News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Critical US Crypto Bill Faces Frustrating Delay: Key Issues Push Vote to January

BitcoinWorld·2025/12/13 19:24

Massive 2,265 Bitcoin Transaction: What This $205 Million Mystery Move Means for Crypto

BitcoinWorld·2025/12/13 19:24

Critical Alert: BOJ Interest Rates May Trigger Bitcoin’s Next Major Move

BitcoinWorld·2025/12/13 19:24

SOL Spot ETF Inflows Surge: $700M Milestone Nears Amid Powerful 7-Day Buying Streak

BitcoinWorld·2025/12/13 19:24

YouTube Enables PYUSD Payouts for US Creators, Boosting Stablecoin Adoption

DeFi Planet·2025/12/13 19:24

Bitcoin Doesn’t Hold Real Value, Says RBI Deputy Governor

Coinpedia·2025/12/13 19:12

Coinpedia Digest: This Week’s Crypto News Highlights | 13th December, 2025

Coinpedia·2025/12/13 19:12

Ripple News Today: VivoPower Launches $300M Institutional Ripple Equity Fund

Coinpedia·2025/12/13 19:12

Singapore Gulf Bank Launches Zero-Fee Stablecoin Minting on Solana Network

Coinpedia·2025/12/13 19:12

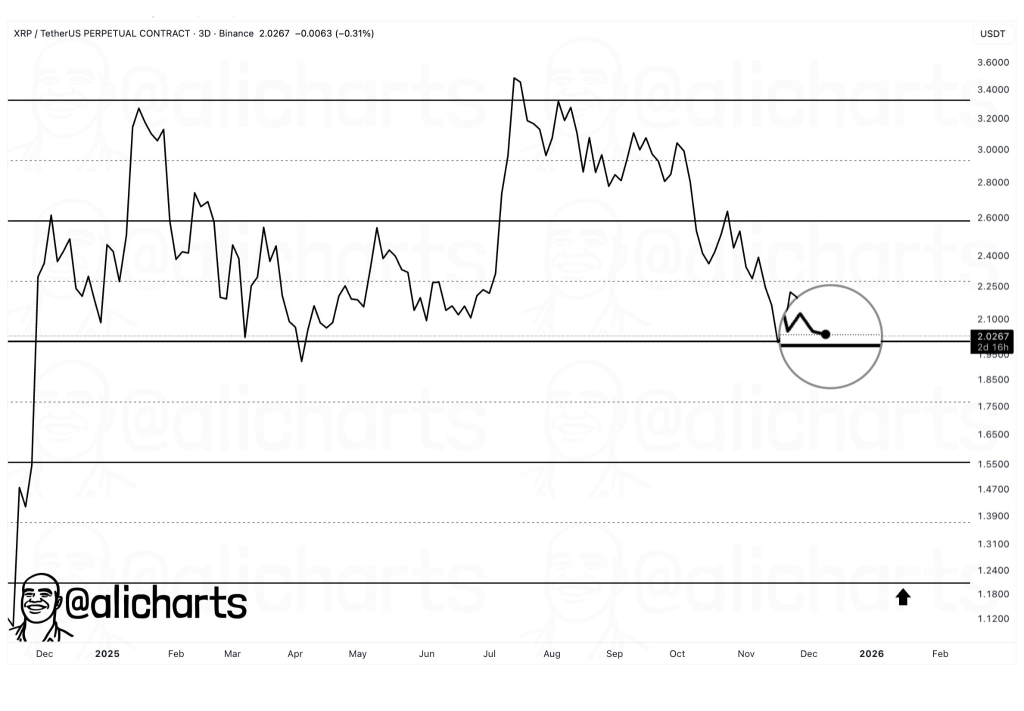

XRP Price Holds $2 as Ripple’s OCC Bank Approval Redefines Crypto’s Institutional Path

Coinpedia·2025/12/13 19:12

Flash

02:32

After Rainbow Six: Siege was hacked and tens of billions of in-game credits were credited to players, Ubisoft urgently shut down the servers and rolled back the game.PANews, December 29—According to Cointelegraph, French gaming giant Ubisoft was forced to suspend the online services of its game Rainbow Six Siege after hackers infiltrated the game and distributed 2 billion R6 Credits (in-game currency) to every player. On December 27, the game team confirmed the exploit for the first time via the X platform, subsequently releasing a series of updates and suspending the game servers and marketplace the following day. Reports from players on social media indicated that hackers managed to control key parts of the game's online system. Players said that upon logging in, everyone received 2 billion R6 Credits, as well as rare items such as skins and weapons. Additionally, according to screenshots shared by players, hackers also took control of the game's messaging and banning systems. The game sells 15,000 R6 Credits for $99.99, meaning players would need to spend approximately $13.33 million to accumulate 2 billion R6 Credits. On December 28, the Rainbow Six Siege team posted on the X platform that they were working to revoke R6 Credits obtained after 11:00 a.m. UTC (UTC+8). The game is currently being tested with a small group of players for relaunch.

02:29

The Rollup founder: If LIT's fully diluted valuation reaches $2 billions, I would choose to buy in.BlockBeats reported on December 29 that Andy, founder of The Rollup, stated that after the initial token volatility is absorbed, Lighter's open interest (OI) is likely to drop by more than 20%, and trading volume may decrease by over 30%. This is not a bull market, but rather a sideways and slightly bearish market environment, and overall, things do not look optimistic. Nevertheless, if LIT's fully diluted valuation is around $2 billions, I would still choose to buy.

02:22

Ubisoft suspends Rainbow Six Siege online services after indiscriminate distribution of $13.3 million worth of in-game tokens by hackersChainCatcher reported that the online service of Ubisoft's Rainbow Six: Siege has been suspended due to a hacker attack. After the breach, the hacker distributed 2 billion in-game R6 tokens to each player.

News