News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

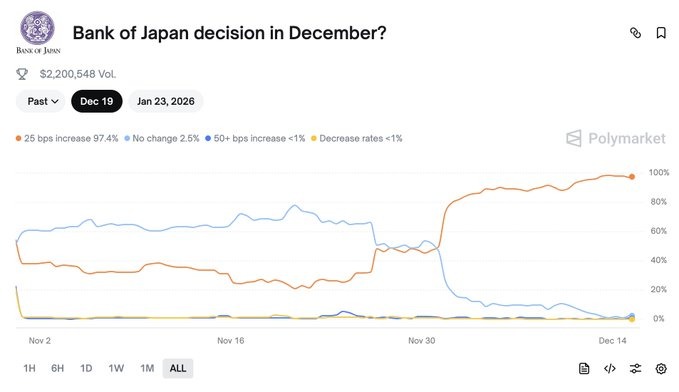

Bitcoin Price To Crash Below $70K as Japan Rate Hike Looms

Coinpedia·2025/12/15 11:21

“Quantum Threat to Bitcoin Is Decades Away”, Says Adam Back

Coinpedia·2025/12/15 11:21

Ethereum Founder Vitalik Buterin Wants Algorithm Transparency on X

Coinpedia·2025/12/15 11:21

“Crypto Cases Were Dropped Under Trump’s Second Term”, NYT Investigation Says

Coinpedia·2025/12/15 11:21

Ondo Price Prediction 2025, 2026 – 2030: Can Ondo Hit $10?

Coinpedia·2025/12/15 11:21

Check out the 33 Winning Projects from the Solana Breakpoint 2025 Hackathon

Over 9000 participants teamed up to submit 1576 projects, with a total of 33 projects winning awards, all of which are cream of the crop industry seed projects.

BlockBeats·2025/12/15 11:12

Bitcoin ETFs are 60% underwater, creating a $100 billion distressed house of cards

CryptoSlate·2025/12/15 10:05

Digital Banks Have Long Ceased to Make Money from Banking; the Real Goldmine Lies in Stablecoins and Identity Verification

User Scale Does Not Equal Profitability, Stability and Identity Are the Core of Digital Banking.

BlockBeats·2025/12/15 09:59

Morning News | Infrared to conduct TGE on December 17; YO Labs completes $10 million Series A financing; US SEC issues crypto asset custody guidelines

A summary of major market events on December 14.

Chaincatcher·2025/12/15 09:50

Crypto ETF Weekly Report | Last week, US Bitcoin spot ETFs saw a net inflow of $286 million; US Ethereum spot ETFs saw a net inflow of $209 million

Bitwise's top ten crypto index fund has officially been listed and is now trading as an ETF on NYSE Arca.

Chaincatcher·2025/12/15 09:50

Flash

00:48

A certain whale withdrew 2,218 ETH, 37.1 million SKY, and 4,772 AAVE from an exchange 7 hours ago.PANews, December 29th – According to monitoring by Onchain Lens, a whale withdrew 2,218 ETH (worth $6.52 million), 37.1 million SKY (worth $2.36 million), and 4,772 AAVE (worth $730,360) from an exchange 7 hours ago. Nineteen days ago, this wallet received 519 ETH (worth $1.62 million) from Wintermute. Currently, the wallet holds a total of 2,738 ETH (with a total value of $8.07 million).

00:42

This Week's Unlock Schedule: HYPE, ZORA, SUI, and Others Will Experience a Large One-Time Token UnlockBlockBeats News, December 29th. According to Token Unlocks data, this week HYPE, ZORA, SUI, and others will experience a one-time large token unlock, including:

HYPE will unlock approximately 9.92 million tokens at 3:30 PM (UTC+8) on December 29th, representing about 2.87% of the current circulating supply, with a value of around $256 million;

SVL will unlock approximately 234 million tokens at 8:00 AM (UTC+8) on December 30th, representing about 2.96% of the current circulating supply, with a value of around $6.8 million;

ZORA will unlock approximately 166 million tokens at 8:00 AM (UTC+8) on December 30th, representing about 4.17% of the current circulating supply, with a value of around $6.7 million.

KMNO will unlock approximately 229 million tokens at 8:00 PM (UTC+8) on December 30th, representing about 5.35% of the current circulating supply, with a value of around $11.8 million;

OP will unlock approximately 31.34 million tokens at 8:00 AM (UTC+8) on December 31st, representing about 1.65% of the current circulating supply, with a value of around $8.6 million;

SUI will unlock approximately 43.69 million tokens at 8:00 AM (UTC+8) on January 1st, representing about 1.17% of the current circulating supply, with a value of around $63.4 million;

EIGEN will unlock approximately 36.82 million tokens at 12:00 PM (UTC+8) on January 1st, representing about 9.74% of the current circulating supply, with a value of around $14.4 million;

ENA will unlock approximately 40.63 million tokens at 3:00 PM (UTC+8) on January 2nd, representing about 0.56% of the current circulating supply, with a value of around $8.6 million.

00:37

Jeffrey Huang reduces ETH long positions and increases HYPE long positionsAccording to hyperbot data, Huang Licheng reduced his long position in ETH by 50 tokens, incurring a loss of $591, and simultaneously increased his long position in HYPE by 5,000 tokens. Currently, his ETH long position holds 8,150 tokens (approximately $24.21 millions), and his HYPE long position holds 18,888.88 tokens (approximately $487,100), with a total unrealized loss of $46,000.

News