News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

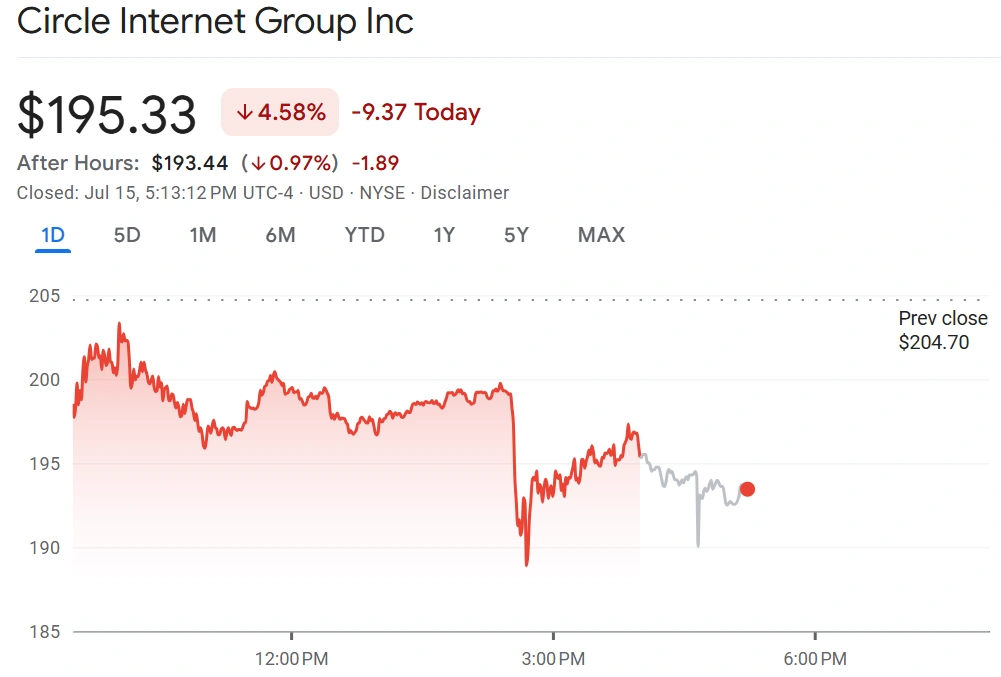

Share link:In this post: House Republicans failed a key vote to advance the GENIUS Act, stalling a major crypto legislative push. The 196–222 vote blocked debate on stablecoin regulation, the defense bill, and related crypto measures. The failed vote triggered a dip in crypto-related stocks, with Circle falling 5% and Coinbase down 2%.

Share link:In this post: SpaceX is planning an insider share sale at a $212 per-share price, which would value the company at $400 billion. Starlink’s rapid growth and strong cash reserves are fueling investor confidence, alongside dominance in global satellite launches. Risks remain, including Starship’s technical setbacks, potential political fallout, and governance concerns over limited access to private share deals.

Share link:In this post: U.S. firms use bonded warehouses to defer Trump’s rising tariffs until goods are ready for U.S. sale. These facilities carry extra storage fees, stricter monitoring and the risk of even higher duties if tariff rates climb. Tariffs have already brought in over $100 billion this year, with June’s $27 billion haul up 301% from last June.

Share link:In this post: President Trump has renewed calls for Federal Reserve Chair Jerome Powell to resign, criticizing the Fed for not cutting interest rates. Markets are reacting with fears of higher inflation, leading to rising long-term Treasury yields and increased borrowing costs. Experts warn that political pressure on the Fed risks undermining its independence, which could destabilize financial markets.

The U.S. House of Representatives has scheduled a new round of procedural vote to take place at around 00:20 tomorrow morning Beijing time. If passed, this will be followed by related debates and a final vote.

SharpLink Gaming becomes the top ETH holder among public companies, overtaking the Ethereum Foundation.Why This Matters for EthereumLooking Ahead: Institutional Crypto Adoption Grows

- 16:03Bitget Now Supports Pre-market and Futures Trading for WLFIAccording to an official announcement reported by ChainCatcher, Bitget has now launched pre-market trading and contract trading, with leverage ranging from 1 to 25 times.

- 16:03Data: If ETH falls below $4,488, total long liquidations on major CEXs will reach $4.348 billionAccording to ChainCatcher, citing data from Coinglass, if ETH falls below $4,488, the total long liquidation volume across major CEXs will reach $4.348 billion. Conversely, if ETH breaks above $4,958, the total short liquidation volume across major CEXs will reach $2.465 billion.

- 16:02Aave founder once responded: The protocol related to the WLFI proposal remains validAccording to ChainCatcher, Aave founder Stani.eth responded at 20:30 today to questions regarding “Is the agreement between WLFI and the AAVE protocol still valid? Are they really building on Aave? There are many different rumors circulating,” stating that the protocol remains valid. “At current prices, the Aave treasury will receive WLFI worth $2.5 billion, making it one of the biggest winners of this cycle.” In response to this view, the Aave founder prominently reposted and commented, “The art of the deal.” As previously reported by ChainCatcher, on-chain analyst @ai_9684xtpa posted an analysis on X, stating that according to previous proposals, Aave, as a WLFI lending ecosystem partner, will have WLFI in this Aave v3 instance adopt the same reserve factor mechanism as the main Aave instance. AaveDAO will receive 20% of the protocol fees generated by the WLFI Aave v3 instance, and will also obtain about 7% of the total WLFI token supply, to be used for future participation in WLFI governance processes, liquidity mining, and promoting the decentralization of the WLFI platform. The distribution of proceeds will be implemented through a trustless smart contract, which will directly allocate the corresponding proportion of protocol fees to the AaveDAO treasury address and the WLFI treasury address.