News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.9)|Zcash team mass resignations trigger ZEC oversold conditions; approx. $2.22B worth of BTC and ETH options expire today; U.S. initial jobless claims for the week ending Jan 3 came in at 208K2Bitget UEX Daily | Non-Farm Eve Market Split; Trump Picks Fed Chair; CME Hikes Precious Metals Margins (Jan 08, 2026)3Hyperliquid: How whale transfers have stressed HYPE’s fragile price structure

Michigan Advances Crypto Reserve Bill to Committee Stage

DeFi Planet·2025/09/19 18:42

Bank of Canada Advocates For A Swift Stablecoin Regulation Amid Market Boom

Cointribune·2025/09/19 18:42

Bitcoin Has 70% Chance of Fresh Highs as ETF Inflows and Metrics Signal Breakout

Cointribune·2025/09/19 18:42

XRP price outlook as REX-Osprey XRPR ETF notches $37.7m in day one volume

Coinjournal·2025/09/19 18:39

Ethena looks to gain as Mega Matrix scoops $6m ENA for treasury strategy

Coinjournal·2025/09/19 18:39

KAITO (KAITO) To Rise Higher? Key Breakout and Retest Signaling Potential Upside Move

CoinsProbe·2025/09/19 18:36

Pump.fun (PUMP) Slides Lower – Could This Emerging Pattern Spark a Bounce Back?

CoinsProbe·2025/09/19 18:36

Is World Liberty Financial (WLFI) Poised for a Breakout? Key Pattern Formation Suggests So!

CoinsProbe·2025/09/19 18:36

Solana Price Surpasses $250 – What’s Next for SOL and Altcoins?

Cryptoticker·2025/09/19 18:18

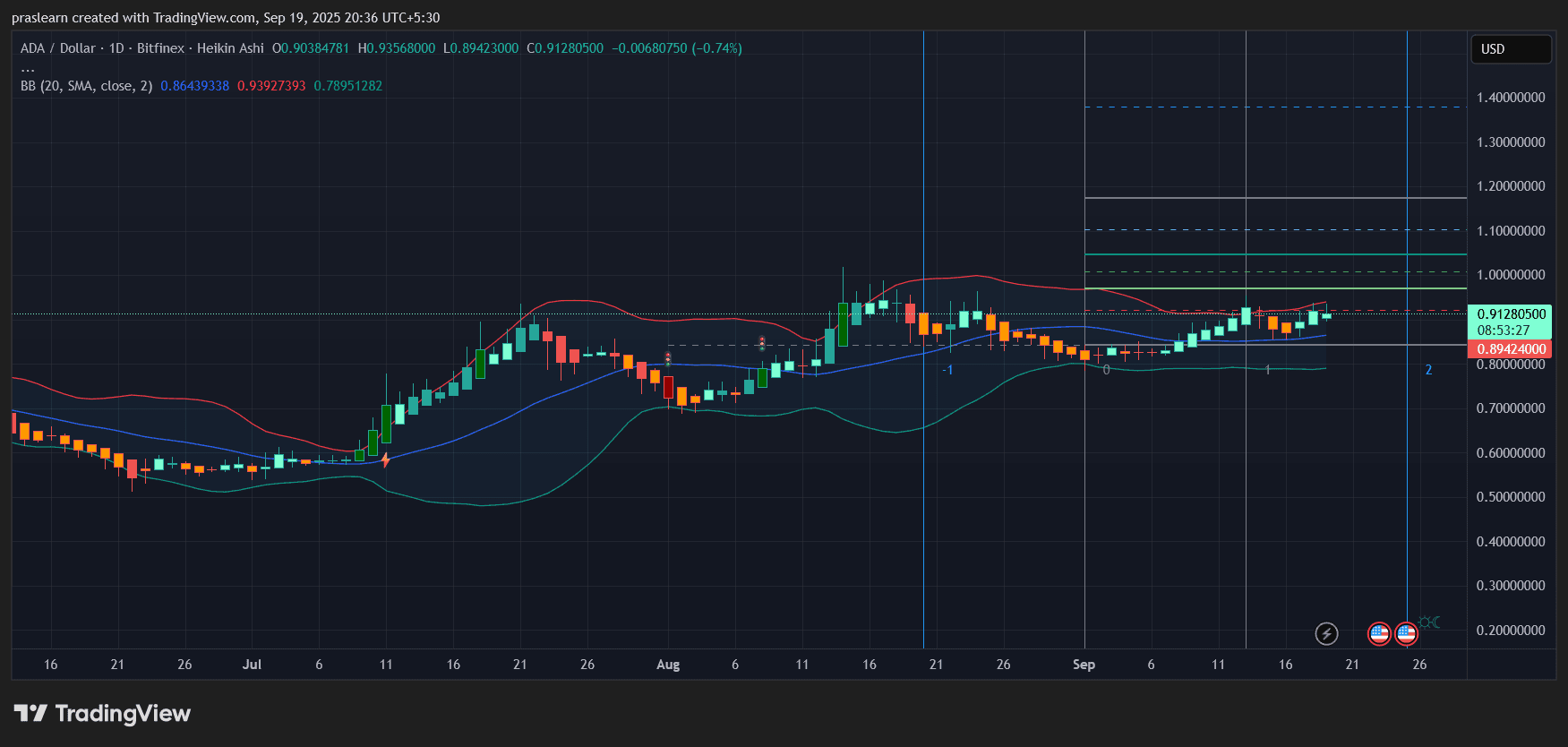

ADA Price Today: Is the Next Big Rally About to Begin?

Cryptoticker·2025/09/19 18:18

Flash

05:57

Guotai Haitong: Only a 5% Probability of Fed Rate Cut in JanuaryAccording to a research report by Guotai Haitong, in December, the U.S. job market continued to experience low hiring and low layoffs, with the unemployment rate unexpectedly falling to 4.4%. The growth of new jobs showed a slowing trend, and subsequent annual revisions may result in downward adjustments. Since the unemployment rate did not rise further and the risk of a sharp slowdown in the job market remains low, the Federal Reserve may have room to pause interest rate cuts. CME data shows that after the release of the non-farm payroll data, the market expects only a 5% probability of a rate cut in January. In 2026, the market expects the Federal Reserve to cut rates twice, with the timing postponed to June and September. Future expectations for rate cuts may depend on the appointment and statements of the new Federal Reserve Chair.

05:27

timbeiko.eth clarified that he will not leave the Ethereum Foundation, but will move to other work as a protocol advisor. Ethereum core developer timbeiko.eth announced on the X platform that his focus will shift from L1 development to exploring Ethereum's cutting-edge use cases in the coming months. However, he clarified that he will not leave the Ethereum Foundation (EF), but his role will change to that of an Ethereum protocol advisor. His current top priority is to ensure a smooth transition of AllCoreDevs and its responsibilities within the Ethereum Foundation. It is reported that Ansgar has agreed to extend his term as the interim chair of the ACDE meetings, and timbeiko.eth will also assist during the transition period until a stable long-term plan is established. timbeiko.eth added that 2026 will be a critical year for all layers of Ethereum, and now is the best time to explore in depth.

05:25

Founder Securities: The market expects the Federal Reserve not to cut interest rates in January, with the earliest rate cut in JuneAccording to ChainCatcher, citing a report from Golden Ten Data, Founder Securities stated in its research report that the December non-farm payroll data was mixed. The overall U.S. job market is on a moderate downward trend, but the marginal improvement in the unemployment rate gives the Federal Reserve more reason to remain on hold in January. The market is pricing in no rate cut by the Federal Reserve in January, with the earliest possible rate cut expected in June. As the Supreme Court may declare IEEPA tariffs unconstitutional, economic expectations may marginally improve, inflationary pressures are weakening, and U.S. Treasury bonds face short-term headwinds, while U.S. stocks benefit from the boom in AI and reduced tariff disruptions.

News