USD retreats after reaching its strongest point since December – BBH

US Dollar Pulls Back After Reaching Multi-Month High

According to analysts at BBH FX, the US Dollar (USD) eased slightly after reaching its strongest level since early December during yesterday’s trading session.

Dollar Under Pressure Despite Favorable US Economic Reports

Recent US economic indicators have painted a balanced picture—showing neither excessive strength nor weakness—which has lent support to both the dollar and US equities. However, analysts remain skeptical that the dollar index (DXY) can maintain levels above 100.00. With inflation cooling and labor market demand softening, there is significant scope for the Federal Reserve to implement further interest rate reductions.

For the week ending January 10, initial jobless claims unexpectedly fell below 200,000, marking the lowest reading since November and signaling that widespread layoffs are not occurring. Such low claims have been rare in recent years. Still, concerns about employment persist, as most job growth in 2025 has been limited to the education and health services sector, suggesting rising risks to the broader labor market.

Meanwhile, the latest US Treasury International Capital (TIC) report revealed that, over the twelve months through November, foreign investors purchased a record $1.569 trillion in long-term US assets—including Treasury bonds and notes, corporate bonds, stocks, and government agency bonds. This figure far exceeds the $960 billion US trade deficit accumulated in the year to October. Efforts by the Trump administration to reduce the trade gap have resulted in fewer dollars leaving the country, which in turn decreases the need for those funds to be reinvested in US assets—a factor that could weigh on the dollar’s performance going forward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dos Equis brings back ‘Most Interesting Man’ commercials amid declining beer sales

InfoFi Hit as X Revokes API Access for Incentive Projects

Morning Minute: Tom Lee Supports Mr. Beast with a $200 Million Investment

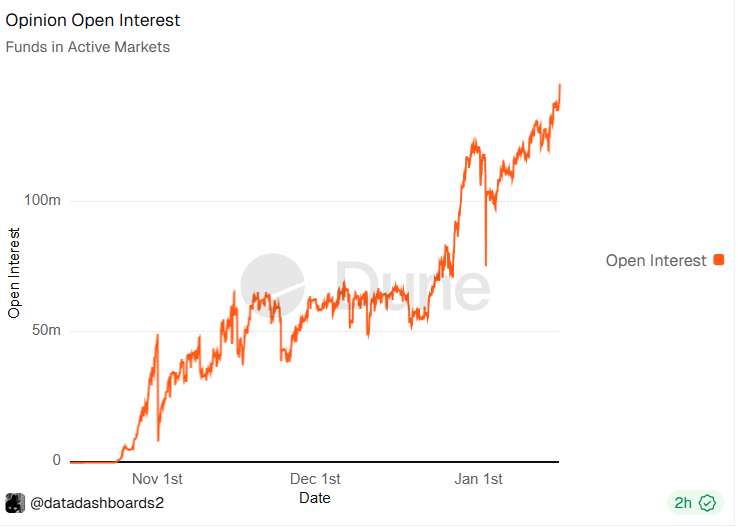

Opinion prediction platform reaches record open interest