News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Ethereum price forecast: analysts reveal shocking targets after the $1.5B liquidation bloodbath

Coinjournal·2025/09/23 19:27

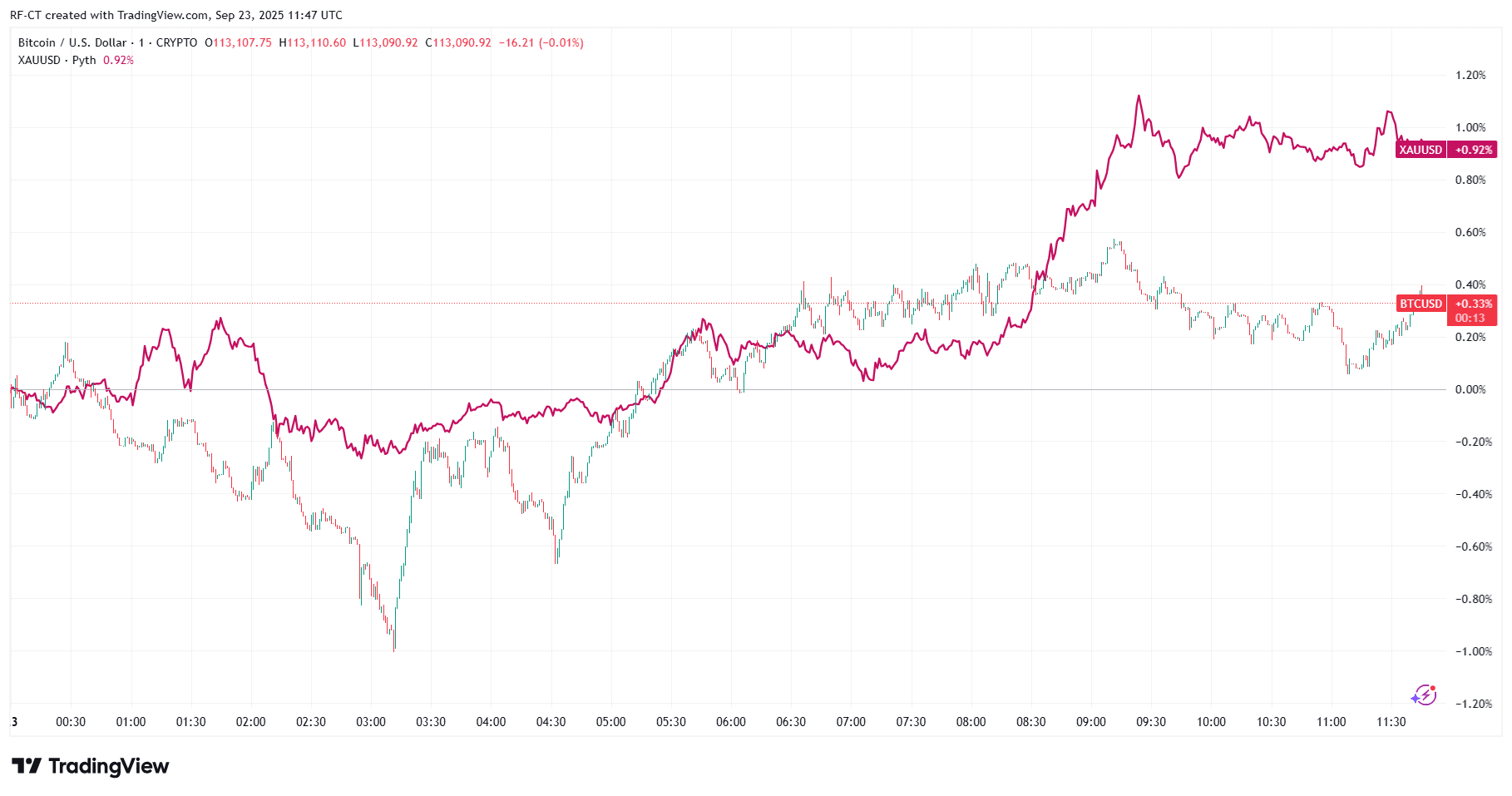

Will Bitcoin Crash? ETFs Outflows vs Gold Breakout Hype

Cryptoticker·2025/09/23 19:12

Ethereum Just Turned Bullish, Here’s What’s Next

Ethereum (ETH) breaks above $4,100 resistance and retests support as exchange reserves hit yearly lows, signaling a potential trend shift.

