Allora (ALLO) aims to become a decentralized AI inference/prediction infrastructure network, aspiring to be an "AI oracle + decentralized model marketplace" within Web3. ALLO is the payment, incentive, and governance token of the Allora network. The Allora mainnet is already live, and ALLO is listed on multiple centralized exchanges (CEXs). ALLO is a new coin in the AI sector.

Currently, the focus of attention regarding this project is:

What is Allora (ALLO)? How is it different from other AI coins (FET, RNDR, etc.)? Is Allora a marketplace for computing power, data, and models, or an oracle/inference network?

What is the current price of Allora (ALLO)? Which CEXs/DEXs allow trading ALLO?

Coin-related

Price calculator

Price history

Price prediction

Technical analysis

Coin buying guide

Crypto category

Profit calculator

What is Allora (ALLO)?

Allora basic info

Allora is a self-improving, decentralized AI network that harnesses community-built machine learning models for accurate, context-aware predictions. Founded by Nick Emmons and Kenny Peluso in 2019 and backed by Polychain Capital, Framework Ventures, and Blockchain Capital with $35 million in funding, Allora (ALLO) will soon be available on Bitget!

What is Allora (ALLO)?

Allora is a decentralized AI network that solves the problem of siloed, proprietary AI by enabling open collaboration and continuous improvement among machine learning models through transparent, incentivized protocols. The platform provides accessible AI for applications across Web3 and enterprise use cases.

Modern AI is dominated by a few proprietary, centralized models which are opaque, difficult to verify, and inaccessible for most users. Traditional AI networks are siloed, limiting collaboration and collective advancement in predictive accuracy. Centralized institutions make it hard to verify how predictions are made and whether they can be trusted.

Allora addresses these challenges by enabling multiple AI models to collaborate and compete within the network. Models submit predictions to specific topics, while other models evaluate them for accuracy. This creates a feedback loop where models are continuously rewarded or penalized based on their performance, making the system smarter over time.

Core Innovation: Allora uses Proof of Alpha consensus, rewarding participants based on quality of predictions rather than computational work or staking. The platform leverages zero-knowledge machine learning (zkML) to allow cryptographic verification of predictions while maintaining privacy and transparency.

Who Created Allora (ALLO)?

Allora was founded in 2019 in New York by Nick Emmons and Kenny Peluso, both former blockchain engineers at John Hancock. The company was originally called Upshot before rebranding to Allora Labs to focus on decentralized AI beyond NFT appraisals.

Nick Emmons (Co-Founder & CEO):

● Former Lead Blockchain Engineer at John Hancock and Manulife

● Developed applications on public blockchains and contributed to blockchain strategy at financial institutions

● Leads strategic direction and vision for decentralized AI at Allora Labs

● Focus areas: Decentralized AI, reinforcement learning, and crowdsourced intelligence

Kenny Peluso (Co-Founder & CTO):

● Bachelor of Science in Applied Mathematics from Brown University

● Former full-stack developer at John Hancock

● Oversees technical development and implementation at Allora Labs

● Worked with Nick Emmons prior to founding Allora Labs

Key Team Members:

● Tayeb Kenzari: Strategy and marketing lead

● Keenan Olsen: Head of Growth

● Brian Chen: Finance and operations

● Guilherme Brandão: Backend and blockchain engineering

● Kjetil Vaagen: Blockchain and data engineering

The Allora Labs team includes about 30 members with expertise in software development, engineering, marketing, finance, and PhD-level academic research, distributed internationally across the US, Canada, Portugal, Norway, and other locations.

What VCs Back Allora (ALLO)?

Allora has raised a total of $35 million across multiple funding rounds from top-tier venture capital firms and prominent investors in both crypto and traditional finance sectors.

Funding Rounds:

● Seed Round: $1.25 million

● Extended Series A (2023): $22 million

● Strategic Round (2024): $3 million, focusing on strategic partnerships to accelerate ecosystem development

Major Venture Capital Backers:

● Polychain Capital (extension round lead)

● Framework Ventures (seed round lead)

● Blockchain Capital (lead investor)

● Delphi Ventures (lead investor)

● ABCDE Capital

● CoinFund

Notable Angel Investors:

● Stani Kulechov (founder of Aave)

Strategic Partnerships:

● Amazon Web Services (AWS): Developer support for deploying Allora worker nodes, part of AWS Activate/Web3 Providers program

● Plume Network: Integration for Real World Assets (RWA) DeFi stack for valuation, pricing, and risk management

● PancakeSwap: Powering prediction markets and price forecasting on Arbitrum

● Phala Network: Joint development for privacy-preserving AI agents and secure computation

● zkPredictor: Zero-knowledge machine learning infrastructure partner for verifiable AI inference

● Steer Protocol: AI-powered liquidity vaults for DeFi markets

● Xross Road: AI-driven analytics for anime, entertainment, and brand sector in Web3

● stc Bahrain: Partnership for Web3 and AI ecosystem growth across the Gulf region

Allora's backing from nearly every crypto and AI venture capital fund demonstrates institutional confidence in decentralized AI networks.

