Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.27%

Current ETH GAS: 0.5-2 gwei

Hot BTC ETF: IBIT

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$111221.98 (+1.38%)Fear and Greed Index51(Neutral)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketWLFITotal spot Bitcoin ETF netflow +$88.1M (1D); -$871.3M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.27%

Current ETH GAS: 0.5-2 gwei

Hot BTC ETF: IBIT

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$111221.98 (+1.38%)Fear and Greed Index51(Neutral)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketWLFITotal spot Bitcoin ETF netflow +$88.1M (1D); -$871.3M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitget: Ranked top 4 in global daily trading volume!

BTC dominance57.27%

Current ETH GAS: 0.5-2 gwei

Hot BTC ETF: IBIT

Bitcoin halving: 4th in 2024, 5th in 2028

BTC/USDT$111221.98 (+1.38%)Fear and Greed Index51(Neutral)

Altcoin season index:0(Bitcoin season)

Coins listed in Pre-MarketWLFITotal spot Bitcoin ETF netflow +$88.1M (1D); -$871.3M (7D).Welcome gift package for new users worth 6200 USDT.Claim now

Trade anytime, anywhere with the Bitget app.Download now

Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF

BITC

Learn more about Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF's (BITC) price performance, volume, premium rate, inflows and outflows, and other key data indicators.

BITC price today and history

$47.2 +0.05 (+0.11%)

1D

7D

1Y

Open price$47.29

Day's high$47.29

Close price$47.15

Day's low$47.07

YTD % change-0.59%

52-week high$79.48

1-year % change-0.44%

52-week low$38.57

The latest price of BITC is $47.2 , with a change of +0.11% in the last 24 hours. The 52-week high for BITC is $79.48 , and the 52-week low is $38.57 .

Today's BITC premium/discount to NAV

Shares outstanding319.36K BITC

BTC holdings234.86 BTC

NAV per share$71.53

BTC change (1D)

+10.47 BTC(+4.67%)

Premium/Discount+0.11%

BTC change (7D)

+22.32 BTC(+10.5%)

BITC volume

Volume (BITC)2.68K (BITC)

10-day average volume (BITC)89.35 (BITC)

Volume (USD)$126.38K

10-day average volume (USD)$4.22K

What is Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC)

Trading platform

ARCX

Asset class

Futures

Assets under management

$4.55M

Expense ratio

0.00%

Issuer

--

Fund family

--

Inception date

--

ETF homepage

--

FAQ

What are the tax implications of investing in the Bitwise Trendwise ETF?

Tax implications can vary based on your location and personal situation. It's important to consult with a tax professional for guidance on how capital gains and dividends from the ETF may affect your taxes.

Can I hold the Bitwise Trendwise ETF in my retirement account?

Yes, as long as the ETF is offered through your retirement account provider, it can generally be held within retirement accounts like IRAs.

How is the performance of the Bitwise Trendwise ETF tracked?

Performance is tracked based on the underlying assets, Bitcoin and Treasuries, and is reported by Bitwise regularly to keep investors informed.

What is the management fee for the Bitwise Trendwise ETF?

The management fee can vary, so it is best to check the latest information provided by Bitwise or on the ETF's official webpage.

What are the risks associated with the Bitwise Trendwise ETF?

The ETF carries risks associated with both Bitcoin volatility and interest rate fluctuations in Treasuries, which can impact its performance significantly.

Is the Bitwise Trendwise ETF suitable for all investors?

While the ETF provides a unique investment opportunity, it may not be suitable for all investors, especially those with low risk tolerance or limited understanding of cryptocurrency markets.

Where can I buy the Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF?

You can purchase the Bitwise Trendwise ETF through various brokerage platforms, and it's also available on Bitget Exchange.

What are the benefits of investing in the Bitwise Trendwise ETF?

Investing in this ETF allows investors to gain exposure to the performance of Bitcoin and Treasuries within a single fund, potentially benefiting from the diversification and risk management it offers.

How does the Bitwise Trendwise ETF work?

The ETF uses a systematic approach to allocate funds between Bitcoin and U.S. Treasuries depending on market conditions, aiming to optimize returns while managing risks.

What is the Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF?

The Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF is a financial product that aims to provide investors with exposure to both Bitcoin and U.S. Treasuries by strategically rotating between them based on market trends.

Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF news

Goldman Sachs' $470M Bitcoin Play: A Signal for Institutional Onboarding and Long-Term Value Capture

- Goldman Sachs allocates $470M in direct Bitcoin holdings and $1.5B in Bitcoin ETFs, signaling institutional acceptance of crypto as a macro-hedge. - The dual strategy balances unmediated price exposure with regulated ETFs like IBIT/FBTC, aligning with evolving U.S. and EU regulatory frameworks. - Rising institutional adoption by firms like BlackRock and JPMorgan validates Bitcoin's role in diversifying portfolios amid inflation and geopolitical risks. - Retail investors are urged to re-evaluate crypto al

ainvest2025-08-27

Bitcoin Market Volatility and Institutional Activity: Decoding Whale Movements as Leading Indicators

- 2025 Q2 saw dormant Bitcoin whale accounts (10,000+ BTC) reactivating, shifting $642M to Ethereum through leveraged positions and large ETH purchases. - Ethereum whales (10,000–100,000 ETH) accumulated 200,000 ETH ($515M), reflecting institutional adoption driven by deflationary supply, 3.8% staking yields, and Dencun/Pectra upgrades. - SEC's utility token reclassification and 29% ETH staking rate boosted Ethereum's appeal, while investors adopted 60–70% Bitcoin/30–40% Ethereum portfolios to balance stab

ainvest2025-08-27

The Institutional Shift from Bitcoin to Ethereum ETFs: A Structural Reallocation with Long-Term Implications

- Institutional capital is shifting from Bitcoin to Ethereum ETFs, driven by Ethereum's infrastructure-grade utility and yield advantages. - SEC approval of Ethereum ETF redemptions and 3.8% staking yields created a $9.4B inflow by Q2 2025, outpacing Bitcoin's $552M. - Ethereum's Dencun upgrade reduced L2 fees by 90%, boosting TVL to $45B and enabling real-world applications beyond speculation. - A capital flywheel effect emerges as staking, TVL growth, and corporate allocations reinforce Ethereum's instit

