News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 28) | The UK adopts the “no gain, no loss” tax treatment for DeFi;Solana ETFs recorded a net inflow of 238,037 SOL yesterday2Solana analysis: SOL price unlikely to break $150 for now3Bitcoin trades above $90K: Here’s what bulls must do to extend the rally

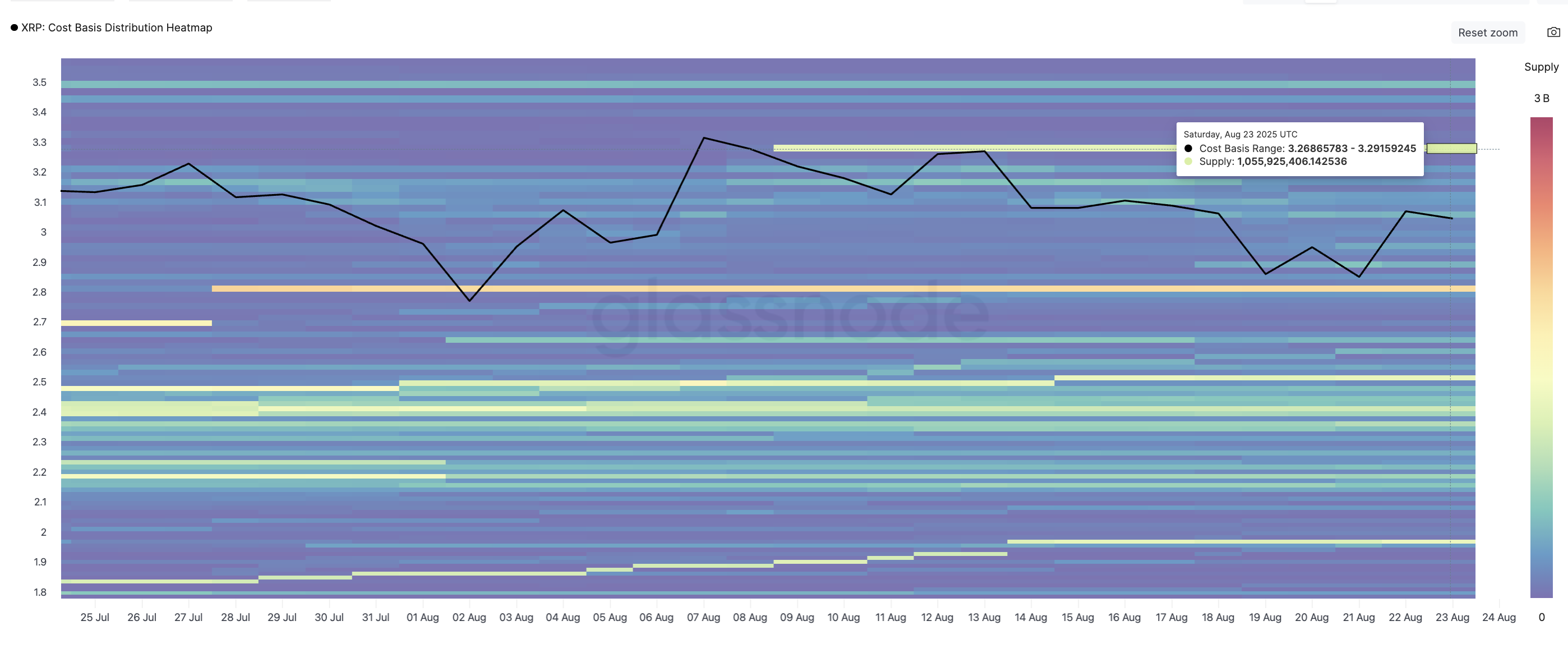

XRP Price Rally Hinges on Breaking This Key Resistance Zone

CryptoNewsNet·2025/08/24 12:20

Australian CEO faces allegations of misleading investors over crypto firm collapse

CryptoNewsNet·2025/08/24 12:20

Cardano’s Lace Wallet to Integrate XRP, Earns Praise & Participation from Lawyer John Deaton

CryptoNewsNet·2025/08/24 12:20

Here’s How Blockchain Will Take Over the IPO Market in 5 Simple Steps

CryptoNewsNet·2025/08/24 12:20

Crypto: Digital Asset Lending Reaches $61.7B and Finally Surpasses Its 2021 Record

Cointribune·2025/08/24 12:05

River Reports Bitcoin’s Surge In Monetary Share

Cointribune·2025/08/24 12:05

Bitcoin: The Bull Run Continues!

Cointribune·2025/08/24 12:05

Saga (SAGA) To Rise Higher? Key Emerging Fractal Signaling Potential Bullish Move

CoinsProbe·2025/08/24 12:05

Bitcoin Price Prediction: BTC Consolidates as Market Awaits THIS Next Big Move

Cryptoticker·2025/08/24 11:55

ChainOpera AI is launching a full-stack collaborative AI economy, with 3 million users and 10,000 developers already joining the Agent Social Network.

Empowering Everyone to Easily Create an AI Agent

BlockBeats·2025/08/24 10:20

Flash

- 06:18Crypto donation platform The Giving Block has processed nearly 100 million USD in crypto donations this yearAccording to Jinse Finance, citing Cryptonews, crypto donation platform The Giving Block has processed nearly $100 million in crypto donations so far this year. Bitcoin remains the top donated asset on the platform this year, followed by stablecoins USDT, USDC, and RLUSD. By the end of 2025, crypto donations have provided food for 28.5 million children, given 357,000 people access to clean water, and successfully treated 22,160 animals.

- 06:13SpaceComputer secures $10 million in funding, co-led by Maven11 and LatticeJinse Finance reported, citing The Defiant, that the satellite-based blockchain verification layer SpaceComputer has completed a $10 million seed round of financing. The round was co-led by Maven11 and Lattice, with participation from Superscrypt, the Arbitrum Foundation, Nascent, Offchain Labs, Hashkey, and Chorus One. Individual investors include Marc Weinstein, Jason Yanowitz, and Ameen Soleimani. The funds will be used to build and launch the first batch of satellites and their onboard secure computing hardware. These satellite units, called SpaceTEE, will operate secure blockchain and cryptographic tasks from space, develop network software, satellite coordination systems, and provide confidential computing and secure record-keeping services.

- 06:11Analysis: Derivatives market reflects a reversal in bearish sentiment for Bitcoin, with bullish demand on the riseAccording to ChainCatcher, despite bitcoin experiencing a price pullback of up to 36% since reaching its all-time high, bitcoin's implied volatility has remained at a relatively controllable level. This change reflects that as bitcoin gradually becomes institutionalized, its risk transmission mechanism is being reshaped. In its early stages, bitcoin's value was mainly driven by speculative traders who sought to profit from its frequent and significant price fluctuations. The derivatives market as a whole reflects a reversal in bearish sentiment. According to Coinglass data, demand for long positions in bitcoin perpetual contracts—a highly leveraged trading market commonly used by crypto traders—is currently rising, while the scale of open interest remains at a relatively moderate level. The funding rate for related contracts has turned positive, indicating that after dipping into negative territory earlier this week, bullish bets have once again become dominant. Deribit data shows that call options with a strike price of $100,000 have the highest open interest. In the previous week, the market was mainly focused on downside protection around $80,000 and $85,000. Spencer Hallarn, head of OTC trading at GSR, stated: "In the past few weeks, speculative long positions have significantly decreased, as evidenced by the decline in perpetual contract open interest and funding rates. This has also prepared the crypto market for the next round of upward movement."