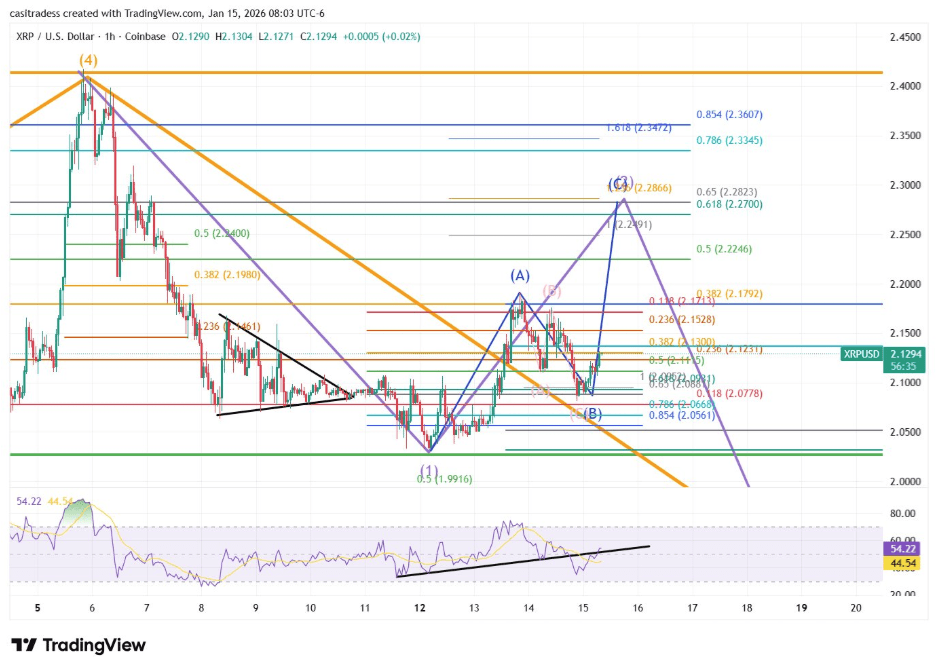

XRP Wave C Push On The Way: What Could Send Price Below $2

Top Cryptos Hold Strong Above Support Trendlines

BOJ Leaves Yen Observers Anxious for Hints of Interest Rate Increases