ainvest2025-08-27

Bitcoin Long-Term Holders See Record Profits Since 2016

Coinlineup2025-08-27

Bitcoin Surges Above $111,000 Amid Institutional Moves

Coinlineup2025-08-27

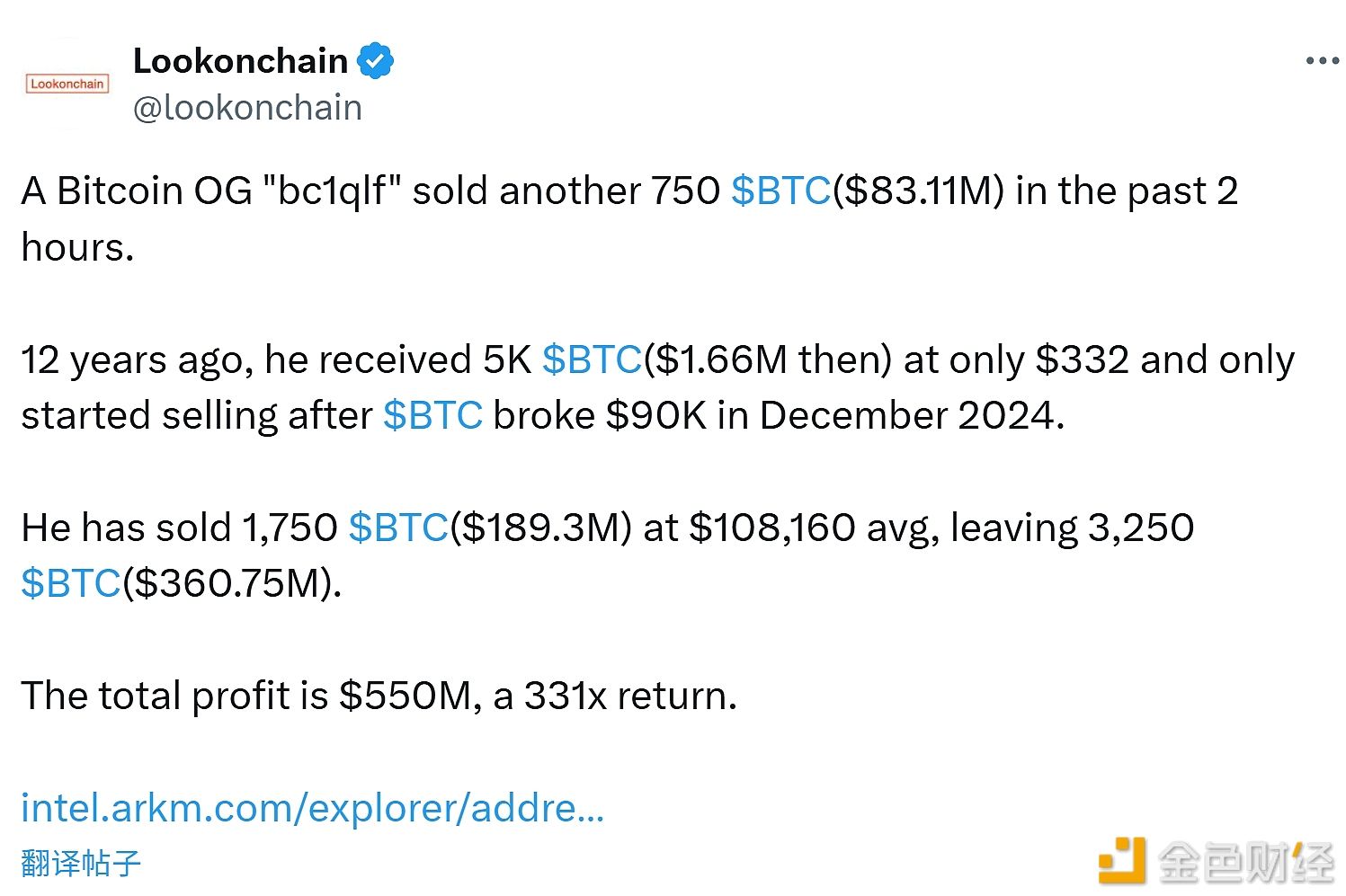

Early Bitcoin holder "bc1qlf" resold 750 bitcoins in the past 2 hours

金色财经2025-08-27

Alternative ETFs

| Symbol/ETF name | Asset class | Volume (USD | Share) | Assets under management | Expense ratio |

|---|---|---|---|---|

IBIT iShares Bitcoin Trust | Spot Active | $2.6B 41.46M IBIT | $83.63B | 0.25% |

FBTC Fidelity Wise Origin Bitcoin Fund | Spot Active | $376.59M 3.92M FBTC | $21.35B | 0.25% |

BITO ProShares Bitcoin ETF | Futures Active | $262.84M 13.19M BITO | $2.76B | -- |

GBTC Grayscale Bitcoin Trust ETF | Spot Active | $155.99M 1.8M GBTC | $19.87B | 1.5% |

ARKB ARK 21Shares Bitcoin ETF | Spot Active | $98.75M 2.7M ARKB | $4.79B | 0.21% |

BITB Bitwise Bitcoin ETF | Spot Active | $88.54M 1.48M BITB | $4.49B | 0.2% |

BTC Grayscale Bitcoin Mini Trust ETF | Spot Active | $57.67M 1.17M BTC | $4.05B | 0.15% |

Prefer buying cryptocurrencies directly? You can trade all major cryptocurrencies on Bitget

Bitget—The world's leading crypto exchange

Looking to buy or sell cryptocurrencies like Bitcoin? Choose Bitget, the cryptocurrency exchange offering top-tier liquidity, an exceptional user experience, and unmatched security!

Bitget app

Trade anytime, anywhere with the Bitget app. Join over 30 million users trading and connecting on our platform.

Cryptocurrency investments, including buying Bitcoin online via Bitget, are subject to market risk. Bitget provides easy and convenient ways for you to buy Bitcoin, and we strive to fully inform our users about each cryptocurrency we offer on the exchange. However, we are not responsible for the results that may arise from your Bitcoin purchase. This page and any information included are not an endorsement of any particular cryptocurrency. Any price and other information on this page is collected from the public internet and cannot be considered as an offer from Bitget.