News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | Trump Plans to Sue Powell; Meta Acquires Manus; Tesla Orders Sharply Decline (December 30, 2025)2Bitget Daily Digest (Dec.30)|Meta acquires Manus for billions of dollars; RWA protocols become the 5th largest DeFi category; Strategy purchases another 1,229 BTC3 Chainlink Is Stuck Around $12 as Selling Pressure Fades: Here’s What Next for LINK Price Rally

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

Chaincatcher·2025/12/08 20:12

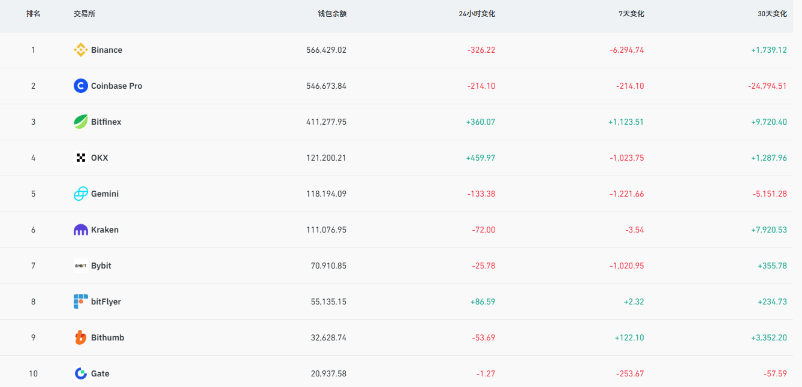

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?

AICoin·2025/12/08 20:06

Bitcoin ’rallies are for selling‘: Top 3 arguments from BTC market bears

Cointelegraph·2025/12/08 18:21

XRP bulls grow louder: What will spark the breakout toward $2.65?

Cointelegraph·2025/12/08 18:21

Bitcoin gives up $90K at US open as two-week exchange outflows near 35K BTC

Cointelegraph·2025/12/08 18:21

Refuting the AI bubble theory! UBS: Data centers show no signs of cooling down, raises next year's market growth forecast to 20-25%

The structural changes in the cost of building AI data centers mean that high-intensity investment will continue at least until 2027, and AI monetization has already begun to show signs.

ForesightNews·2025/12/08 18:13

The “infinite money glitch” fueling Strategy and BitMine has evaporated, forcing a desperate pivot to survive

CryptoSlate·2025/12/08 17:34

The Base-Solana Bridge Dispute: "Vampire Attack" or Multichain Pragmatism?

The root of the contradiction lies in the fact that Base and Solana occupy completely different positions in the "liquidity hierarchy."

ForesightNews 速递·2025/12/08 17:03

Stable TGE tonight: Is the market still buying into the stablecoin public chain narrative?

According to Polymarket data, there is an 85% probability that its FDV will exceed 2 billion USD on the day after its launch.

ForesightNews 速递·2025/12/08 17:03

Flash

19:41

The Federal Reserve meeting minutes release a cautious dovish signal, considering further interest rate cutsChainCatcher News, according to Golden Ten Data, the Federal Reserve has released the minutes of its final interest rate decision meeting of the year, confirming that FOMC members are willing to consider further rate cuts. The minutes indicate that the Fed's stance is shifting towards dovishness, with most rate decision-makers open to exploring the possibility of additional rate cuts, though policy adjustments will still depend on weak inflation data.

19:14

Federal Reserve meeting minutes show officials were deeply divided at the December meetingAccording to Odaily, the latest Federal Reserve meeting minutes show that the FOMC agreed to cut interest rates at the December meeting, but engaged in an in-depth and detailed debate over the risks currently facing the US economy. According to the minutes, given the various risks facing the US economy, even some officials who supported the rate cut acknowledged that "the decision was the result of weighing pros and cons, or they might have supported keeping the target rate range unchanged." Some participants stated that, based on their economic outlook, after lowering the target rate range at this meeting, it may be necessary to maintain the target rate range unchanged for a period of time. During the debate at this meeting, officials were divided on both tightening and easing monetary policy, which is an unusual outcome for the Federal Reserve, and this situation has occurred for two consecutive meetings. (Golden Ten Data)

19:09

Most participants at the Federal Reserve meeting: If inflation declines over time, further easing of monetary policy would be appropriate.Odaily reported that according to the Federal Reserve meeting minutes, most participants believe that if inflation declines over time, further easing of monetary policy would be appropriate. (Golden Ten Data)

News