How Allora (ALLO) Works

Allora operates through a collaborative system where multiple AI models work together to produce accurate predictions without centralized control.

Collaborative AI Network

Many AI models (called "workers") make predictions on specific topics such as crypto prices, sentiment analysis, or DeFi signals. These predictions are evaluated by "reputers" who score them for accuracy and relevance. This creates a competitive environment where models constantly improve based on real-world feedback.

Self-Improvement Loop

Models earn rewards in ALLO tokens for correct predictions and get penalized for errors. They can learn from each other's successes and failures. This continuous feedback loop makes the system smarter and more reliable over time without human intervention.

Specialized Topics Architecture

AI tasks are organized into specialized topics, allowing models to focus on areas where they perform best. For example, one model might excel at Bitcoin price prediction while another specializes in Ethereum sentiment analysis. Each topic has tailored evaluation metrics to ensure accurate performance measurement.

Three-Layer Technical Architecture

Allora uses a modular architecture with three main layers:

1. Inference Consumption Layer: Interface where users request AI predictions on specific topics and pay in ALLO tokens

2. Inference Synthesis and Evaluation Layer: Workers execute inference tasks while reputers evaluate prediction accuracy

3. Consensus and Validation Layer: Validators operate nodes on the Allora blockchain, processing transactions and enforcing staking, rewards, and governance rules

Cosmos SDK Blockchain Foundation

Allora operates on its own Layer 1 blockchain built on the Cosmos SDK, providing scalability, interoperability, and security. The Cosmos-based architecture enables decentralized AI inference, evaluation, and consensus with integrated zero-knowledge machine learning for privacy and verifiability.

Privacy and Verification

Zero-knowledge machine learning keeps individual predictions private while cryptographic proofs verify correctness on-chain. This ensures transparency without compromising data security or revealing sensitive information about model operations.

Multi-Chain Interoperability

While the core network is Cosmos-based, Allora integrates with Ethereum, Solana, Bitcoin (via predictive models), Mantle, Starknet, zkSync, and other Web3 ecosystems to extend utility and accessibility across blockchain networks.

You can access the platform at allora.network and explore documentation at docs.allora.network.

Allora Token (ALLO) and Economics

The ALLO token serves as the native utility and governance token powering the Allora decentralized AI network, enabling payments, staking, rewards, and participation in key network activities.

Token Details

● Token Name: Allora

● Token Symbol: ALLO

● Total Supply: 1,000,000,000 tokens (1 billion)

● Initial Circulating Supply: 20.05% (approximately 200,500,000 ALLO)

● Blockchain Deployment: Allora Layer 1 (Cosmos SDK-based) with multichain bridges to Ethereum, Base, and BNB Chain

● Token Standard: ICS20 (Cosmos interchain)

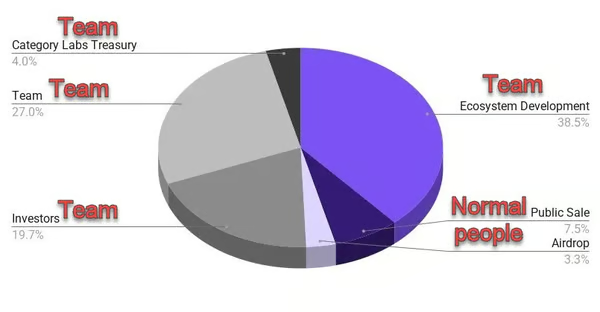

Token Distribution

● Early Backers (VCs): 31.05%

● Core Contributors (Team): 17.50%

● Network Emissions: 21.45%

● Community: 9.30%

● Foundation: 9.35%

● Ecosystem & Partnerships: 8.85%

● Allora Prime Staking: 2.50%

Vesting Structure: Backers and contributors have three-year lockup with 12 months full lock, then 33% unlock, remainder linearly over 24 months. Ecosystem and community allocations have 50% unlocked at Token Generation Event (TGE), remainder released linearly over two years. Network emissions use Bitcoin-like declining schedule for staking and reward mechanisms.

