Oh dear! Is gold really being pushed up by speculators?

Gold’s Bull Market: Speculation, Trends, and What the Data Really Shows

Reflections on The Economist’s recent coverage, as shared by Adrian Ash of BullionVault in a note originally sent to Weekly Update subscribers in late November.

What’s the most striking feature of a major gold bull run? It’s how quickly anyone glancing at the price becomes an overnight “expert.”

Take The Economist as a recent example.

The magazine claims that speculators are the main force behind gold’s latest price swings, as if this is a groundbreaking revelation.

According to their analysis, what began as a modest increase in central bank gold reserves has snowballed into a wave of speculative money chasing ever-higher prices. They warn that this classic “momentum trade” will eventually come to an end.

Should investors panic and sell before that unspecified turning point arrives?

What evidence does The Economist offer?

The magazine points to the way gold prices in late 2025 have closely mirrored the shifting appetites of hedge funds and gold-backed ETFs.

Is this really newsworthy?

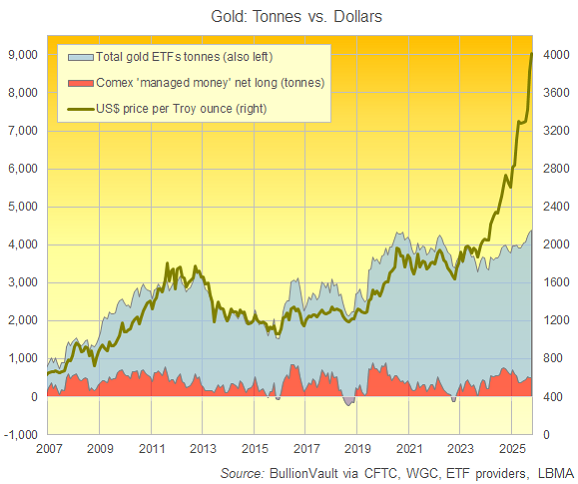

Gold ETFs have been around for about two decades, debuting around the same time US regulators began publishing data on “Managed Money” positions in Comex gold futures and options. While these two data sets don’t capture every global investment in gold, together they provide the clearest snapshot we have.

Since 2006, gold’s price has consistently moved in step with the combined positions of gold ETFs and speculative Comex bets—sometimes the price leads, sometimes the positions do, but the connection is clear.

This pattern makes sense, just as Wall Street’s habit of hiring top traders for hot markets does. When trading desks rake in profits, bonuses follow. When gold prices climb, ETF demand and leveraged bullish bets surge.

A Recent Shift in the Gold Market

What The Economist overlooks is a significant shift that began about three years ago. Despite gold being the top-performing major asset in both 2025 and the 21st century so far, the usual link between gold prices and speculative positioning broke down around the start of 2023.

Before 2023, the size of global gold ETF holdings plus net speculative bets on Comex moved in the same direction as gold prices 88% of the time, both month-to-month and year-over-year.

But in the first half of 2023, this correlation dropped to 66% monthly, and over the following 18 months, it fell to just 17% on a yearly basis.

This was a notable divergence. However, the old pattern has since reasserted itself, with gold prices and speculative positions once again moving together 88% of the time each month, and perfectly aligned year-over-year.

Speculators Return—But That’s Nothing New

So, The Economist is correct that speculators have played a role in gold’s recent rally. But this is simply a return to the historical norm. It also answers the question repeatedly asked last year: What happens when investors and speculators come back to gold after sitting on the sidelines between $1,800 and $2,600?

Signs of this renewed activity first appeared in September 2024, with ETF holdings rising, Comex speculators increasing their positions, and private investors in Western markets returning to physical gold.

This momentum led to a sharp price surge in October, prompting headlines about gold-buying frenzies in Japan, Australia, and online markets worldwide—fuel for pundits to cry “Bubble!”

Yet, even The Economist only mentions “bubble” twice in its latest analysis—once to describe the actual bubble in AI stocks, and again to suggest that central banks are unlikely to “bet the farm” on gold if it means chasing a bubble.

Is Gold Breaking Its Boom-Bust Cycle?

Perhaps The Economist’s reluctance to call a bubble is a warning sign. As Wall Street veterans say, bull markets end when the last skeptic finally buys in. But The Economist hasn’t turned bullish yet. Maybe, just maybe, gold is reestablishing itself as a core portfolio asset, breaking its old cycle of booms and busts. This may be due in part to central bank buying, but more so because gold remains the standout performer of the century.

Current Market Sentiment

Following October’s dramatic rally, investors are treading carefully. ETF inflows this month have been the slowest since May, and hedge funds appear to be reducing their positions—a common move ahead of the US Thanksgiving holiday.

In fact, Comex traders began scaling back their bullish bets before the October peak, trimming positions by 10% in the first week of the month, according to the latest CFTC data (which, like much official data, has been delayed by the recent US government shutdown).

We’ll provide further updates as new data emerges. For now, the renewed connection between speculation and gold prices is simply a return to form—not a headline-worthy anomaly, but a restoration of a long-standing trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

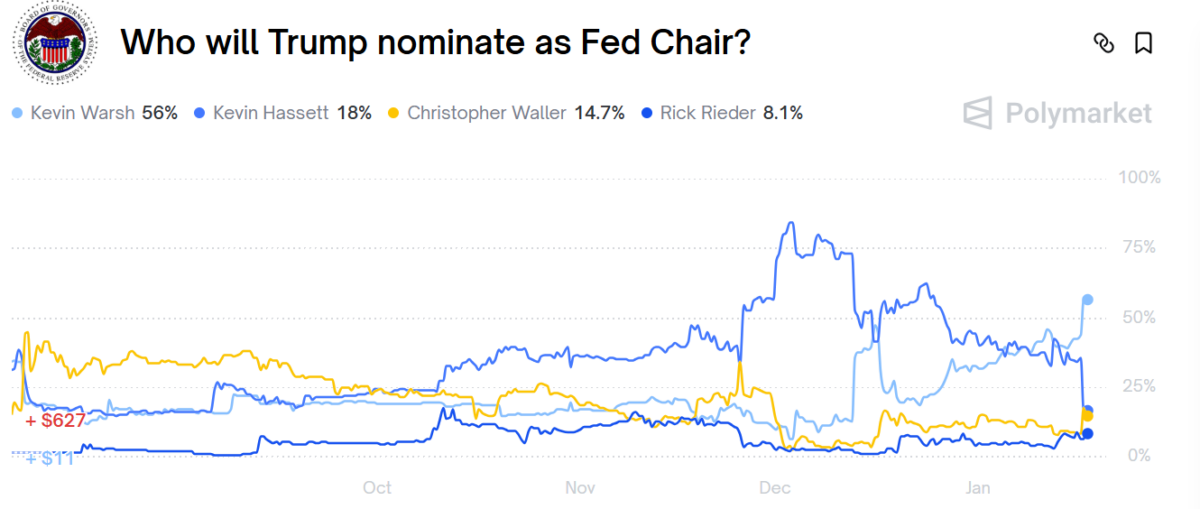

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble

A $280 Million Bitcoin Heist Leads to Monero Price Rally

3 Fastest-Growing and Trending Cryptos in 2026 — HBAR, SUI, and ENA

Tesla’s AI team creates a patent that addresses AI “drift” in positional encoding