Cryptopotato·2025/09/23 16:00

Benchmark gives bullish outlook on Metaplanet despite stock decline

Quick Take Benchmark Equity Research reiterated its “Buy” rating on Metaplanet despite the stock’s 40% decline over the past month. Metaplanet is differentiated by the ability to utilize its bitcoin holdings to generate recurring income from derivative strategies, Benchmark said.

The Block·2025/09/23 16:00

Ethereum Whales’ 201K ETH Accumulation and Rising OBV May Signal Rally Toward $5,000

Coinotag·2025/09/23 16:00

Flare Mainnet Launches FXRP, Bringing XRP Into DeFi

Newscrypto·2025/09/23 16:00

Bitcoin May See Short-Term 11% Pullback Before Possible Rally Toward $162,000, Analyst Says

Coinotag·2025/09/23 16:00

Flash

05:52

The U.S. Judiciary Committee opposes Section 604 of the CLARITY ActOn January 17, the head of the U.S. Senate Judiciary Committee sent a letter to the Senate Banking Committee opposing Section 604 of the "Blockchain Regulatory Certainty Act," arguing that this provision would weaken federal regulations on money transfers. Senate Judiciary Committee Republican Chairman Chuck Grassley and lead Democratic member Dick Durbin pointed out in the letter that the provision aims to protect software developers from criminal liability due to third-party misuse of their products, but may undermine the current regulations' ability to hold unlicensed money transfer businesses accountable. The letter cited the Department of Justice's prosecution of Tornado Cash developer Roman Storm as an example, emphasizing the importance of existing regulations and urging the rejection of the relevant provision. The Banking Committee had originally scheduled a debate and vote on the bill for Thursday, but the agenda was canceled due to opposition.

05:50

Protect Developers or Weaken Oversight? Judiciary Committee Strongly Opposes Section 604 of the CLARITY ActBlockBeats News, January 17th, the chairman of the U.S. Senate Judiciary Committee stated in a letter to the Senate Banking Committee that the "Blockchain Regulatory Certainty Act" would weaken federal fund transfer regulation and should not be included in cryptocurrency market structure legislation.

The Judiciary Committee's Republican chairman, Chuck Grassley, and chief Democratic member, Dick Durbin, wrote in the letter that Section 604 of the Banking Committee's market structure bill - aimed at protecting software developers from criminal liability for third-party misuse of their products - would "weaken" federal law regarding unlicensed money transmission. "The Senate Judiciary Committee (which has jurisdiction over Title 18 of the U.S. Code) was not consulted, nor was it afforded the opportunity for advance substantive consideration of the proposed changes."

The letter cited the case of the Department of Justice's prosecution of Tornado Cash developer Roman Storm, stating that the case demonstrated that the prosecuting party had sufficiently argued the importance of existing regulations holding parties to unlicensed money transmission accountable. This letter is another blow to the market structure bill, with the Senate Banking Committee originally scheduled to debate and vote on the bill on Thursday but canceling the agenda on Wednesday night in the face of increasingly strong opposition.

If the provision is retained in the bill, the Judiciary Committee (responsible for legal matters) would need to sign off as the third committee on the overall package, and this latest controversy suggests that the legislative process may become even more complicated. DeFi advocates insist that without these specific protection provisions, they may withdraw their support, signaling another difficult deadlock.

The letter emphasized: "Therefore, we urge the committee to reject any proposed provisions that would weaken the government's ability to hold parties accountable for unlicensed money transmission, including Section 604."

05:28

Goldman Sachs CEO: Expects a Long Road Ahead for the "CLARITY Act" to Make ProgressBlockBeats News, January 17th - Goldman Sachs CEO David Solomon said during the company's Q4 2025 earnings conference call that many Goldman employees are "closely watching" issues, including the US Congress's "Clarity in Digital Assets Markets Act," as they could have a significant impact on the tokenization and stablecoin space. "But based on the news in the past 24 hours, it seems that there is still a long way to go for this bill to make progress, but I do believe that this innovation is crucial."

News