Trump proposes allowing you to use funds from your 401(k) for a home purchase. However, returning the money can be a complex process.

Does Using Retirement Savings for Homeownership Improve Affordability?

If purchasing a home means sacrificing your retirement security, does it truly make housing more affordable?

Trump Administration’s Proposal: Easier Access to 401(k) Funds for Home Buying

The Trump administration has introduced a plan aimed at making it simpler for Americans to tap into their retirement savings to buy a home. But is this a wise move?

According to the proposal, which is expected to be unveiled at the World Economic Forum in Davos, workers would be allowed to withdraw funds from their 401(k) accounts to purchase a house. While they would still owe income tax on the withdrawal, the usual 10% penalty for early withdrawal would be waived. Currently, this exception only applies to early withdrawals from traditional IRAs, or you can withdraw Roth IRA contributions at any time without taxes or penalties.

Popular Articles from MarketWatch

Legislative Hurdles and Plan Details

Any modification to 401(k) withdrawal rules would require approval from Congress, as these plans are overseen by the IRS and governed by ERISA regulations. Lawmakers have periodically eased restrictions on accessing retirement funds, most recently by relaxing hardship withdrawal requirements.

Another aspect of the proposal, as discussed by White House economic adviser Kevin Hassett, would allow individuals to reinvest their down payment back into their retirement accounts as equity in their new home. Currently, there is no system in place to facilitate this. The closest alternative is a self-directed IRA that invests in real estate, but these are limited to investment properties, not primary residences.

401(k) plans are not intended for holding personal assets such as real estate, cryptocurrency, or even uninvested cash. Contributions are typically made through payroll deductions and invested in options selected by your employer’s fiduciary committee.

Some employers permit self-directed brokerage accounts within 401(k) plans, but even then, investments are generally limited to those offered by the account provider, not assets you bring in yourself.

Even those who open brokerage windows within their 401(k) plans tend to stick with mainstream investments like cash and popular index ETFs, rather than venturing into riskier territory.

Craig Copeland, director of wealth-benefits research at the Employee Benefit Research Institute (EBRI), expressed skepticism: “From what I’ve seen, none of these options would be permitted. I don’t see how they plan to implement this. There’s currently no way to allow people to put money back in, and annual contribution limits still apply.”

Employer Adoption Is Not Guaranteed

Copeland also notes that even if legislation permits new 401(k) withdrawal options, employers are not required to offer them. So, even with regulatory changes, individual companies may choose not to implement these features.

Potential Risks of Withdrawing Retirement Funds

Withdrawing money from retirement accounts to cover major expenses like home purchases is not a new concept. For example, some have used IRA funds for a down payment or taken out 401(k) loans for personal needs. Many others have accessed retirement savings for emergencies, education, or other exceptions to the early withdrawal penalty. A recent Transamerica Center for Retirement Studies survey found that 37% of participants had taken a loan, early withdrawal, or hardship withdrawal from their retirement accounts, raising concerns about the trend.

The main issue is that withdrawing funds is easy, but replenishing those savings is much more difficult. Most early withdrawals from 401(k) accounts are never replaced, leading to what the industry calls “leakage.” This reduces retirement savings and can create long-term financial challenges as more people tap into their accounts prematurely.

David Stinnett, who leads Vanguard’s strategic retirement consulting team, warns, “If leakage increases significantly, it’s a real concern. You don’t want to see more money leaving retirement accounts.” Vanguard tracks these trends in its annual How America Saves survey.

Existing 401(k) Loan Options

Current 401(k) loan rules allow you to borrow up to 50% of your account balance or $50,000, whichever is less, and repay it through payroll deductions. This is essentially borrowing from yourself and paying yourself back with interest (plus administrative fees). Previously, taking a loan meant you had to pause new contributions, but now you can continue saving while repaying the loan.

What’s the cost? For a $10,000 loan with a steady 10% annual growth rate over five years, you might forgo less than $6,000 in investment gains, since you’re repaying the loan as you go.

