News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.9)|Zcash team mass resignations trigger ZEC oversold conditions; approx. $2.22B worth of BTC and ETH options expire today; U.S. initial jobless claims for the week ending Jan 3 came in at 208K2Bitget UEX Daily | Non-Farm Eve Market Split; Trump Picks Fed Chair; CME Hikes Precious Metals Margins (Jan 08, 2026)3Hyperliquid: How whale transfers have stressed HYPE’s fragile price structure

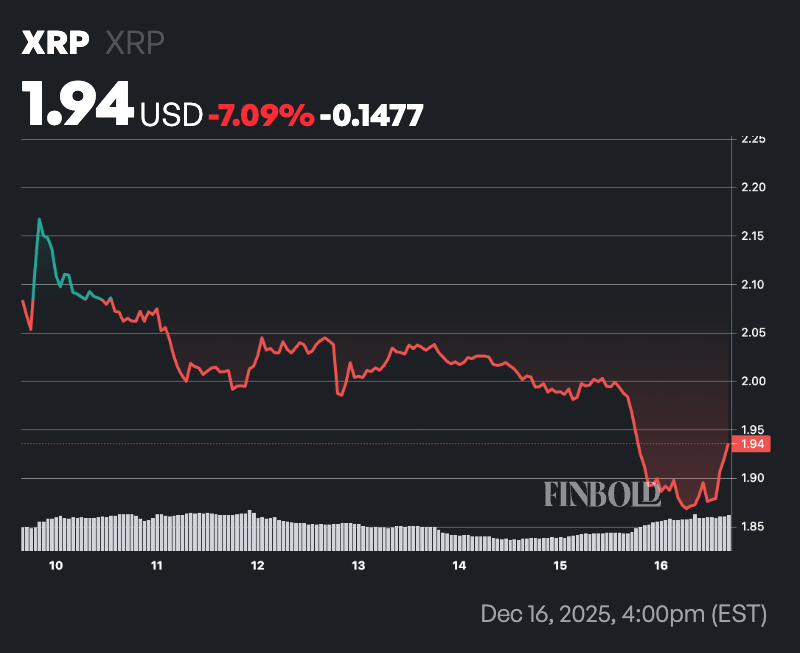

Analyst Warns XRP Investors: We May See a Drop to $1.56. Here’s why

·2025/12/16 14:33

Cloud Mining Industry Outlook 2026: Market Trends, Platforms, and Participation Models

CryptoNinjas·2025/12/16 14:33

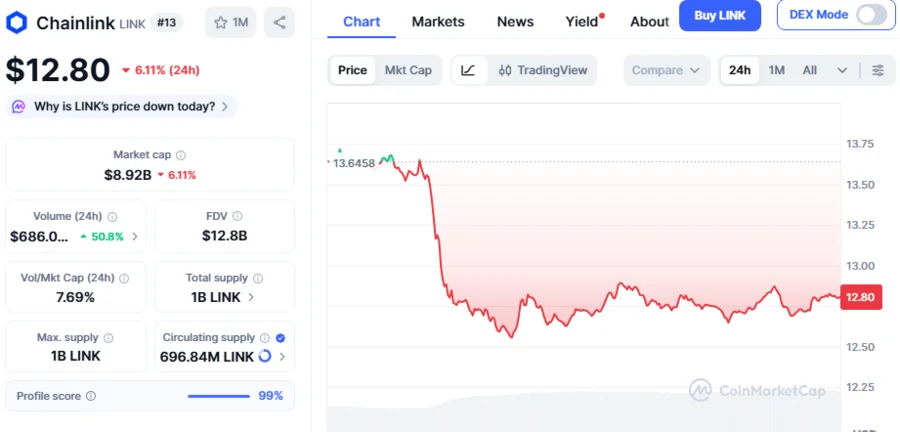

Chainlink Whales Accumulate 20.46M Tokens as LINK Consolidates at $12.69, Is Market Rally Coming?

BlockchainReporter·2025/12/16 14:31

Fhenix Showcases Encrypted-by-Default Payments With Privacy Stages and Private x402 Transactions

