U.S. stock markets had a rough week, wiping out about $650 billion in market value as major indexes moved lower. The Nasdaq fell around 1.4%, the Dow Jones dropped 1.2%, and the S&P 500 slipped roughly 1%, even as stocks remain near record highs.

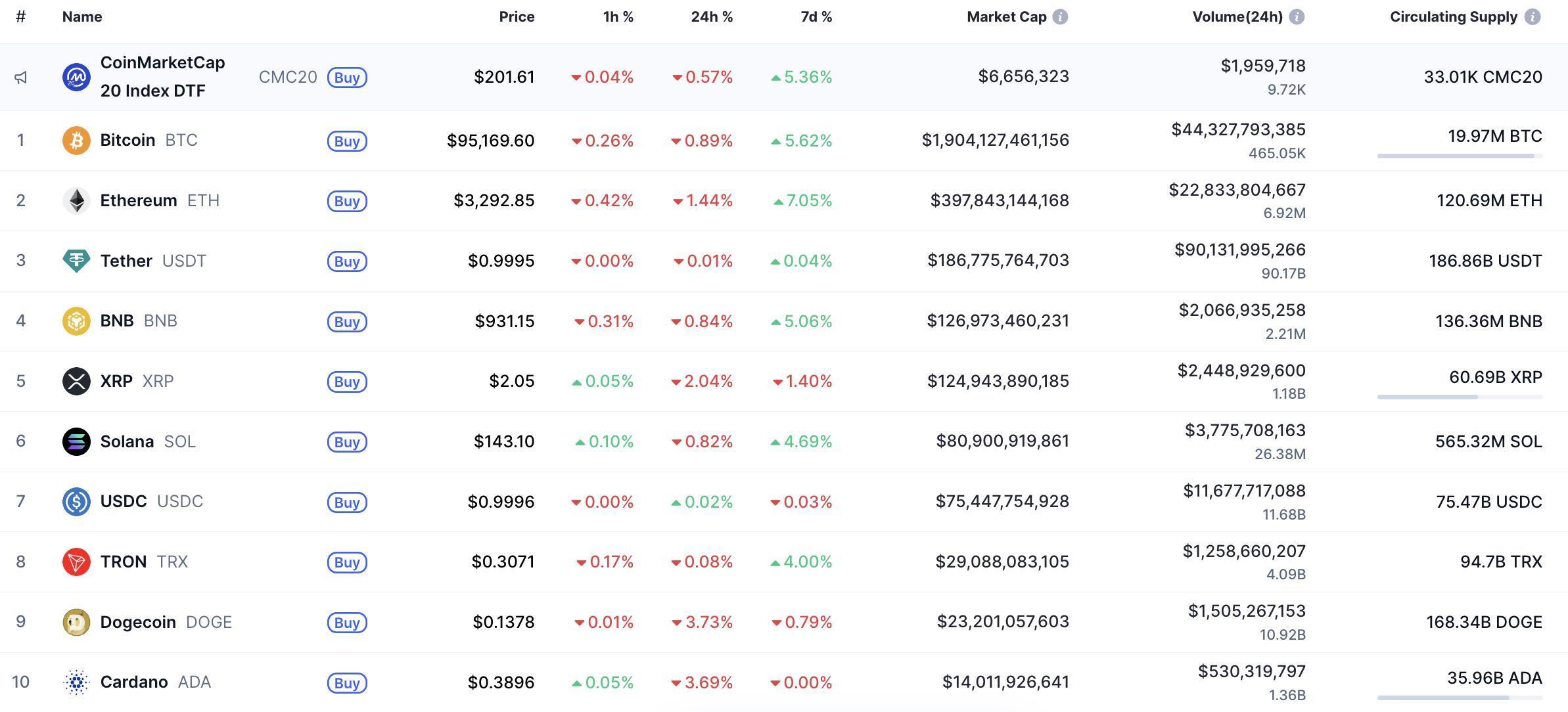

At the same time, Bitcoin moved in the opposite direction. Bitcoin rose about 7% this week, adding roughly $130 billion to its market value. The total crypto market gained close to $190 billion, highlighting a clear split between traditional markets and digital assets.

Volatility was not limited to stocks. Silver prices briefly fell nearly 8% within minutes after touching a fresh record high, underlining how unstable commodity trading has become.

Experts say the moves point to a rotation out of traditional safe assets and into riskier assets, including cryptocurrencies. Bitcoin is still about 23% below its peak near $126,000, leading some investors to argue it has room to catch up. At the time of writing, BTC is trading at $96,400 and is up by more than 1%.

On days when U.S. stocks sold off sharply and crypto prices pushed higher. In one session, hundreds of billions were erased from equities while crypto markets added tens of billions, a pattern experts say does not happen often.

Not everyone is convinced the Bitcoin rally is healthy. Longtime Bitcoin critic and gold supporter Peter Schiff called the move a “sucker’s rally.” He argued that traders are selling gold and silver mining stocks to buy Bitcoin ETFs and crypto-linked stocks, calling it a mistake.

“My guess is that some traders are taking profits in gold and silver mining stocks and buying Bitcoin ETFs and $MSTR,” he wrote.

Schiff also pointed out that while gold and silver hit new highs, many mining stocks fell, which he sees as a buying opportunity for precious metals investors. He has repeatedly urged traders to sell Bitcoin into strength and move funds into gold instead.

(adsbygoogle = window.adsbygoogle || []).push({});On the other side of the debate, Bitcoin bulls remain firm. Michael Saylor, one of Bitcoin’s most vocal supporters, recently reiterated his long-term view, saying simply that “Bitcoin is the strategy.”