Over the past ten years, 40% of oil industry positions in the US have disappeared and are unlikely to return

US Oil and Gas Sector Faces Lasting Job Losses Amid Record Output

Photographer: Eli Hartman/Bloomberg

Over the past ten years, the American oil and gas sector has eliminated 40% of its workforce, even as production reached unprecedented heights. Experts say these lost positions are unlikely to return.

Traditionally, rising oil prices have led to increased drilling and hiring in this highly cyclical industry. However, after the shale boom collapsed in the mid-2010s and investors saw disappointing returns, this pattern broke down.

Top Stories from Bloomberg

Advancements in drilling technology, increased automation, and a wave of corporate mergers have contributed to the loss of approximately 250,000 jobs since employment peaked in 2014, even as oil output soared by 50%.

Photographer: Jake Dockins/Bloomberg

Despite record production levels and a pro-drilling administration in 2025, employment in the sector remains at its lowest point in three years.

Karr Ingham, president of the Texas Alliance of Energy Producers, remarked, “This business has always experienced ups and downs. In the past, when prices rebounded, hiring would follow. That’s no longer the case.”

This shift has left fewer opportunities for professionals like Shaun Carter, a geologist who lost his job when his Oklahoma employer abruptly closed in 2019.

After being laid off, Carter began working as a truck driver based in Houston, covering routes across the Southeast and Midwest. What started as a temporary solution has become a long-term career, and his hopes of returning to oil and gas are fading.

“I don’t have much optimism,” Carter shared during a call from his truck at a loading dock.

Following the 2014 oil price collapse, investors demanded that companies prioritize profitability over expansion, sparking a wave of mergers and layoffs. Since early 2023, mergers and acquisitions in the industry have surpassed $500 billion—a more than 20% increase compared to the previous three years. Major companies like Chevron, ConocoPhillips, and Exxon Mobil have all announced further job cuts in 2025 as crude prices declined.

Efficiency Rises, Jobs Decline

Today, US oil producers are extracting a record 13.8 million barrels of crude daily, using less than a third of the drilling rigs active in 2014. Each rig now produces about four times more oil than a decade ago, a testament to improved equipment, refined methods, automation, and incentives for faster drilling.

While the US government has sought to access Venezuela’s oil reserves, industry leaders remain cautious about investing there. According to Fernando Valle of Hedgeye Risk Management, this move is unlikely to create more American jobs, as domestic labor remains more cost-effective.

Since returning to office, President Donald Trump has prioritized boosting US oil and gas output by easing environmental rules and opening more federal land and waters for drilling. However, some experts, like University of Houston’s Ramanan Krishnamoorti, believe that expanding offshore drilling won’t translate into new jobs, as future rigs will be operated remotely and largely automated.

“Robots and automation will run these rigs, much of it managed from shore,” Krishnamoorti explained. “The industry will look very different—fewer jobs overall, and those that remain will be safer.”

Photographer: Daniel Acker/Bloomberg

With oil prices hovering near $60 a barrel, many producers are just breaking even—enough to keep wells operating, but not enough to generate significant profits. This presents a challenge for President Trump, who wants to support industry profitability while keeping fuel prices low for consumers.

According to a Federal Reserve Bank of Dallas survey, energy executives say oil prices need to reach about $65 a barrel to justify drilling new wells. Prices have stayed below that threshold for three months, and even a brief surge would need to last to prompt increased investment.

“Companies are under pressure to cut costs wherever possible,” said Trey Cowan of the Institute for Energy Economics and Financial Analysis. “Labor is usually the first area to be reduced.”

Despite these cutbacks, some companies are outperforming expectations. ConocoPhillips, for example, exceeded its own production forecasts last quarter despite spending less on capital. Chevron also increased output in the Permian Basin with fewer rigs.

Personal Stories Amid Industry Change

Carter has nearly returned to the oil and gas field several times. In May 2024, Marathon Oil contacted him about a new opportunity after he was a runner-up for a previous position. He expressed interest and was told to expect a follow-up call.

However, while driving to a Costco in Tulsa, Oklahoma, Carter heard on the radio that ConocoPhillips had made a bid to acquire Marathon. “I immediately knew what that meant,” he recalled. The job offer never materialized.

With contributions from David Wethe, Kevin Crowley, Alex Newman, Jade Khatib, Cecile Daurat, Marie Monteleone, and Reade Pickert.

