News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

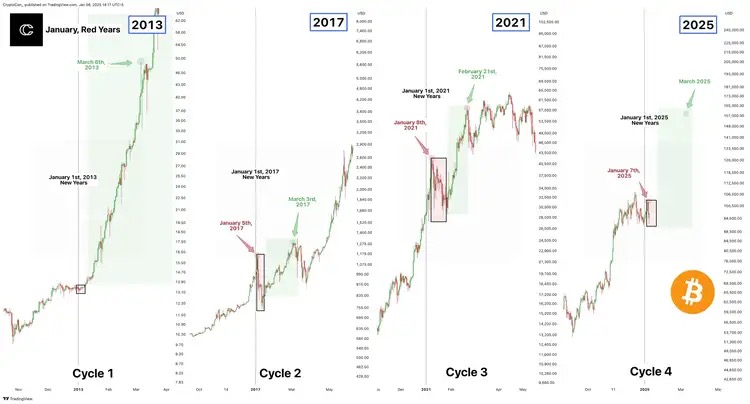

Bitcoin January decline is a common occurrence in 'post-halving years' — Analysts

Cointime·2025/01/13 09:34

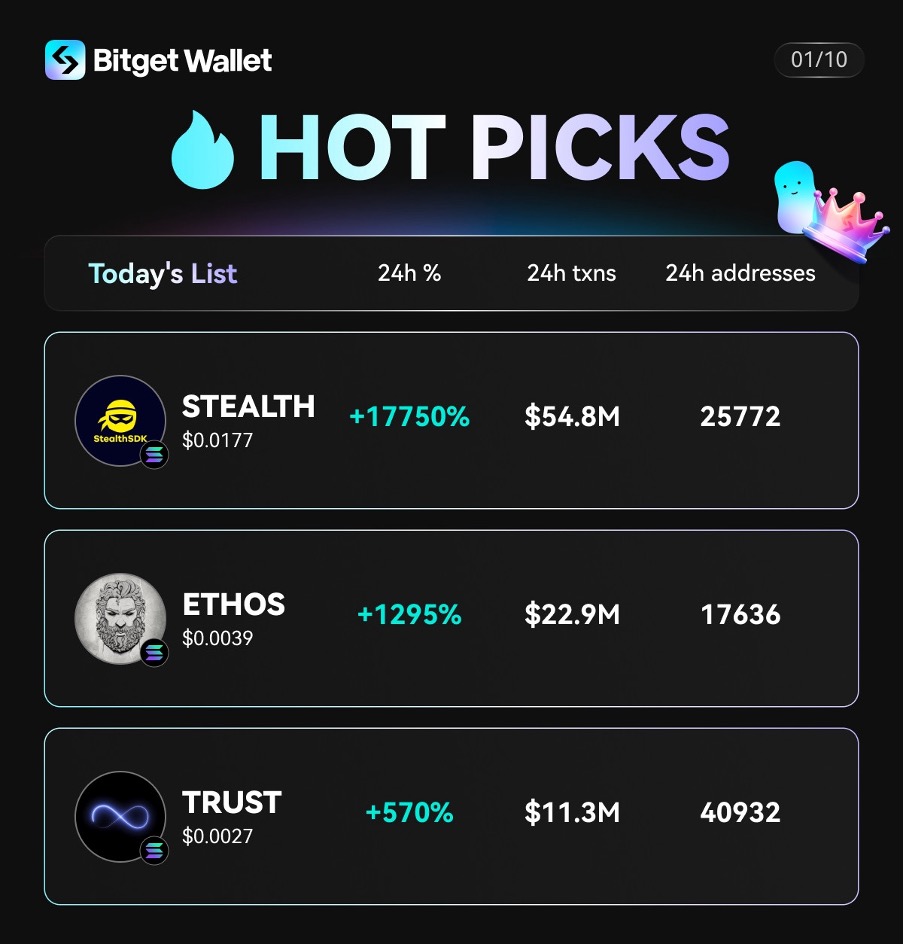

Today's popular MEME list

币币皆然 ·2025/01/10 10:20

Bitcoin speculators panic sell at $92K in 'good time for accumulation'

According to new research from CryptoQuant, short-term Bitcoin holders may be providing the market with a classic "buy the dip" signal.

