News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bullish divergence in altcoin dominance points to early stages of a major rally with more upside potential.Early Stages of Altseason?What to Watch Next

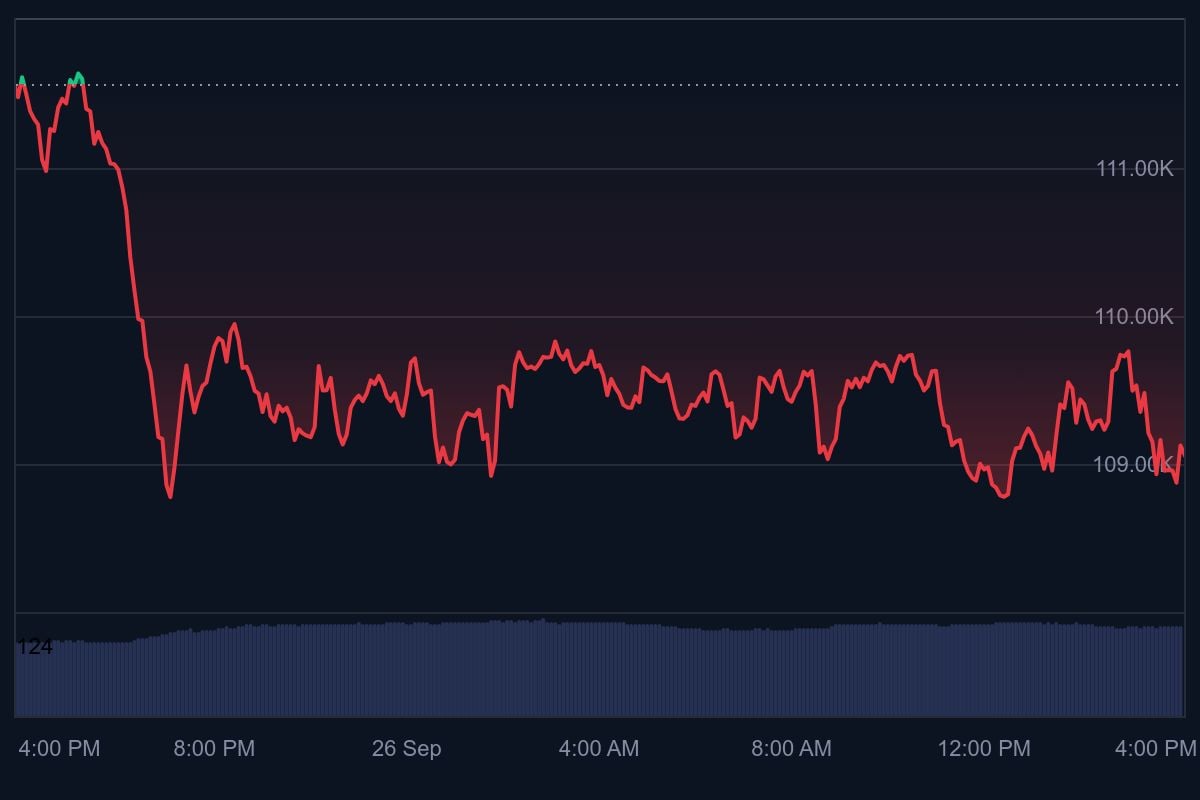

Bitcoin holds near $109K while US stock futures react to inflation data and new tariffs.Stock Markets React to Tariff NewsWhat This Means for Bitcoin

Cronos ($CRO) sets sights on $0.8868, signaling over 350% potential upside as bullish sentiment grows.What’s Fueling the $CRO Price Surge?Can Cronos Reach $0.8868?

SWIFT is testing stablecoins and blockchain-based messaging using Consensys' Linea network.Why Stablecoins and Linea?The Bigger Picture for Crypto Integration

Bitcoin often dips in September but rallies hard in Q4. Will 2025 follow the same bullish pattern?Bitcoin Q4 Performance: A Bullish TurnaroundWhat to Watch This Q4