More from Bloomberg Businessweek

©2026 Bloomberg L.P.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why tokenized stocks, funds and gold will have a breakout year in 2026

Milk Mocha Enters Stage 11 After 465x Gains! Is It the Best Crypto to Buy Now?

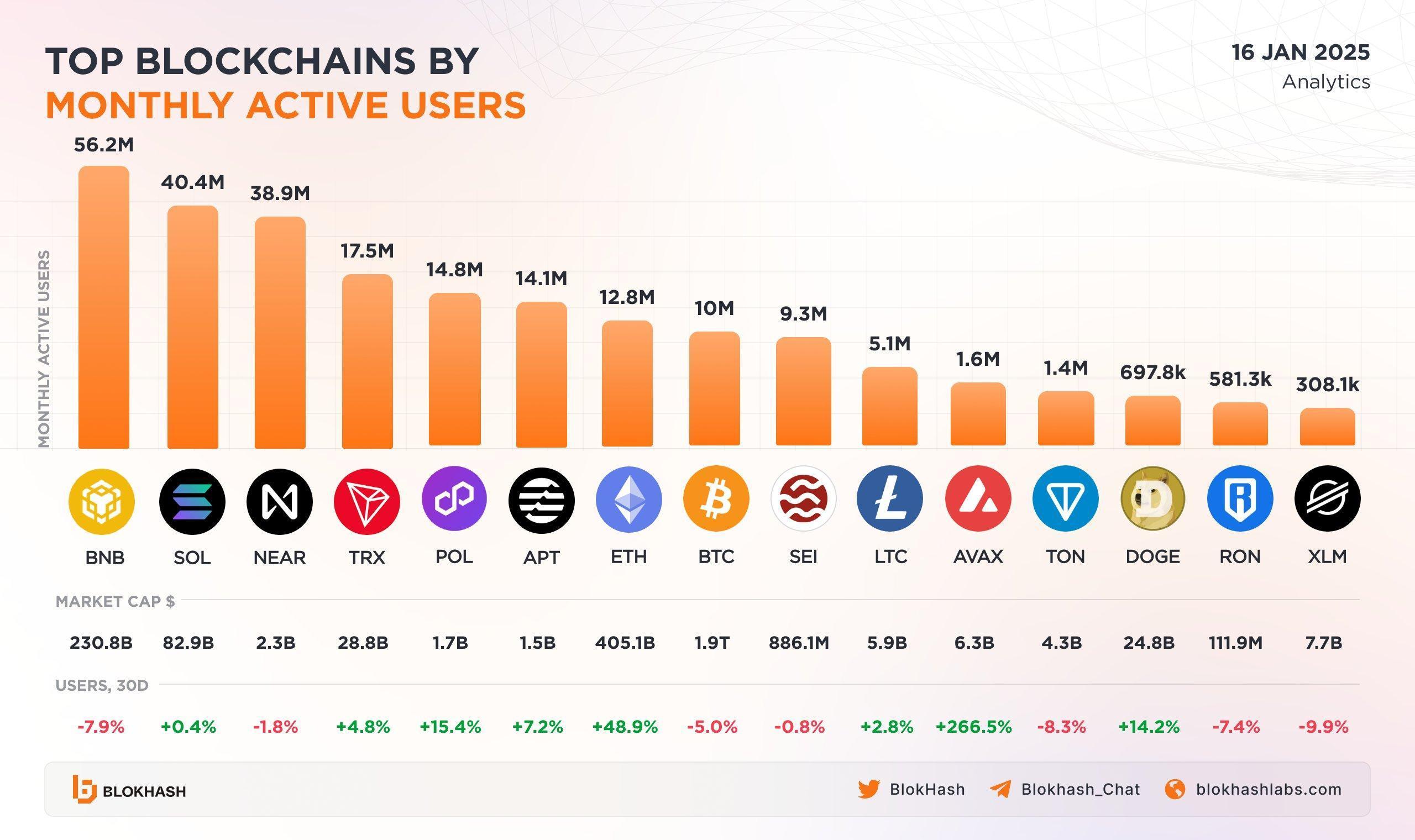

Solana (SOL) Leads Among Top Blockchains by Active Users — Will It Rise Higher?

The Saturday Spread: Leveraging the Markov Principle to Identify Undervalued Prospects (PANW, NTES, DKS)