News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

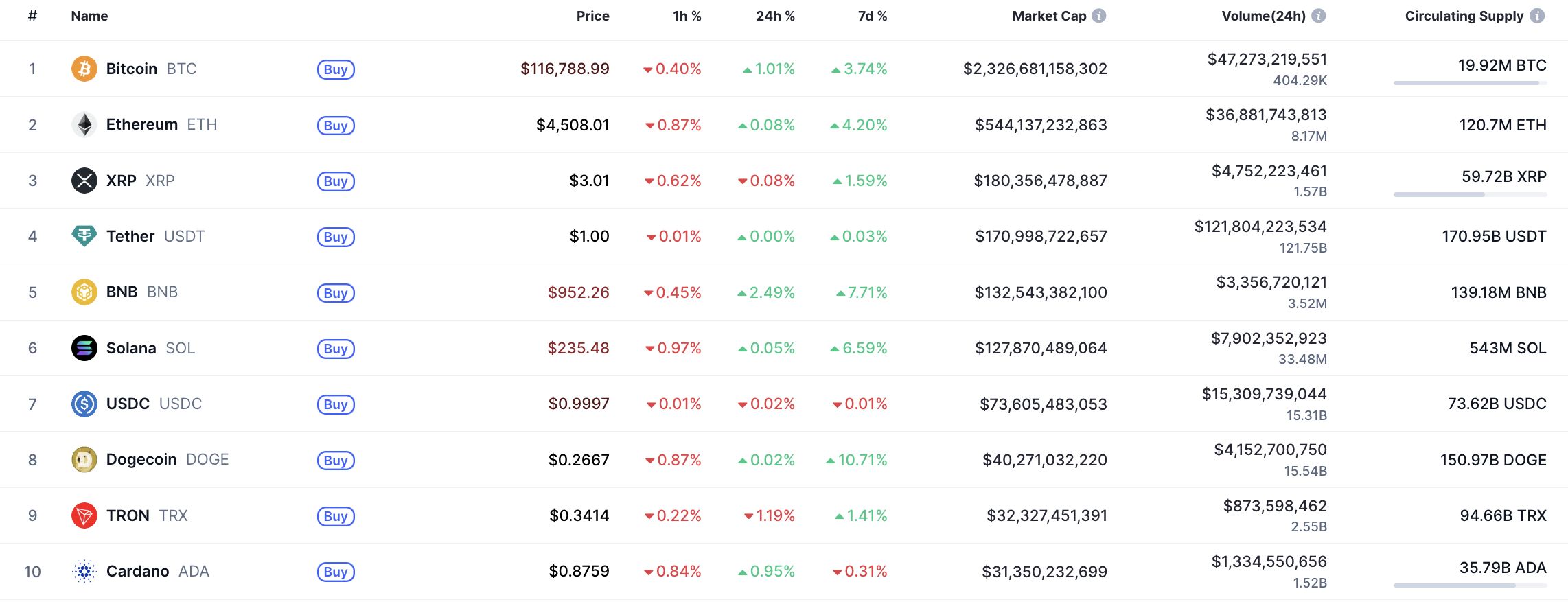

Bitcoin slips below $115K after Fed implements quarter-point interest rate cut

Cointelegraph·2025/09/17 21:54

Over $1.6 Billion DOGE Sold This Month, But Dogecoin Price Continues Rally, Here’s Why

Dogecoin price surged to $0.282 on ETF hype, but $1.63 billion in DOGE selling raises risks. If DOGE breaks $0.287, it could target $0.300, but losing $0.273 support risks a sharp reversal.

BeInCrypto·2025/09/17 21:41

AiCoin Daily Report (September 16)

AICoin·2025/09/17 21:23

Is Ethereum Currently Undervalued At $4,700? NVT Reading Suggests So As New Crypto Shines Alongside ETH

TheCryptoUpdates·2025/09/17 21:06

Tokyo Fashion Brand Expands Into Bitcoin and AI

Mac House rebrands as Gyet to diversify into cryptocurrency, Web3, and AI. The company increases share capacity and begins US-based Bitcoin mining to build digital asset reserves and support technology-focused growth.

BeInCrypto·2025/09/17 18:21

Solana Could Remain Rangebound Near $230–$240 After False Breakout, Possibly Testing $220–$230

Coinotag·2025/09/17 18:15

Midweek CoinStats: DOGE May Consolidate Near $0.27, Could Break Toward $0.30–$0.35

Coinotag·2025/09/17 18:15

SHIB May Remain Sideways Near $0.000013 After False Breakout, Could Test $0.00001290

Coinotag·2025/09/17 18:15

Bitcoin Could Trade Near $116K as Fed 25bp Cut Signals Possible Post‑LTCM Easing

Coinotag·2025/09/17 18:15

Flash

23:10

Spot gold opens higher at $4,548 per ounce, approaching a new highSpot gold opened higher on Monday and is currently quoted at $4,548 per ounce, approaching a historical high.

19:51

Institutions Exit During Christmas Holiday, Spot Bitcoin ETF Sees Net Outflow of $782 MillionBlockBeats News, December 29 — Data shows that during Christmas week, US-listed spot bitcoin ETFs experienced large-scale capital outflows, with a cumulative net outflow of approximately $782 million. Among them, Friday saw a single-day net outflow of $276 million, marking the peak outflow during the holiday period. Specifically, BlackRock IBIT had a single-day outflow of nearly $193 million, Fidelity FBTC saw an outflow of about $74 million, and Grayscale GBTC continued its modest but persistent redemptions. As a result, the total assets under management of spot bitcoin ETFs dropped to around $113.5 billion, lower than the more than $120 billion seen earlier in December. It is worth noting that despite the capital outflows, the price of bitcoin has remained around $87,000, indicating that this round of withdrawals is more likely due to year-end asset rebalancing and reduced holiday liquidity, rather than market panic. Analysis points out that this marks the sixth consecutive trading day of net outflows for spot bitcoin ETFs, with cumulative outflows exceeding $1.1 billion, making it the longest outflow cycle since this autumn. However, institutional sources believe that holiday outflows are not uncommon, and as trading resumes in January, institutional funds may flow back in, making ETF capital trends more meaningful at that time.

19:50

Christmas Holiday Exodus Sees Spot Bitcoin ETF Outflows of $782 MillionBlockBeats News, December 29th, data shows that during the Christmas period, the listed U.S. spot Bitcoin ETF experienced large-scale fund outflows, with a cumulative net outflow of approximately $782 million. Among them, the single-day net outflow on Friday reached $276 million, the peak of outflows during the holiday season.

Specifically, BlackRock's BITO saw a single-day outflow of nearly $193 million, Fidelity's FBTC saw an outflow of about $74 million, and Grayscale's GBTC saw a slight but continuous fund redemption. As a result, the total assets under management of Bitcoin spot ETFs dropped to around $113.5 billion, below the $120 billion mark earlier in December.

It is worth noting that despite the fund outflows, the Bitcoin price still held around $87,000, indicating that this fund withdrawal was more likely due to year-end asset rebalancing and reduced holiday liquidity rather than market panic.

Analysis points out that this is the sixth consecutive trading day of net outflows for the spot Bitcoin ETF, with total outflows exceeding $1.1 billion, marking the longest outflow period since the fall. However, institutional professionals believe that holiday outflows are not uncommon, and as trading resumes in January, institutional funds may flow back, making the ETF fund flow direction more significant.

News