News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

US Banks Abruptly Drain $25,000,000,000 From Federal Reserve’s Lifeline for Lenders

Daily Hodl·2025/12/05 16:00

Best Crypto Presale Opportunities After the Altcoin Drawdown: Why Mono Protocol’s Approach Stands Out

Cryptodaily·2025/12/05 16:00

Crypto Treasury Underwriter Clear Street Eyes $12B IPO Led By Goldman Sachs

Clear Street targets a $12B IPO led by Goldman Sachs as crypto-treasury underwriting demand reshapes U.S. equity and debt markets.

Coinspeaker·2025/12/05 16:00

French Bank BPCE Offers Direct Crypto Access for Millions of Clients

France’s second-largest bank, BPCE, will begin offering direct crypto purchases next week, emphasizing a trend of improved regulatory sentiment in Europe.

Coinspeaker·2025/12/05 16:00

Strategy CEO Says No Bitcoin Sale till 2065 Despite BTC Losing $90K SupportBitcoin Price Forecast: Cup-and-Handle Intact, Can BTC Reclaim $100k to Co

Bitcoin dipped below $90,000 after heavy liquidations. Strategy’s CEO vows not to sell.

Coinspeaker·2025/12/05 16:00

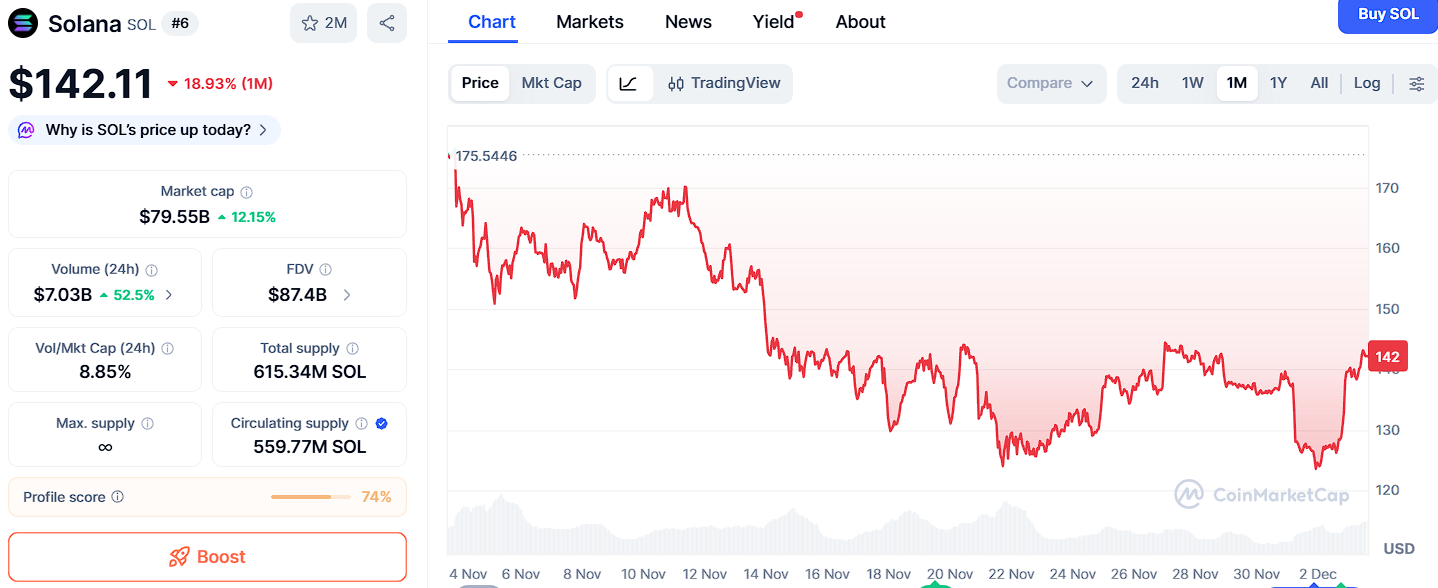

Top 3 Breakout Coins Before 2026: Ozak AI, BNB, and Solana Show Explosive Signs

Cryptodaily·2025/12/05 16:00

Polymarket’s New Play: Betting Against Its Own Users. Wait, What?

Kriptoworld·2025/12/05 16:00

Eric Trump’s Wealth Surges With His Family-Backed Crypto Companies

Eric Trump’s wealth has surged as crypto becomes the Trump family’s fastest-growing financial engine. Major stakes in American Bitcoin and World Liberty Financial have added hundreds of millions to his net worth. Eric remains committed to crypto as traditional Trump businesses expand globally.

CoinEdition·2025/12/05 16:00

Flash

18:29

The Federal Reserve's reverse repo operation accepted $105.993 billion from 49 counterparties.The Federal Reserve accepted 49 counterparties in its fixed-rate reverse repurchase operations, with a total amount reaching $10.5993 billions.

17:17

Polymarket Predicts 80% Probability of "Bitcoin Reaching $100,000 by 2026"BlockBeats News, January 1st, the probability of the prediction "Bitcoin to rise to $100,000 by 2026" on Polymarket is currently at 80%. Additionally, the probability of it rising to $110,000 is currently at 64%, dropping to $75,000 at 78%, and dropping to $65,000 at 58%.

17:04

Data: 37.23 million TON transferred from Fragment to Telegram, worth approximately $60.31 millionChainCatcher News, according to Arkham data, at 00:52, 37.2326 million TON (worth approximately $60.31 million) were transferred from Fragment to Telegram.

News