News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Imposes 25% Tariffs on Iran's Trade Partners; Google Market Cap Breaks $4 Trillion for the First Time; Gold Surpasses $4600 Threshold (Jan,13, 2026)2Bitget Daily Digest (Jan.13)|Market Risk-Off Triggered by Fed Independence Dispute; Meta Plans to Cut Metaverse Investment; Strategy Added 13,627 BTC Last Week

Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

The Block·2025/12/19 01:30

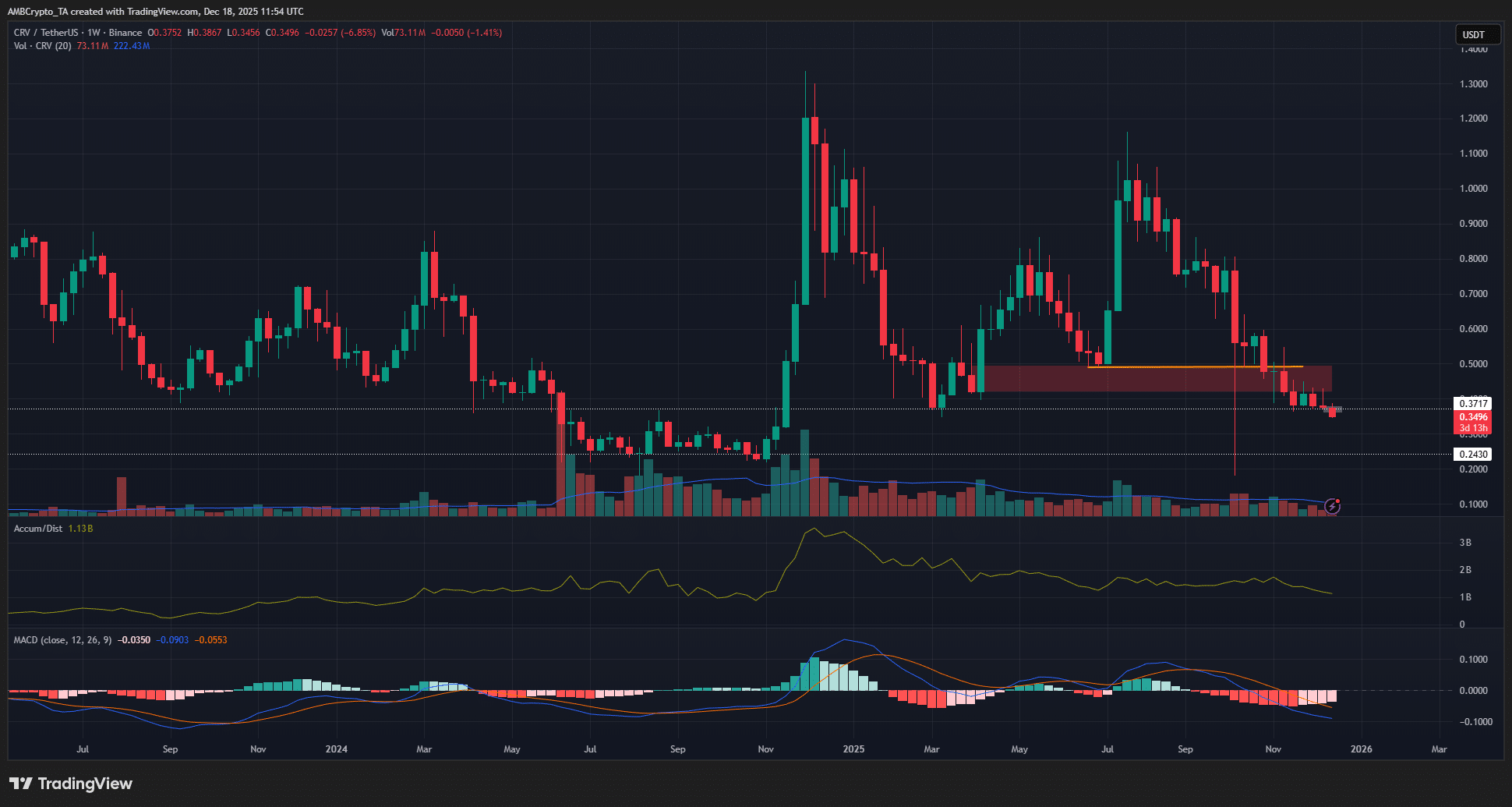

Dissecting Curve DAO’s price action as CRV eyes another support test

AMBCrypto·2025/12/19 01:03

Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

Bitcoinworld·2025/12/19 01:00

Crucial Alert: CoinMarketCap’s Altcoin Season Index Plummets to a Weak 17

Bitcoinworld·2025/12/19 00:57

Crucial $2.65 Billion Bitcoin Options Expire Today: What Traders Must Know

Bitcoinworld·2025/12/19 00:27

Stunning 80,000 ETH Transferred: Whale’s $226 Million Move to Beacon Depositor Revealed

Bitcoinworld·2025/12/19 00:12

Charles Hoskinson: Trump Crypto Ventures Have Been 'Frustrating'—But Others Won't Talk About It

Decrypt·2025/12/19 00:05

XRP Technical Analysis: Bullish Pattern Emerges Amid Market Weakness

TimesTabloid·2025/12/19 00:00

Synthetix Returns to Ethereum Mainnet: A Triumphant Homecoming for DeFi Derivatives

Bitcoinworld·2025/12/18 23:57

Flash

14:52

Spot Gold Hits Fresh All-Time High, Surpasses $4630.21 per OunceBlockBeats News, January 13th, according to Bitget market data, COMEX Silver reached up to $89/oz, rising 4.59% intraday. Spot Gold broke through $4630.21/oz, hitting another all-time high.

Spot Silver broke through $89/oz, rising 4.54% intraday.

14:44

X, Cloudflare Platform Suspected OutageBlockBeats News, January 13, according to the network monitoring website DownDetector, user reports show that social media platform X, cloud acceleration service provider Cloudflare, and other platforms experienced issues.

14:39

Bitwise CIO says bitcoin ETF demand could trigger a significant price surgeBitwise Chief Investment Officer Matt Hougan stated on the X platform that the price of bitcoin may repeat the trend of gold in 2025. He pointed out that gold's price reacted slowly in the early stages after central bank purchases doubled in 2022, but then surged by 65% in 2025 as selling pressure was exhausted. Currently, since the launch of bitcoin ETF in January 2024, it has absorbed more than 100% of the new supply. If this demand continues, the long-term exhaustion of sellers may trigger a sharp price increase.

News