Why Nvidia (NVDA) Shares Are Rising Today

Nvidia Shares Rise Following TSMC’s Strong Earnings

Nvidia (NASDAQ:NVDA), a major player in the graphics chip market, saw its stock climb 2.8% during afternoon trading after Taiwan Semiconductor Manufacturing Co. (TSMC) reported quarterly results that exceeded expectations. This development has sparked renewed confidence in the ongoing demand for hardware supporting artificial intelligence (AI).

TSMC, recognized as the world’s top contract chip manufacturer, is often viewed as a bellwether for the technology sector. The company achieved record revenue in the fourth quarter, surpassing analyst forecasts, thanks to heightened demand for advanced chips powering AI technologies.

The upbeat results from TSMC had a positive impact across the semiconductor industry, lifting the shares of companies such as ASML, Nvidia, and AMD. Investors are interpreting TSMC’s robust performance and its intention to boost capital expenditures as evidence that the AI-fueled growth cycle for semiconductors remains strong and is likely to persist.

By the end of the trading day, Nvidia’s stock closed at $187.11, marking a 2.1% increase from the previous session.

Market Reaction and Recent Developments

Nvidia’s stock is known for its volatility, having experienced 18 separate swings greater than 5% over the past year. Today’s moderate gain suggests that while the news is significant, it does not dramatically alter the market’s overall view of the company.

The last notable surge occurred 27 days ago, when Nvidia’s shares rose 3% after Reuters reported that the Trump administration had initiated a multi-agency review, potentially paving the way for the first shipments of Nvidia’s H200 AI chips to China.

This procedural step marks progress toward reopening the Chinese market, which Nvidia’s CEO Jensen Huang has previously estimated could be worth billions in revenue. Additionally, Tigress Financial increased its price target for Nvidia to $350 and reiterated a “Strong Buy” rating, citing the company’s leadership in AI infrastructure and data center solutions. Bernstein analysts also maintained an Outperform rating, noting the stock appeared “unusually cheap.”

Since the start of the year, Nvidia’s share price has remained steady. Currently trading at $187.44, the stock is 9.5% below its 52-week high of $207.04 set in October 2025. For perspective, a $1,000 investment in Nvidia five years ago would now be valued at $14,576.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AUD/JPY Price Forecast: Constructive outlook prevails, first upside barrier emerges near 106.50

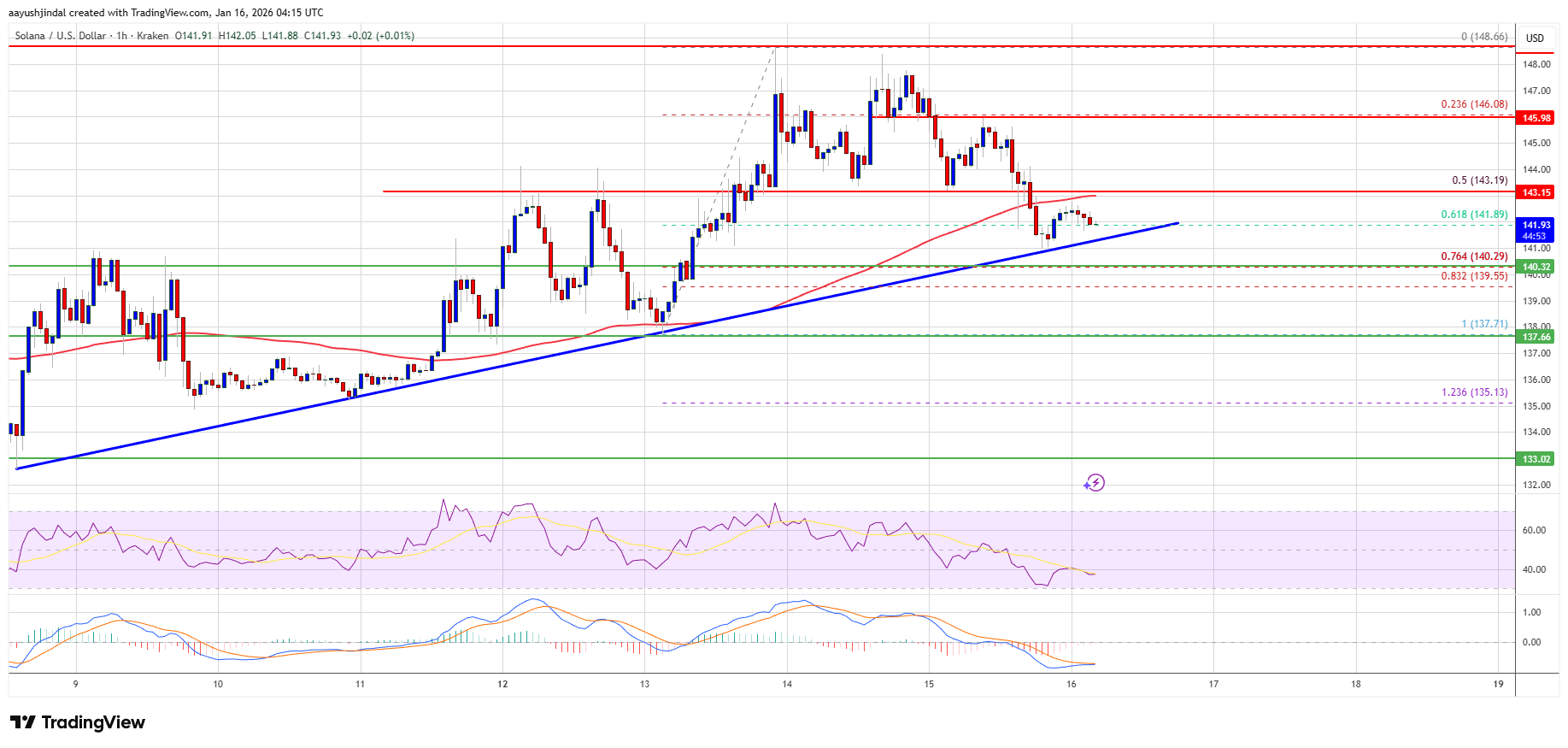

Solana (SOL) Slips Back to Support, Setting Up a High-Tension Test

Ethereum Staking Hits Record Levels As Buterin Urges Builders To Deliver Real Apps

Cheongju’s Landmark Crypto Seizure: South Korean City Successfully Sells Digital Assets from Tax Delinquents