Customers are benefitting from the global stablecoin arms race — but that won’t last forever

Stablecoins are entering their most competitive phase yet. For years, the sector’s biggest players (primarily Tether and Circle) dominated largely on liquidity and network effects. But now that the GENIUS Act is allowing stablecoins to go mainstream, the battleground is shifting.

Stablecoin issuers are all frantically looking for ways to offer the highest possible rewards to their customers in order to gain market share, even if it means drastically cutting into their own margins. It’s easy to understand why. The issuers that manage to grab a big slice of the stablecoin market today are pretty much guaranteed long-term dominance in payments.

While it’s still hard to tell which players will emerge victorious from this race, one thing is for sure: this competition will massively benefit stablecoin users all around the world — at least in the short-term. Over long time horizons, yields are likely to go back down once the stablecoin winners are properly established.

Yields galore

Technically, under the GENIUS Act, stablecoin issuers aren’t allowed to directly offer interest to their users. But firms have found an easy workaround by partnering up with various exchanges, which offer yields on their behalf.

What does the market currently look like? Coinbase offers 4.11% yield on USDC. Kraken has pushed that number to around 5%. Meanwhile, USDe on MEXC is offering yields closer to 6%. And in some cases, depending on how long you lock up your stablecoins and which exchanges or staking instruments you use, users can boost their yields up to a striking 8–14%.

These figures are remarkable for one simple reason: the U.S. Treasury market (the backbone of the world’s “risk-free” yield) does not currently offer anything close to 8%. (Nor can you access any meaningful yields through banks.) For stablecoin issuers to provide such returns, they must go beyond merely parking collateral in short-term treasuries and create synthetic yield mechanisms and structured financial products. Put differently, they’re getting creative, and creating riskier products in order to offer higher rates.

Grabbing market share

We can understand the situation as a land grab. Tether and Circle have huge networks, deep liquidity pools, and the strongest brand recognition in the ecosystem. If you launch a new stablecoin today, you need to offer something that feels meaningfully better. And in a market where the tokens are designed to be dollar-equivalents, yield is the easiest differentiator.

If your competitor is offering 5% yield, you have to offer 6%. If they move to 6%, you must find a way to offer 7%. Each time, you’re cutting into your own margins, with the belief that the short-term pain will be worth it in the long run.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SwissBorg Strengthens Base Ecosystem Access With Native USDC and ETH Integration

Crypto makes inroads into US real estate as Megatel, Newrez clear hurdles for payments, rewards token

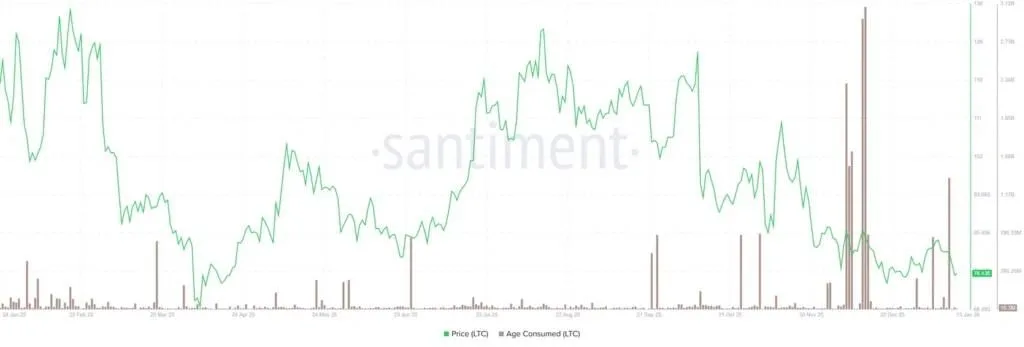

Litecoin Price Prediction: Will LTC Hold Key $72 Support?

Analysts Bullish On BlockDAG Hitting $1 in 2026 – Why It’s The Best Crypto To Buy Before Launch