USD/INR hits a new four-week peak as foreign institutional investors continue to offload Indian stocks

Indian Rupee Hits Four-Week Low Amid Foreign Fund Outflows

The Indian Rupee (INR) slipped to its lowest level in a month against the US Dollar (USD) during Friday’s opening session. The USD/INR pair climbed close to 90.70, reflecting the Rupee’s weakness as overseas investors continue to pull money out of Indian equities.

Data from the National Stock Exchange (NSE) revealed that Foreign Institutional Investors (FIIs) sold shares worth Rs. 4,781.24 crore on Wednesday. Persistent selling by FIIs has weighed on Indian stocks, especially as there has been no announcement of a trade agreement between India and the United States. In January alone, FIIs have been net sellers on nine out of ten trading days, reducing their holdings by Rs. 21,706.27 crore.

Although India’s External Affairs Minister Subrahmanyam Jaishankar and US Secretary of State Marco Rubio described this week’s trade discussions as positive on social media, international investors remain cautious due to the lack of concrete progress in negotiations. Recent talks have yet to shift market sentiment.

HSBC economists have highlighted that subdued capital inflows into Indian equities are a significant challenge for the Rupee.

On the economic side, both retail and wholesale inflation in India accelerated in December. However, this rise in price pressures is unlikely to prevent the Reserve Bank of India (RBI) from considering further interest rate reductions soon. While the Consumer Price Index (CPI) increased by 1.33% year-over-year, it remains below the RBI’s target range of 2% to 6%.

Market Update: US Dollar Remains Firm as Fed Maintains Hawkish Stance

- The Indian Rupee continues to lose ground against the US Dollar, even as the Dollar Index (DXY) dips slightly to around 99.28 ahead of a long weekend in the US. Despite this, the DXY remains close to its recent six-week peak of 99.50.

- Thursday saw the US Dollar strengthen sharply following assertive comments from Federal Reserve officials. Both Kansas Fed President Jeffrey Schmid and Atlanta Fed President Raphael Bostic emphasized the importance of keeping interest rates restrictive due to ongoing inflation concerns.

- Bostic remarked, “We need to stay restrictive because inflation is too high,” and projected that inflationary pressures could persist through 2026, as many companies are still adjusting prices to account for tariffs.

- The CME FedWatch tool indicates that the Federal Reserve is expected to keep interest rates unchanged at 3.50%-3.75% during its January meeting.

- Looking ahead, the appointment of the next Federal Reserve Chair by the White House is anticipated to be a key event for the Silver market. President Trump stated in December that he would name Jerome Powell’s successor sometime in January.

- Recent interviews suggest that White House Economic Adviser Kevin Hassett, former Fed Chair Kevin Warsh, and current Fed Governors Christopher Waller and Michelle Bowman are among the leading candidates to replace Powell.

USD/INR Technical Overview: Approaching 90.70

The USD/INR pair is nearing the 90.70 mark, supported by a rising 50-day Exponential Moving Average (EMA), which continues to provide a foundation for the uptrend. The price remains above this moving average, limiting any significant pullbacks.

The 14-day Relative Strength Index (RSI) stands at 58.76, above the neutral midpoint, signaling ongoing bullish momentum. The first layer of support is found at the 50-EMA, currently at 89.9134.

If the pair stays above this average, further gains are likely. However, a close below the 50-EMA could trigger a deeper correction. Momentum would strengthen if the RSI moves into the 60s, while a decline toward 50 could limit upside potential and suggest a period of consolidation.

(This technical analysis was prepared with assistance from an AI tool.)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

