US Dollar Outlook: Three-Week USD Surge Encounters Resistance – Next Move in Focus

US Dollar Index Approaches Key Resistance After Three-Week Rally

The US Dollar Index (DXY) has continued its upward momentum, extending the holiday rally for a third consecutive week and now faces significant Fibonacci resistance. This recent climb has recouped a substantial part of the losses seen in November. How the DXY behaves at this critical juncture will help determine if a lasting bottom is forming or if the upward move will pause and enter a consolidation phase.

Although the short-term trend remains positive, the future direction depends on whether the Dollar can maintain its strength at this resistance level. A decisive breakout would signal the potential for the rally to persist into the new year. The DXY weekly technical chart highlights these crucial levels for traders to watch.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

If Bitcoin Rips in Q1 2026, These 5 Altcoins Could Outperform With 1,000%+ Upside

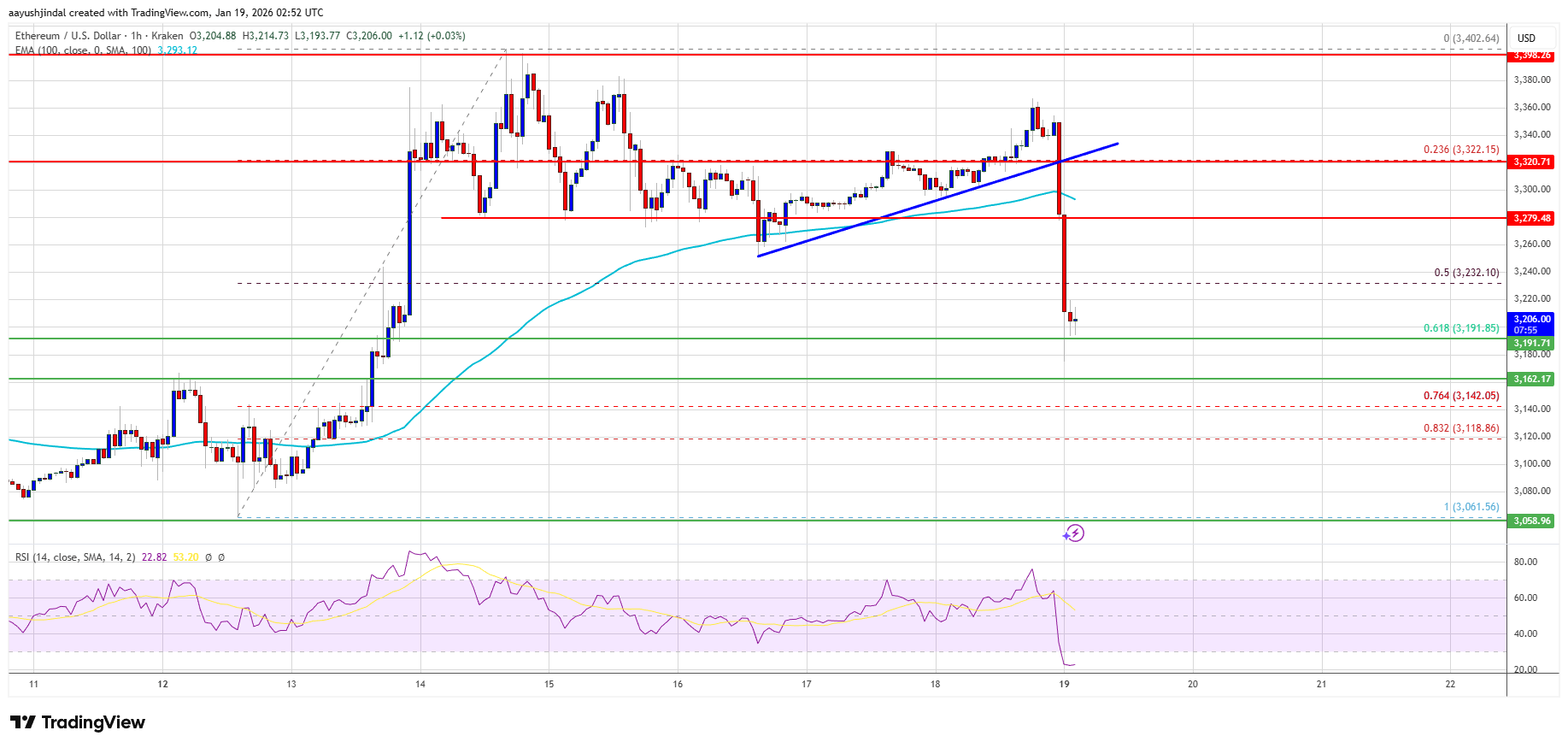

Ethereum Price Falls Back to $3,200, Recovery Faces Its First Real Test

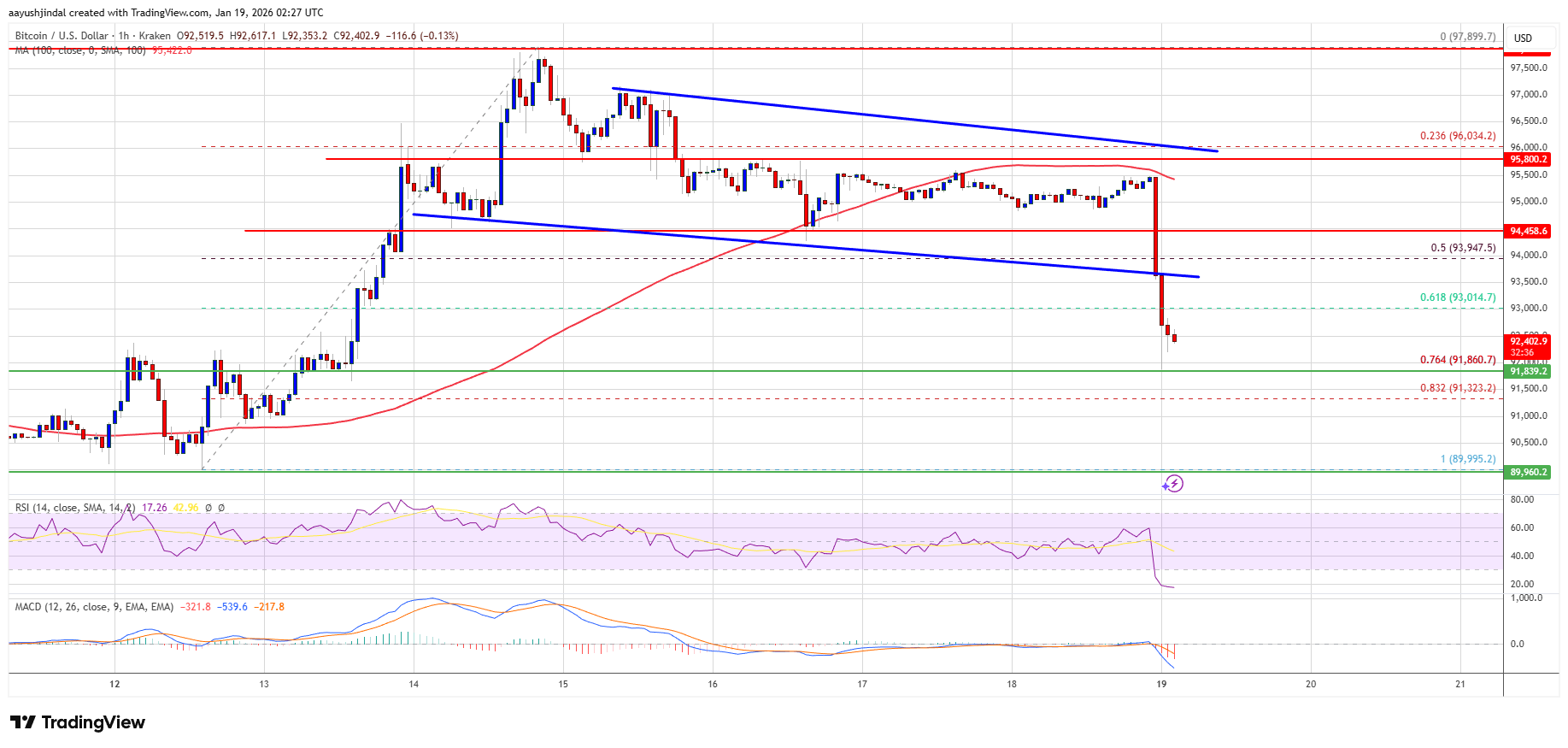

Bitcoin Price Sharp Pullback Raises One Question: Will $92K Hold?

China economy stumbles in Q4 with 4.5% growth as aluminum and coal outputs hit record