Cointelegraph·2025/01/10 08:49

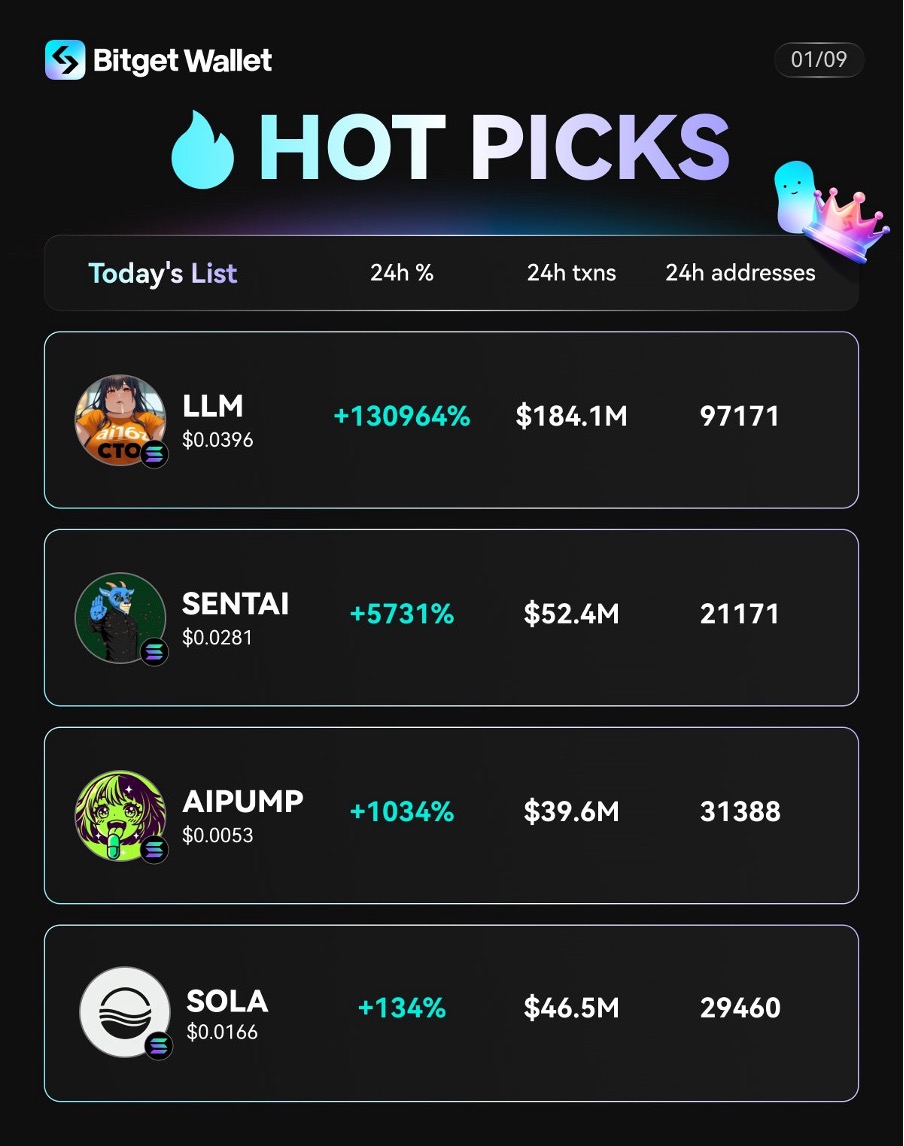

Today's Popular MEME Inventory

币币皆然 ·2025/01/09 08:51

Top teams and industry capital support: An overview of $XTER market cap expectations

远山洞见·2025/01/09 06:52

Flash

- 19:08Data: 127,900 SOL transferred from an anonymous address, worth approximately $17.49 millionAccording to ChainCatcher, Arkham data shows that at 02:47 and 02:48, 127,900 SOL (with a total value of approximately $17.49 million) were transferred from an anonymous address (starting with FKp1tE...) to two different anonymous addresses. 1. 73,090 SOL (worth about $9.9973 million) were transferred to an anonymous address (starting with DYKLk...).2. 54,777.65 SOL (worth about $7.4925 million) were transferred to an anonymous address (starting with BG7tW...).

- 18:34JPMorgan: The US dollar is expected to weaken by 2026, but the risk of Fed rate hikes may challenge this viewJinse Finance reported that JPMorgan's currency strategist team, led by Meera Chandan and Arindam Sandilya, had previously predicted that the US dollar would strengthen after Trump took office as president this year. However, as the dollar posted its worst first-half performance in 50 years, the team had to quickly adjust its outlook. The team's view on the dollar turned negative in March and has remained so ever since. Strategists now expect the dollar to decline by about 3% by mid-2026, then stabilize. However, analysts point out that several major factors complicate the bank's bearish outlook. Firstly, despite the recent rate cuts by the Federal Reserve, US interest rates remain higher than those of many other global central banks. They stated that this makes global investors more inclined to keep their funds in the US and limits the appeal of diversifying into assets outside the US. More broadly, JPMorgan is concerned that a rebound in the US job market or growth expectations could prompt traders not only to rule out the possibility of rate cuts next year but also to increasingly bet on potential rate hikes. "We remain net bearish on the dollar in 2026, although the magnitude and breadth are both less than in 2025," Chandan and her colleagues wrote.

- 17:32A certain whale has opened a 3x leveraged long position on MON and is now floating a profit of over $2 million.According to Jinse Finance, Onchain Lens monitoring shows that as the price of MON rises, a whale's previously opened 3x leveraged MON long position has now generated an unrealized profit of over $2 million. In addition, this whale also holds 3x leveraged long positions in HYPE and ZEC.