Gold Price Outlook: XAU/USD drops close to $4,600 as Trump eases stance regarding Iran

Gold Prices Slide Amid Stronger US Dollar

During early trading hours in Asia on Friday, gold (XAU/USD) dropped to approximately $4,605. The decline in the precious metal’s value follows the release of US Initial Jobless Claims data, which strengthened the US Dollar. Investors are also awaiting the US December Industrial Production figures, set to be announced later in the day. Additionally, remarks from Federal Reserve Governor Michelle Bowman are expected.

US Jobless Claims Fall Unexpectedly

According to Thursday’s report from the US Department of Labor, new unemployment claims dropped to 198,000 for the week ending January 10. This number was not only below the anticipated 215,000 but also lower than the revised figure of 207,000 from the previous week.

“Recent data is keeping expectations for the Fed steady, at least for the first half of the year. As a result, the dollar index has reached a multi-week peak, which is currently putting pressure on gold prices,” commented Peter Grant, vice president and senior metals strategist at Zaner Metals.

Geopolitical Factors Impacting Gold

In addition, the easing of tensions between the United States and Iran has reduced demand for traditional safe-haven assets like gold, which typically benefit from periods of global or economic instability.

US President Donald Trump stated early Thursday that Iran has “no plan for executions,” addressing concerns about the fate of an anti-government protester in custody. However, Trump also warned of “grave consequences” should the executions proceed, indicating that all options remain open.

Market Outlook

Traders are expected to keep a close eye on the evolving situation in Iran. Any indication of rising unrest could potentially drive gold prices higher in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

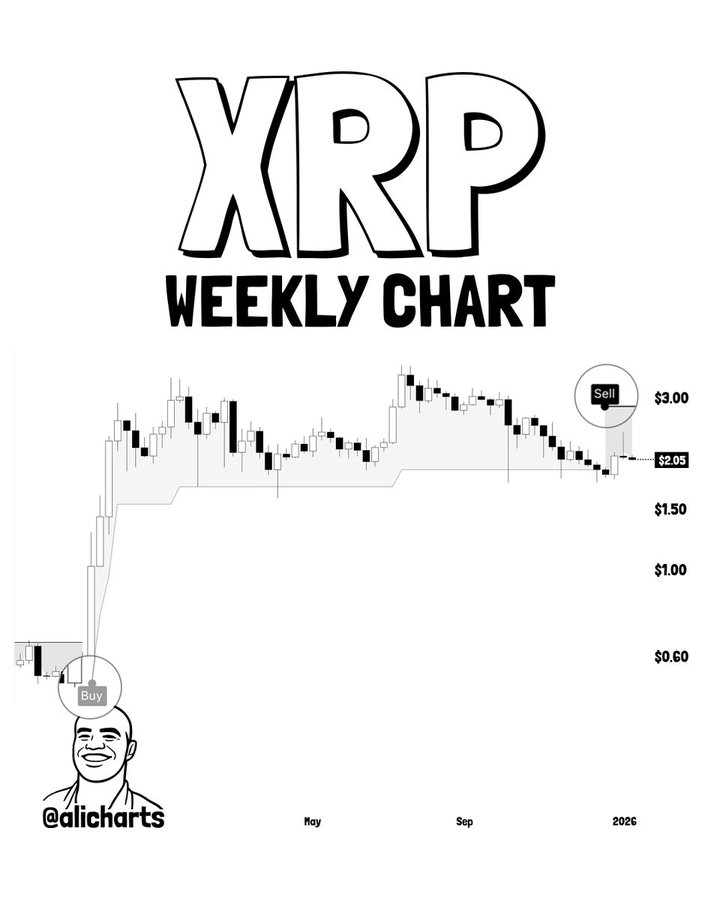

XRP In A ‘Super Cycle’? SuperTrend Suggests Another Story

President Trump Plans an “Emergency Power Auction”: What It Could Mean for Bitcoin Miners

German inflation expected to reach 2.2% in 2025