News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Paradigm Bets on Brazil: The New Battleground for Stablecoins Is Not in the United States

BlockBeats·2025/12/17 03:49

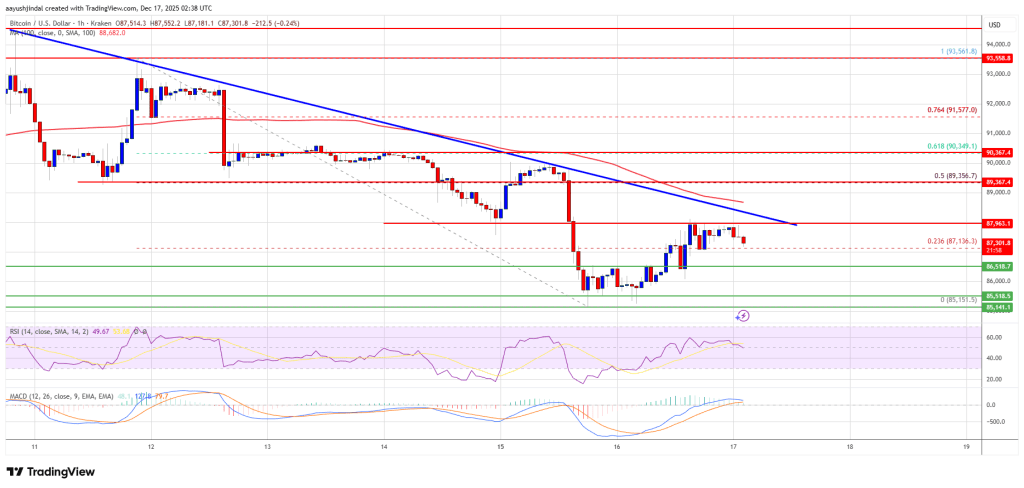

Bitcoin price regroups after decline—Is a directional breakout imminent?

币界网·2025/12/17 03:17

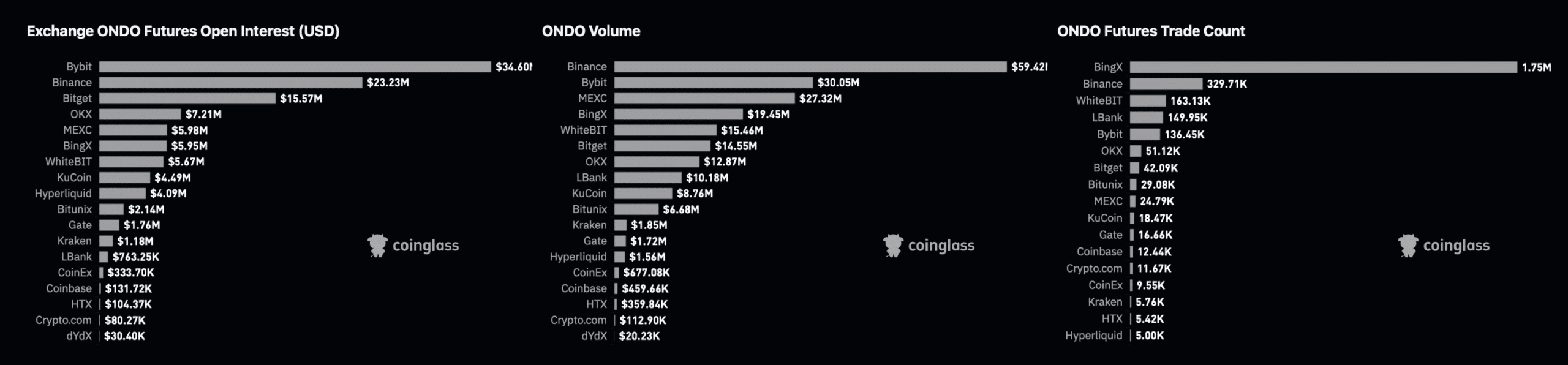

Two main reasons why the current decline of ONDO is only temporary.

币界网·2025/12/17 03:14

Mapping 2 reasons why ONDO’s current dip is only temporary

BlockBeats·2025/12/17 03:03

How much capital can Hyperliquid’s major move "Portfolio Margin" bring?

BlockBeats·2025/12/17 02:48

Won-Dollar Exchange Rate Soars: Hits Critical 1480 Level for First Time in 8 Months

Bitcoinworld·2025/12/17 02:42

Flash

14:35

Hashrate: The current three-month average of the core inflation rate is 1.6%, with Trump seeking a data-dependent nominee for Federal Reserve Chair.BlockBeats News, December 21, Kevin Hassett, Director of the White House National Economic Council, stated, "The current three-month average of the core inflation rate is 1.6%, and Trump is seeking a data-dependent candidate for Federal Reserve Chair." (FXStreet)

14:34

Sean Farrell of Fundstrat says bearish rumors are due to misunderstandings about the company's operationsSean Farrell from Fundstrat stated that the news about the company being bearish on the market is a misunderstanding of how Fundstrat operates. (Cointelegraph)

14:28

Opinion: Traditional DeFi is dead and will be replaced by more mature on-chain financial marketsChainCatcher news, according to CoinDesk, Maple Finance co-founder and CEO Sidney (Sid) Powell stated in an interview that DeFi in the traditional sense is "dead," and that the truly decisive factor in the future will be on-chain capital markets.

News