Japanese yen continues to draw attention as the week comes to a close

Japanese Yen Shows Heightened Volatility Amid Official Comments

The Japanese yen continues to exhibit significant fluctuations among major currencies, with the USD/JPY pair experiencing a wide trading range following a sharp decline during Asian market hours. The currency pair dropped to a low of 157.97 after Japan's finance minister Katayama made additional remarks regarding potential intervention, as detailed . Since then, the pair has rebounded to around 158.30, though it remains below the earlier peak near 158.60-70.

Statements from Tokyo officials aimed at curbing the yen’s decline are not uncommon. However, the tone and wording used this time signal a shift in their approach.

Earlier this week, Katayama made a notably precise observation about price movements, which stood out among typical comments (). Today, he went further, suggesting that intervention in the currency market is now considered an option under the US-Japan agreement. This effectively serves as a warning that Tokyo may have Washington’s support to act if necessary.

Despite these developments, the Takaichi trade has remained a dominant factor weighing on the yen since October, and that trend continues to shape the broader outlook. However, today’s market mood has shifted somewhat in the short term:

After several failed attempts to move below the 100-hour moving average (represented by the red line) this week, USD/JPY sellers finally succeeded today. This has resulted in a more balanced short-term outlook, with prices now fluctuating between the 100-hour and 200-hour moving averages (the latter shown as the blue line).

This development gives traders some flexibility as they assess how a potential snap election might influence the Takaichi trade and whether further yen depreciation could prompt intervention from Tokyo. According to Credit Agricole, efforts by opposition lawmakers to challenge Takaichi’s leadership could help balance the trade, reducing the one-sided pressure against the yen.

The firm also suggests that the market may be experiencing a classic buy the rumour, sell the fact scenario, with political uncertainty in Japan impacting the yen’s performance.

Currently, investors appear to be favoring yen crosses in anticipation of more accommodative fiscal and monetary policies should Takaichi’s position be strengthened.

However, with market sentiment already heavily tilted towards further yen weakness, there is a risk that enthusiasm could wane once the election is officially announced next week. As opposition parties mobilize to challenge Takaichi’s authority, Credit Agricole warns that this could limit further USD/JPY gains driven purely by political factors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

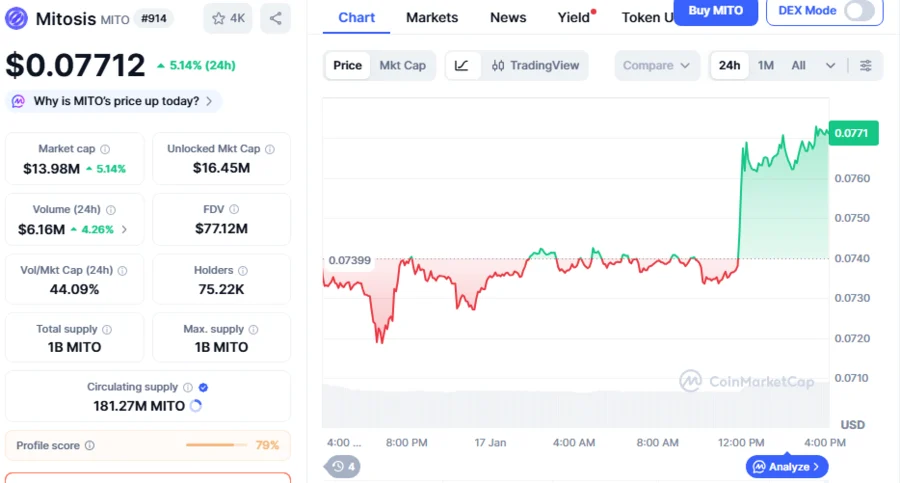

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds