News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

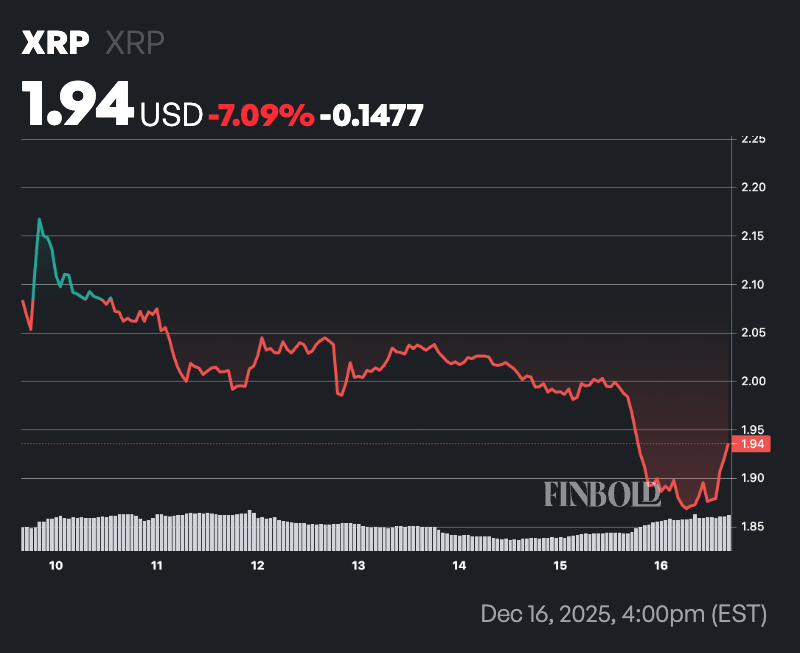

Analyst Warns XRP Investors: We May See a Drop to $1.56. Here’s why

·2025/12/16 14:33

Cloud Mining Industry Outlook 2026: Market Trends, Platforms, and Participation Models

CryptoNinjas·2025/12/16 14:33

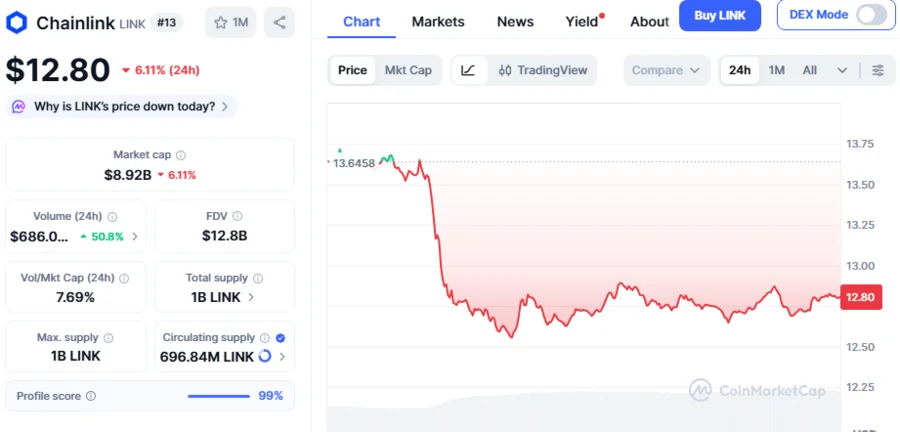

Chainlink Whales Accumulate 20.46M Tokens as LINK Consolidates at $12.69, Is Market Rally Coming?

BlockchainReporter·2025/12/16 14:31

Fhenix Showcases Encrypted-by-Default Payments With Privacy Stages and Private x402 Transactions

BlockchainReporter·2025/12/16 14:27

Visa launches stablecoin settlement in US via Circle's USDC on Solana

The Block·2025/12/16 14:15

Cloud Mining Platforms 2025: A Guide to Hardware-Free Bitcoin Mining Services

CryptoNinjas·2025/12/16 14:12

Artificial intelligence predicts XRP price for Q1 2026

币界网·2025/12/16 14:05

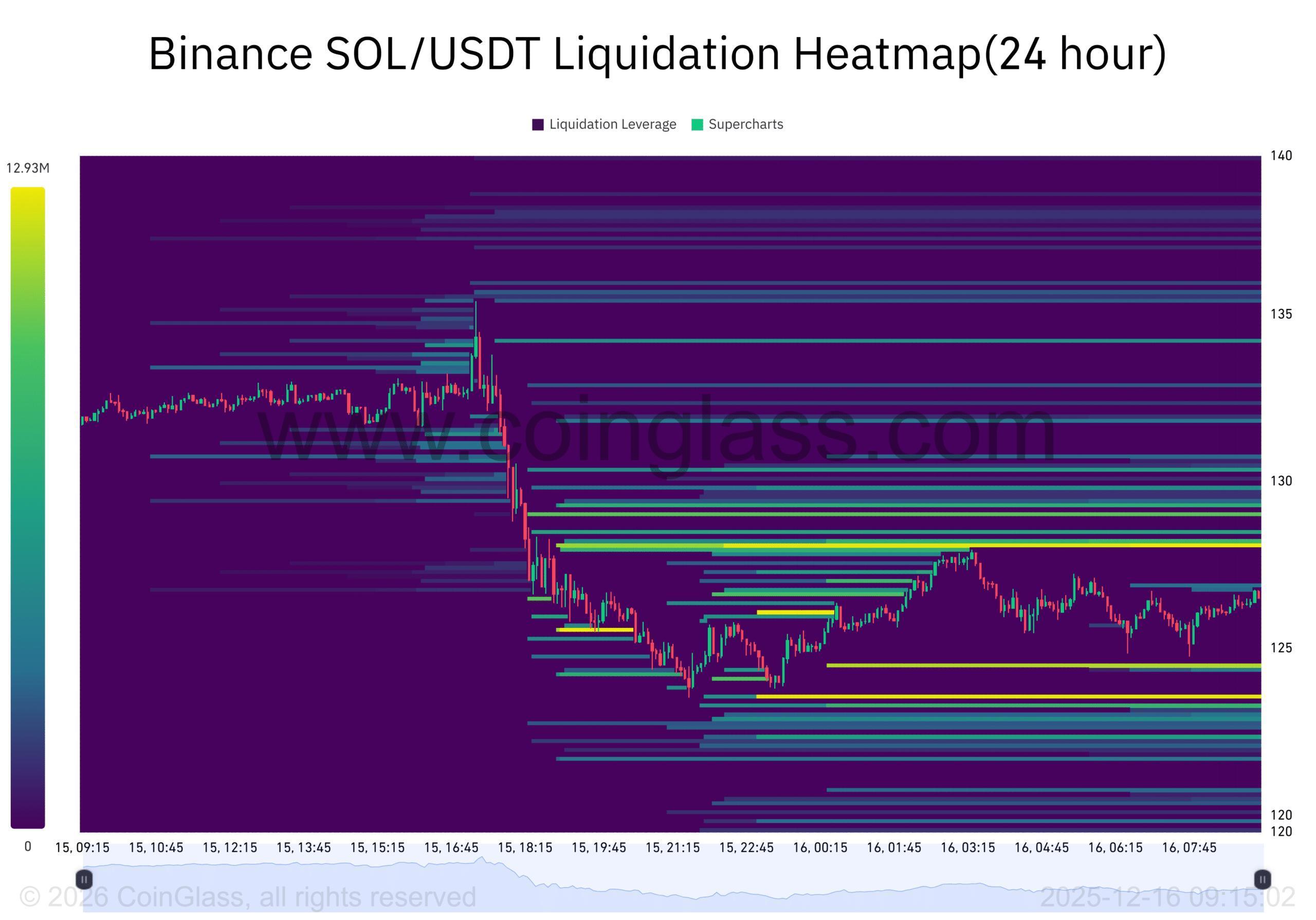

Solana’s sell pressure intensifies – How deep will SOL’s pullback go?

BlockBeats·2025/12/16 14:03

Flash

12:27

Russia's largest bank Sberbank issues its first Bitcoin-backed loanAccording to Odaily, Russia's largest bank, Sberbank, has issued the country's first loan backed by crypto assets to the major local bitcoin mining company Intelion Data. Sberbank stated that the loan is secured by digital currencies mined by Intelion Data, but did not disclose the loan amount, the quantity of collateralized assets, or the term, and defined it as a "pilot" business. Sberbank pointed out that such products are not only suitable for mining companies, but may also be promoted to enterprises holding crypto assets. The bank used its own crypto asset custody solution, Rutoken, in the transaction to ensure the security of the collateral during the loan period. Sberbank Deputy Chairman Anatoly Popov stated that digital asset regulation in Russia is still at an early stage, and the bank is willing to cooperate with the central bank to improve relevant rules, using this pilot as a reference for future regulation and infrastructure development. Intelion Data CEO Timofey Semenov said that this transaction is an important practical case for industry development, and if successful, it may be further promoted in Russia's mining sector. (DL News)

12:26

Bubblemaps: 68 Wallets Ambush ATLAS Launch, Currently Holding 47% of SupplyBlockBeats News, December 28th, Twitter account WhaleInsider with 600,000 followers once again promoted the Meme coin ATLAS. Shortly before its launch, 68 wallets received funds through ChangeNow. These wallets had no on-chain activity before, received funds in a short time, received a similar amount of ETH, and sniped ATLAS. These addresses currently hold 47% of the supply worth $1 million. WhaleInsider had previously posted that the Meme coin ATLAS, inspired by U.S. Vice President JD Vance's pet dog, surged 100% in a day.

12:25

Animoca Brands co-founder: 2026 will be the "Year of Utility Tokens," with each token having a clear use casePANews, December 28 — According to Cointelegraph, Animoca Brands co-founder Yat Siu stated that in 2025, the crypto market will experience mispricing due to excessive bets on Trump policies, with Bitcoin facing its fourth annual decline in history. Trump’s priorities, such as tariffs and trade wars, will impact risk assets, and the market mistakenly regards these as core concerns, while in reality, cryptocurrencies are not his primary focus. Yat Siu pointed out that Animoca Brands plans to go public through a reverse merger with Nasdaq-listed fintech company Currenc Group, with Animoca Brands holding 95% of the merged entity. The company aims to become a proxy tool for altcoins in the public market, providing investors with diversified exposure to altcoins and Web3 assets. Animoca Brands currently has investments in over 620 portfolio companies, with about 100 new projects added last year. For the 2024 fiscal year, the company’s unaudited bookings reached $314 million, and it has achieved EBITDA profitability for four consecutive years. With key U.S. legislation such as the Clarity Act and GENIUS Act clarifying regulatory frameworks, 2026 will mandate industry focus on compliance and real-world application scenarios. As legal certainty improves, established enterprises will launch tokens related to their businesses, shifting the market focus from pure speculation to products solving real problems. 2026 will become the year of utility tokens, with every issued token having a clear use case.

News