BlockchainReporter·2025/12/16 14:27

Visa launches stablecoin settlement in US via Circle's USDC on Solana

The Block·2025/12/16 14:15

Cloud Mining Platforms 2025: A Guide to Hardware-Free Bitcoin Mining Services

CryptoNinjas·2025/12/16 14:12

Artificial intelligence predicts XRP price for Q1 2026

币界网·2025/12/16 14:05

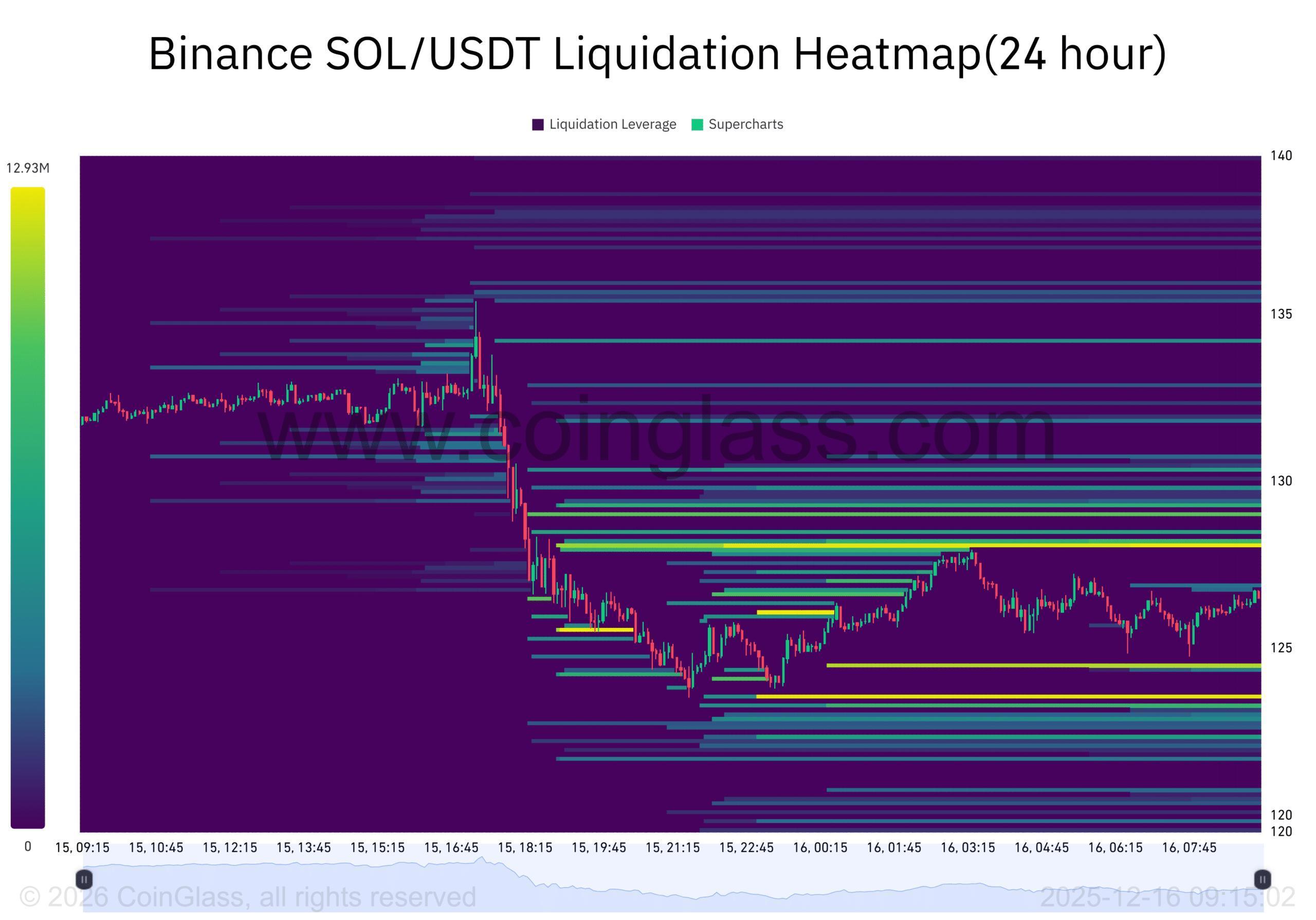

Solana’s sell pressure intensifies – How deep will SOL’s pullback go?

BlockBeats·2025/12/16 14:03

Flash

10:29

"I'm Here to Conquer" Market Cap Surges to Over $29 Million, Setting a New All-Time HighBlockBeats News, January 10, according to market data, the Chinese Meme token "I've Arrived on a Horse" briefly surpassed a $29 million market cap, hitting a new all-time high, and has now retraced to $26.25 million, with a 24-hour gain of 143%.

BlockBeats Note: Meme coins are highly volatile, mostly driven by market sentiment and hype, lacking practical value or use cases. Investors should be aware of the risks.

10:23

Huang Licheng's address long position floating loss expands to $610,000On January 10, according to HyperInsight monitoring, the overall floating loss of long positions held in Huang Licheng's address has expanded to $610,000, after previously reaching a total floating profit of over $1.4 million. The current positions are: 10,706 ETH long with 25x leverage, liquidation price at $3,000.16, floating loss of $460,000; 86,000 HYPE long with 10x leverage, liquidation price at $12.12, floating loss of $150,000.

10:02

KOLECT completes $1.2 million Pre-Seed funding round, led by amber.ac under Amber GroupBlockBeats News, January 10, trading strategy platform KOLECT has recently completed a $1.2 million Pre-Seed round of financing. The round was led by Amber Group's Web3 accelerator program amber.ac, with Wonder Capital Group and GC Capital participating as follow-on investors. KOLECT focuses on sentiment-based quantitative trading, aiming to transform social media sentiment into executable trading strategies. KOLECT stated that the funds raised will be used for in-depth development of the core platform, community building, and integration of the prediction market segment. A representative from amber.ac said, "Social trading will become an important driving force in the crypto market, and we believe it will reshape the traditional investment and trading model."

News