News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Arthur Hayes projects a $1 million Bitcoin price based on the Federal Reserve's potential policy shift towards yield curve control, which he argues would devalue the dollar and drive capital into alternative assets.

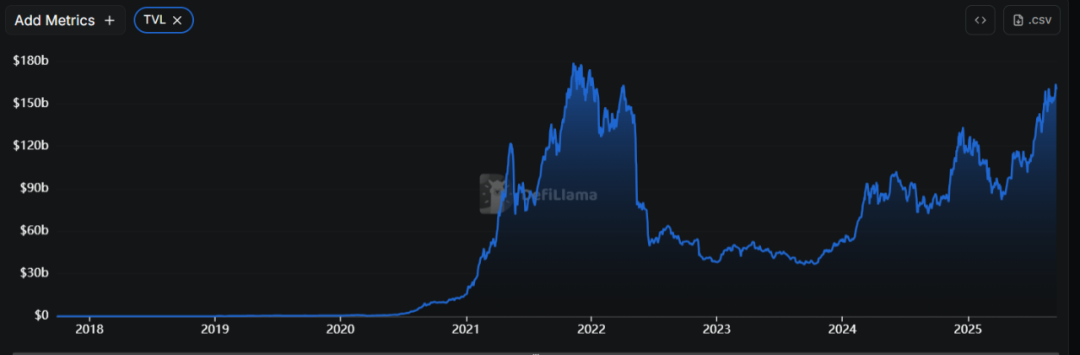

Aave DAO is making sweeping changes by cutting half its L2s and doubling down on GHO. The strategy could secure dominance in DeFi lending but also risks controversy and short-term TVL losses.

Altcoin season is here, but most investors see little profit. With liquidity in top tokens and millions of new coins, portfolios remain stuck.

FUNToken today announced that its highly anticipated $5 million community giveaway smart contract has successfully passed an independent security audit by CredShields, a leading blockchain security firm. This milestone sets the stage for one of the largest community-driven reward distributions. The $5M giveaway smart contract was designed to power FUNToken’s innovative rewards campaign, where participants

Pi Coin’s price struggles under $0.360, but improving Bitcoin correlation and bullish MACD momentum hint at recovery potential if resistance breaksPi Coin’s price struggles under $0.360, but improving Bitcoin correlation and bullish MACD momentum hint at recovery potential if resistance breaks.

HBAR has cooled off after hitting a 20-day high, with shrinking inflows and rising shorts raising the risk of deeper losses.

The United States (US) Federal Reserve (Fed) will announce monetary policy decisions and publish the revised Summary of Economic Projections (SEP), the so-called dot plot, following the September policy meeting on Wednesday. Market participants widely anticipate the US central bank to cut the policy rate for the first time since last December, lowering it to

In the next decade, RWA could become the decisive turning point for crypto to enter the real economy and achieve mainstream adoption.