1 Service Stock to Watch This Week and 2 That Disappoint

Business Services Sector: Opportunities and Cautions

Specialized business service providers play a crucial role in helping organizations enhance efficiency and reduce expenses. Their expertise has led to significant productivity gains for clients, which is reflected in the sector’s impressive 11.8% growth over the past half-year—closely tracking the S&P 500’s performance.

Despite these achievements, only a select few companies are likely to maintain long-term success, as innovative AI-powered competitors are quickly gaining ground. With this in mind, we highlight one standout stock with strong growth potential, as well as two that investors may want to avoid.

Two Business Services Stocks to Consider Selling

Kyndryl (KD)

Market Capitalization: $6.18 billion

Spun off from IBM in 2021, Kyndryl (NYSE:KD) has become the largest global provider of IT infrastructure services, offering design, implementation, and management of technology systems for enterprise clients.

Reasons for Concern with KD:

- Annual sales have declined by 4.8% over the past five years, indicating unfavorable market dynamics.

- With an average free cash flow margin of -0.4% during the same period, the company has limited financial flexibility to support growth or reward shareholders.

- Negative returns on capital suggest that some of its expansion strategies have not delivered the desired results.

Currently priced at $27.18 per share, Kyndryl trades at a forward price-to-earnings ratio of 8.3.

ManpowerGroup (MAN)

Market Capitalization: $1.43 billion

Established in the postwar era to address the need for temporary staffing, ManpowerGroup (NYSE:MAN) connects millions with job opportunities through its extensive global network, offering recruitment, staffing, and workforce management solutions.

Risks Associated with MAN:

- Organic revenue growth has lagged expectations over the last two years, suggesting a need to refine its offerings or market approach.

- Profitability has suffered, with earnings per share dropping by 18.4% annually over five years, while revenue remained stagnant.

- Returns on capital have continued to decline from an already low base, highlighting ineffective investment strategies.

ManpowerGroup shares are trading at $30.98, reflecting a forward P/E of 8.9.

One Business Services Stock Worth Buying

Motorola Solutions (MSI)

Market Capitalization: $65.7 billion

Tracing its roots back to the invention of the first handheld police radio in 1940, Motorola Solutions (NYSE:MSI) delivers essential communications, video security, and command center software to public safety organizations and businesses worldwide.

Why We Favor MSI:

- Revenue has grown at an annual rate of 8.5% over the past five years, outpacing the industry average and reflecting strong customer demand.

- With $11.31 billion in annual revenue, the company benefits from significant scale and distribution advantages.

- A robust free cash flow margin of 18.8% allows for consistent reinvestment and capital returns, with increasing cash flow providing further growth opportunities.

Motorola Solutions is currently valued at $394.93 per share, equating to a forward P/E of 24.8. Wondering if now is the right time to invest?

Building a Resilient Portfolio with Quality Stocks

Relying on just a handful of stocks can leave your investments vulnerable. Now is the time to secure high-quality assets before the market broadens and current opportunities fade.

Don’t wait for the next bout of market turbulence. Explore our Top 6 Stocks for This Week—a handpicked collection of leading stocks that have delivered a remarkable 244% return over the past five years (as of June 30, 2025).

Our 2020 selections included well-known names like Nvidia, which soared by 1,326% between June 2020 and June 2025, as well as lesser-known companies such as Kadant, which achieved a 351% five-year return. Discover your next winning investment with StockStory today.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

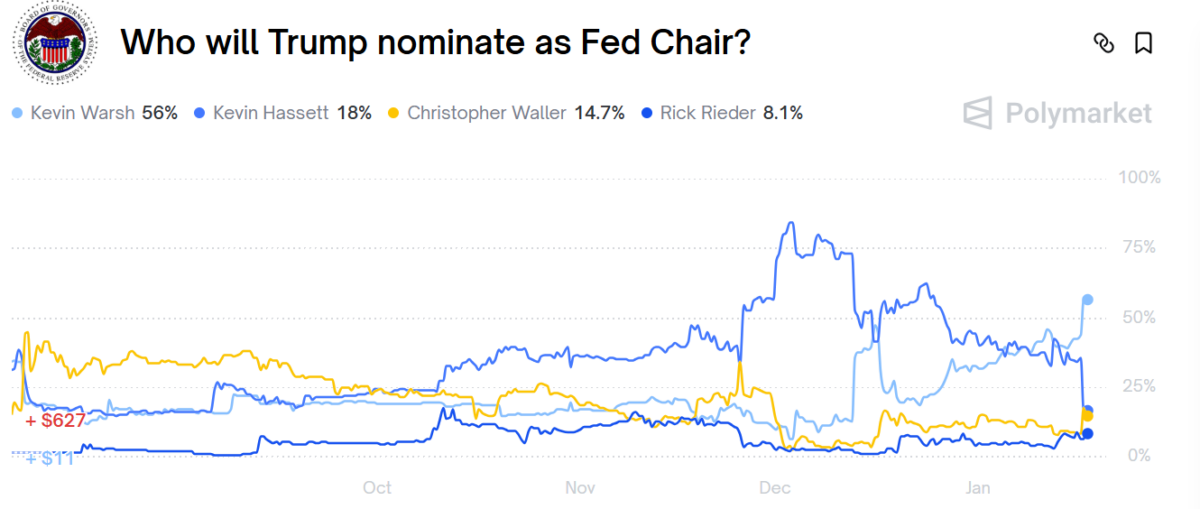

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA