News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.29)|HYPE, SUI, and EIGEN tokens are set to undergo large unlocks this week; Bitcoin spot ETFs recorded a net outflow of $276 million in a single day, marking six consecutive days of net outflows2Bitget US Stock Daily Report | Spot Silver Continues to Surge, Refreshing 83 USD High; CME Raises Metal Performance Margins; US Stocks Focus on Fed Policy at Year-End (December 29, 2025)

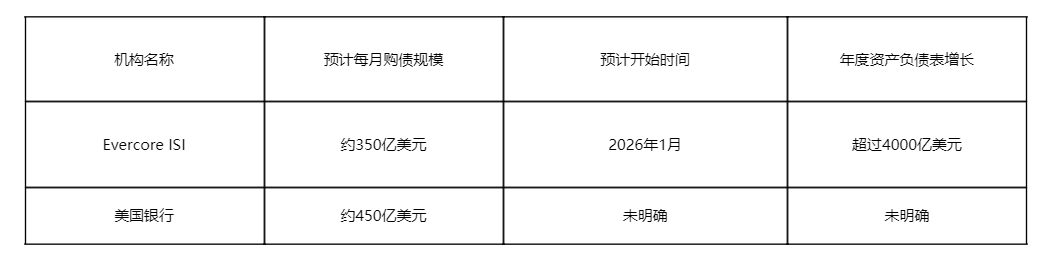

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

AICoin·2025/12/11 16:41

The Federal Reserve cuts interest rates as expected, what happens next?

AICoin·2025/12/11 16:41

Evolutionary Logic and Ecological Value of the DeFi 2.0 Era Analyzed through IXO Protocol

Is it possible for investment to be risk-free? This is difficult to achieve in both traditional DEX and CEX platforms...

ThePrimedia·2025/12/11 16:23

Terra Founder Do Kwon Gets 15 Years for $40B Fraud

Terra founder Do Kwon sentenced to 15 years in prison for the $40 billion Terra/Luna collapse.

Coinspeaker·2025/12/11 16:00

The End of The Four-Year Bitcoin Cycle? Cathie Wood Knows Why

Kriptoworld·2025/12/11 16:00

Billionaire Ken Griffin Pours $4,700,000 Into Two Assets in New Bet on Future of Quantum Technology

Daily Hodl·2025/12/11 16:00

BNB Price Halts Below $900 as Zerobase Hack Nullifies BNBChain Transaction Record

BNB struggles below $890 after a phishing attack on Zerobase dampened enthusiasm from BNB Chain’s historic throughput record of 8,384 transactions per second.

Coinspeaker·2025/12/11 16:00

Flash

21:09

The Dow Jones Index closed down 249.04 points, with both the S&P 500 and Nasdaq also declining.ChainCatcher news, according to Golden Ten Data, the Dow Jones Index closed down 249.04 points, a decrease of 0.51%, at 48,461.93 points on December 29 (Monday); the S&P 500 Index closed down 24.19 points, a decrease of 0.35%, at 6,905.75 points; the Nasdaq Composite Index closed down 118.75 points, a decrease of 0.5%, at 23,474.35 points.

21:04

All three major U.S. stock indexes closed lower, with Tesla falling over 3%ChainCatcher News, according to Golden Ten Data, U.S. stocks closed lower on Monday, with the Dow Jones Industrial Average preliminarily down 0.5%, the S&P 500 Index down 0.35%, and the Nasdaq down 0.5%. Tesla (TSLA.O) fell 3.2%, Micron Technology (MU.O) rose 3.4%, and Nvidia (NVDA.O) dropped 1%. The Nasdaq Golden Dragon China Index closed down 0.66%, Alibaba (BABA.N) fell more than 2%, and NIO (NIO.N) rose 5%.

19:27

French Hill says stablecoin bill needs to clarify market structure rulesUS Congressman French Hill stated that a stablecoin bill without market structure is like a cellphone without a network. He emphasized that the industry needs clear rules, including regulatory frameworks for banks, brokers, and decentralized finance, to ensure proper functioning. (CoinDesk)

News

![[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.](https://img.bgstatic.com/multiLang/image/social/87a413b57fb2c702755e8bc5b4385a781765441081405.png)