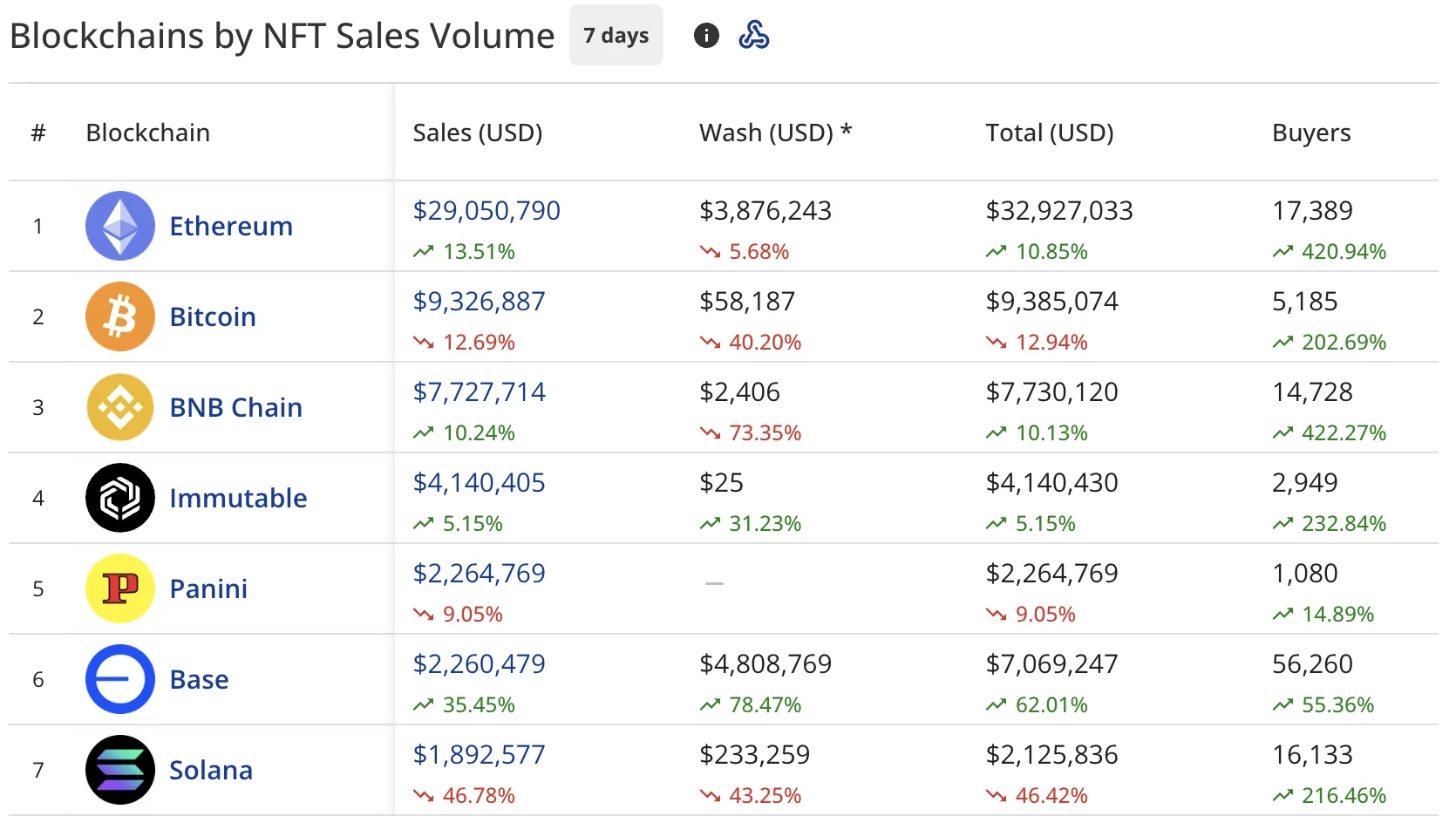

NFT buyers rise 120% despite sales staying flat at $61.5 million

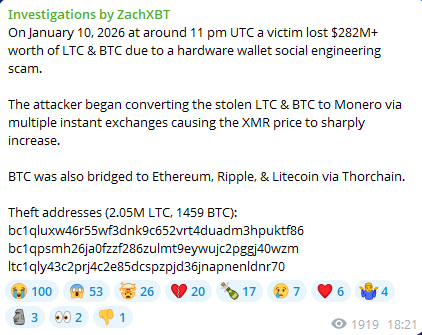

Was Monero’s (XMR) Surge Fueled by a $282M Theft Swap? Chart Says No!

Trump’s renewed attacks on the Fed evoke 1970s inflation fears and global market backlash

Bitcoin Flashes Near-Identical Fractal Before The 2021 Bull Run Started