News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

UNI Falls 23%, LINK Runs Low on Supply & BlockDAG Dominates With Daily Winners and $403M Presale Run!

Explore why BlockDAG’s $403M presale and Buyer Battles are pulling in serious attention while UNI tries to recover and LINK faces a supply crunch!UNI Price Down, On-Chain Strength UpLINK Holders Wait as Supply ShrinksBuyer Battles Push BlockDAG to the Top!Looking Ahead

Coinomedia·2025/09/09 23:51

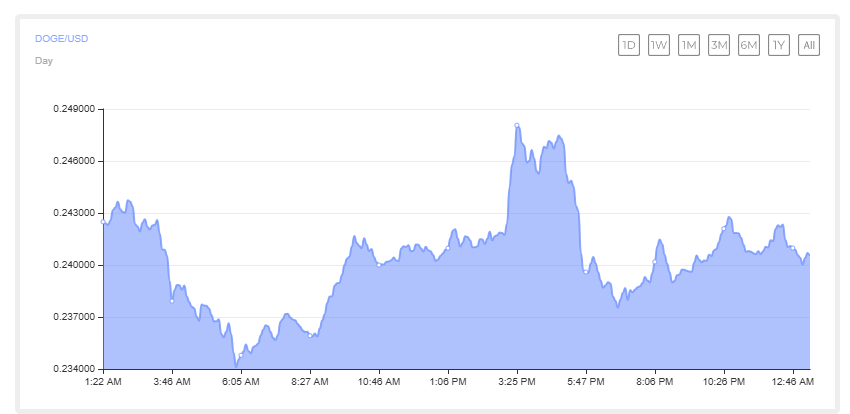

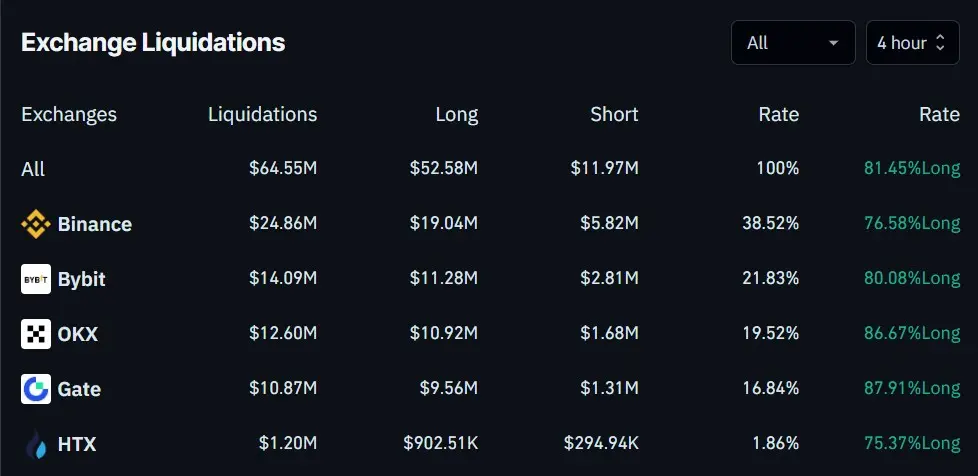

MYX and WLD Trading Volumes Surpass DOGE and XRP

WLD and MYX hit over $10B in trading volume, outpacing DOGE and XRP in the crypto derivatives market.Liquidations Highlight Market VolatilityNew Leaders in Derivatives Trading

Coinomedia·2025/09/09 23:51

Exciting ICON SODA Migration: Your Essential Guide to a Seamless

CryptoNewsNet·2025/09/09 23:45

Solana (SOL) Hits $200+ with $7B+ in Perp Open Interest, Funding Rates Calm

CryptoNewsNet·2025/09/09 23:45

Dogecoin ETF Approval: Can DOGE Price Hit $0.50 and Surge Toward $1 Next?

CryptoNewsNet·2025/09/09 23:45

ICE Gains 14.1% Weekly as Diamond Bottom Pattern Anchors Price Near $0.005184

CryptoNewsNet·2025/09/09 23:45

Bitcoin, Ethereum slips amid US payrolls report

CryptoNewsNet·2025/09/09 23:45

Filecoin Holds $2.39 as Price Consolidates Between Support and $2.41 Resistance While Retesting Key Trendline

CryptoNewsNet·2025/09/09 23:45

Ripple Strikes Custody Deal with BBVA to Boost Crypto Services in Spain

DeFi Planet·2025/09/09 23:39

Eightco Shares Soar 3,000% on Worldcoin Treasury Strategy

DeFi Planet·2025/09/09 23:39

Flash

10:03

Institution: Compared to gold, silver seems to benefit more from U.S. interest rate cuts.According to Golden Ten Data on January 2, Rania Gule, Senior Market Analyst at trading platform XS.com, stated in a report that in an environment where interest rates may decline, silver could benefit more than gold. Gule noted that silver is more sensitive to changes in monetary policy. He added that silver's high liquidity, ease of trading, and relatively low cost make it an attractive safe-haven asset for both retail and institutional investors. In 2025, silver rose by nearly 148%, reflecting its "multi-dimensional" nature as a safe-haven asset, currency hedge, and a key mineral for the U.S. economy. It is expected that as the U.S. dollar depreciates, dollar-denominated silver will become more attractive to non-U.S. buyers, thereby driving global demand.

10:01

Hong Kong stocks surge on the first trading day of 2026, driven by multiple factorsAccording to Golden Ten Data on January 2, based on the views of multiple market institutions, there are several reasons behind the surge in Hong Kong stocks on the first trading day of 2026: First, on January 2, the offshore RMB/USD exchange rate broke above 6.97 during trading, reaching its highest level since May 2023, further encouraging capital inflows into Hong Kong stocks; Second, Biren Technology, known as the "first GPU stock in Hong Kong," soared on its debut, and this "intra-day doubling" profit effect boosted market sentiment for investments in hard technology, semiconductors, and AI sectors; Third, leading Hong Kong stocks received positive news, such as Hua Hong Semiconductor acquiring a 97.4988% stake in Huali Microelectronics from four counterparties including Hua Hong Group, and Baidu planning to spin off Kunlun Chip for an independent listing, once again confirming the market prospects and capital recognition of the chip and AI computing power sectors. (Shanghai Securities News)

09:38

Signs of further growth in UK manufacturingAccording to Golden Ten Data on January 2, Rob Dobson, Director at S&P Global Market Intelligence, stated that towards the end of the year, the UK manufacturing sector has released more signals of growth. Output has increased for the third consecutive month, and the number of new orders has improved for the first time since September 2024 (albeit only slightly). The domestic market remains a positive driver of economic growth, while new export business, although having declined for four consecutive years, has taken a significant step towards stabilization. With the negative impacts of uncertainties such as the autumn budget, tariffs, and the Jaguar Land Rover cyberattack easing, UK manufacturers have benefited from the weakening of several headwinds before the end of the year. It is expected that early 2026 will show whether economic growth can be sustained after these temporary stimuli fade. The foundation for economic expansion needs to shift more towards growing demand rather than increased inventories and clearing backlogs. The interest rate cut in December is expected to play a role in facilitating this shift, encouraging manufacturers and their clients to increase spending and investment. However, manufacturers remain cautious—business confidence in December declined for the first time in three months.

News