The true opportunity cost depends on how you use the borrowed funds. If the money goes toward a home down payment, you’re simply shifting your investment, though real estate may not appreciate as quickly as stocks, and the funds become less accessible for future needs.

This is why some still withdraw from their 401(k)s for home purchases, even with the 10% penalty, especially if they don’t have Roth IRA contributions or a traditional IRA that allows a first-time homebuyer exception.

For those determined to buy a home, a 10% penalty on a $10,000 withdrawal amounts to $1,000, plus $1,200 to $2,400 in taxes. This may not deter them, nor would waiving the penalty necessarily encourage new buyers if other housing market challenges persist.

Financial advisors often recommend loans over outright withdrawals because if you never repay a $10,000 withdrawal, you could miss out on as much as $150,000 in growth over 30 years. It’s also important to avoid overextending yourself financially, which could lead to future hardship.

As Chicago-based certified financial planner Valerie Rivera puts it, “This is essentially borrowing from your future. If your only available funds for a home purchase are in your retirement account, you may not be financially ready to buy.”

Weighing the Impact on Housing Affordability

Ultimately, the effect of this proposal on housing affordability and the broader affordability challenges in the U.S. remains uncertain. Each individual must balance current expenses—housing, childcare, education, food—with saving for the future.

Rivera describes the plan to allow 401(k) withdrawals for home purchases as a short-term fix: “People focus on the down payment and overlook ongoing costs. They may end up house-rich but cash-poor, struggling to maintain their property.”

Have Questions About Investing?

If you’re seeking advice on investing, integrating it into your overall financial strategy, or maximizing your money, you can reach out for guidance. Please include “Fix My Portfolio” in your email subject line.

You’re also welcome to join discussions on retirement planning in our community forums.

More Top Reads from MarketWatch

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

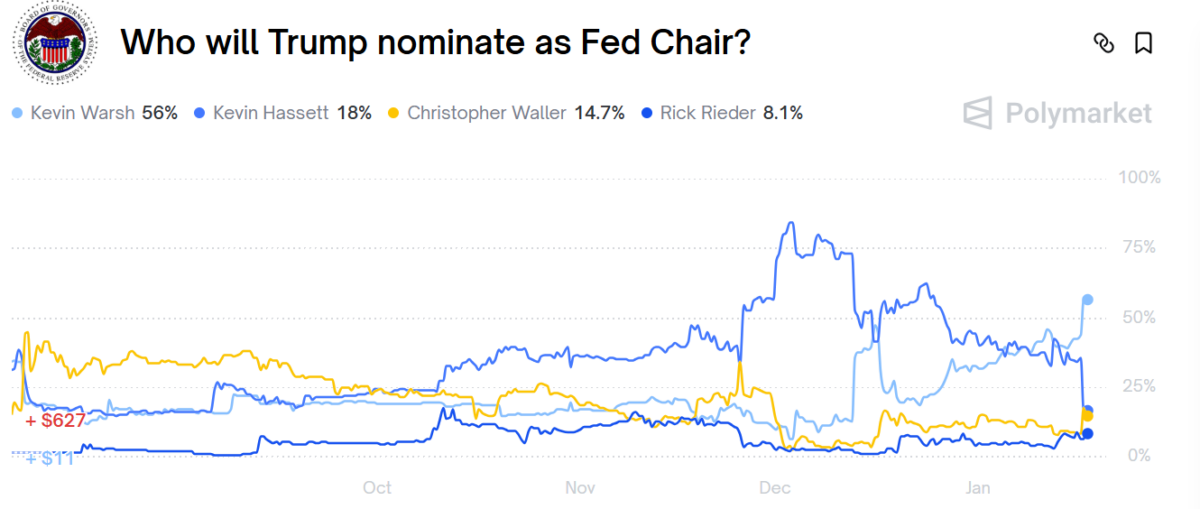

Kevin Hassett odds of replacing Powell at Fed Reserve on Polymarket tank, $11.4 million bets in trouble