Token Utilities

● Payments for AI Inference: Users and applications pay ALLO to access AI-powered predictions, insights, and analytics delivered by network worker models

● Staking & Participation: Validators and reputers stake ALLO to secure the network, evaluate predictions, and participate in consensus, earning protocol rewards for honest participation

● Earning by Contributing: Workers (AI model operators) earn ALLO by providing accurate predictions on various topics

● Governance: Token holders vote on network upgrades, protocol parameters, topic creation, and funding directions in decentralized governance

● Ecosystem Incentives: ALLO funds hackathons, development grants, and ecosystem initiatives that grow the Allora platform

● Premium Staking: Allora Prime staking program offers exclusive rewards, yield boosts, and early feature access for participants

Why Allora?

Traditional AI systems are centralized, opaque, and inaccessible to most users. Allora addresses these fundamental challenges with proven technology and ecosystem support:

Proven Leadership: Founded by Nick Emmons and Kenny Peluso, both former blockchain engineers at John Hancock with experience in public blockchain development and financial technology innovation.

Institutional Backing: $35 million raised from leading investors including Polychain Capital, Framework Ventures, Blockchain Capital, Delphi Ventures, and CoinFund, demonstrating confidence in decentralized AI.

Self-Improving Collective Intelligence: Unique mechanism where multiple independent AI models continuously improve through competition and collaboration within specialized topics, with reputers evaluating predictions to ensure only top performers are rewarded.

Proof of Alpha Consensus: Rewards participants based on prediction quality and accuracy rather than computational work or staking, ensuring economic alignment and market-driven accuracy across the network.

Zero-Knowledge Machine Learning Integration: Leader in zkML technology, allowing predictions to be cryptographically proven as correct on-chain without exposing private data or model internals, balancing transparency with privacy.

Strategic Partnership Network: Integrations with Amazon Web Services for infrastructure, PancakeSwap for prediction markets, Plume Network for RWA DeFi, Phala Network for privacy-preserving AI, and stc Bahrain for regional expansion.

Multi-Chain Architecture: Native Cosmos Layer 1 blockchain with interoperability across Ethereum, Solana, Bitcoin, zkSync, Starknet, and other networks, providing accessibility and cross-chain utility.

Active Ecosystem: Public testnet with over 300,000 participants, accelerator program supporting AI agent builders, and operational partnerships generating real-world usage and revenue.

Modular Topic Architecture: AI applications organized into specialized topics (DeFi signals, NFT pricing, gaming NPCs, healthcare predictions) allowing tailored scoring and model competition for targeted domains.

Developer Tools: Model Development Kit (MDK), REST and RPC APIs, CLI tools, and open-source repositories enable easy integration for developers building decentralized AI applications.

Balanced Token Economics: Distribution across contributors, ecosystem growth, and long-term network emissions with Bitcoin-like declining schedule promoting sustained participation and network decentralization.

Allora combines decentralized governance, continuous model improvement, privacy technologies, and cross-chain interoperability to build a self-improving global intelligence layer for Web3 and enterprise applications.

Allora (ALLO) Goes Live on Bitget

We are thrilled to announce that Allora Network (ALLO) will be listed in the Innovation and AI Zone.

Trading Available: 11 November 2025, 13:00 (UTC)

Trade ALLO/USDT on Bitget!

Disclaimer: The opinions expressed in this article are for informational purposes only. This article does not constitute an endorsement of any of the products and services discussed or investment, financial, or trading advice. Qualified professionals should be consulted prior to making financial decisions.

ALLO resources

ALLO supply and tokenomics

Links

What is the development prospect and future value of ALLO?

The market value of ALLO currently stands at $22.19M, and its market ranking is #721. The value of ALLO is not widely recognized by the market. When the bull market comes, the market value of ALLO may have great growth potential.

As a new type of currency with innovative technology and unique use cases, ALLO has broad market potential and significant room for development. The distinctiveness and appeal of ALLO may attract the interest of specific groups, thereby driving up its market value.

Is ALLO worth investing or holding? How to buy ALLO from a crypto exchange?

How to get Allora through other methods?

What is Allora used for and how to use Allora?

Want to get cryptocurrency instantly?

Buy cryptocurrencies instantly with a credit cardTrade popular cryptocurrencies nowHow to buy popular cryptocurrenciesSign up now!Want to view similar cryptocurrencies?

What are the prices of popular cryptocurrencies today?What would have happened if you had bought popular cryptos?What are the price predictions for popular cryptocurrencies from 2025 to 2050?Allora Market

Learn about other cryptos