CAD flat despite China trade agreement – Scotiabank

The Canadian Dollar (CAD) is little changed on the day, with neither a modest bid for US equity futures nor a more obvious bump in crude prices helping the CAD out, Scotiabank's Chief FX Strategists Shaun Osborne and Eric Theoret report.

USD/CAD range-bound with double-top risk

"Price action is just as agnostic about the trade agreement PM Carney has reached with China during this week’s visit (lower tariffs on Chinese EVs to Canada, significantly lower tariffs on Canadian canola and reduced tariffs on other farm products)."

"The deal also includes an agreement to pursue closer trade and investment in energy among other things. This looks positive for Canada and, at the very least, should help firm up the cap on the USD that we think sits around the 1.39 point currently."

"Spot has moved sideways in effect this week with USD gains to the 1.3925 rejected twice, setting up a potential double top pattern on the short-term chart. USD losses below 1.3885 this morning may serve as a “heads up” that the USD is poised to test the 1.3855 neckline trigger of the pattern. A clear break lower targets a drop to the upper 1.37s."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

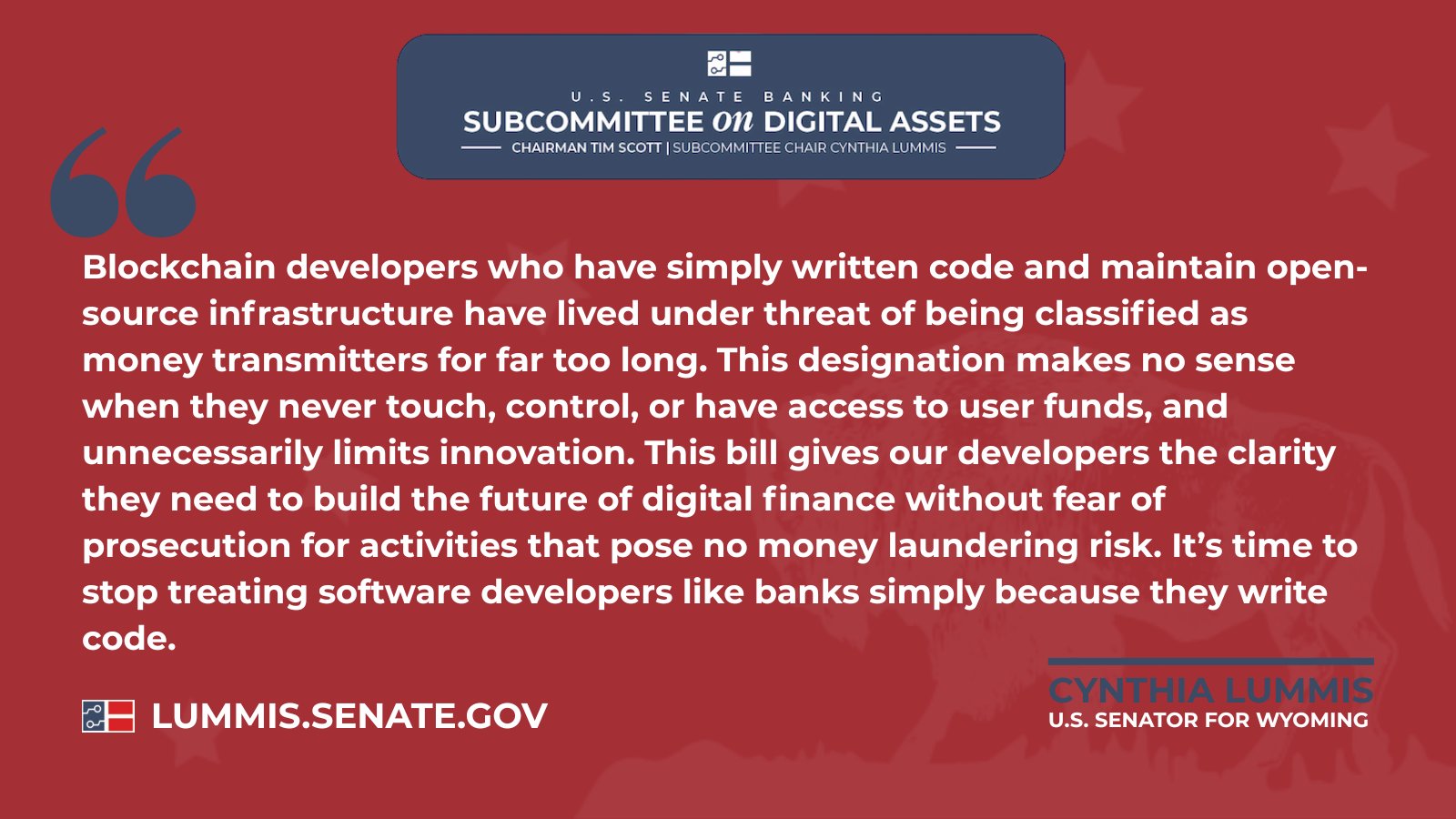

Senate Judiciary flags DeFi oversight ‘gaps’ in U.S. crypto bill

Morph Integrates RedStone Oracle for Real-Time, Secure Pricing for On-Chain Payments

SwissBorg Hooks Base for Killer Crypto Swaps – Kriptoworld.com

TRON Holds Long-Term Ascending Channel as Weekly Trend Stays Firm