News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 3) | Trump Strongly Hints at Hassett as Next Fed Chair; Elon Musk Predicts a $38.3T “Crisis” Could Trigger a BTC Price Surge2Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise3BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

IoTeX Launches Real-World AI Foundry to Fuse Blockchain, AI and Live Data

DeFi Planet·2025/10/05 11:03

Can Ethereum Price Form Historic Highs Following Bitcoin’s Recent ATH?

Ethereum is nearing a new all-time high after reclaiming $4,500 support. Strong momentum and investor confidence may drive a breakout above $5,000.

BeInCrypto·2025/10/05 11:00

Can Bitcoin ETFs Fuel the Biggest Price Surge Yet?

Cryptoticker·2025/10/05 10:51

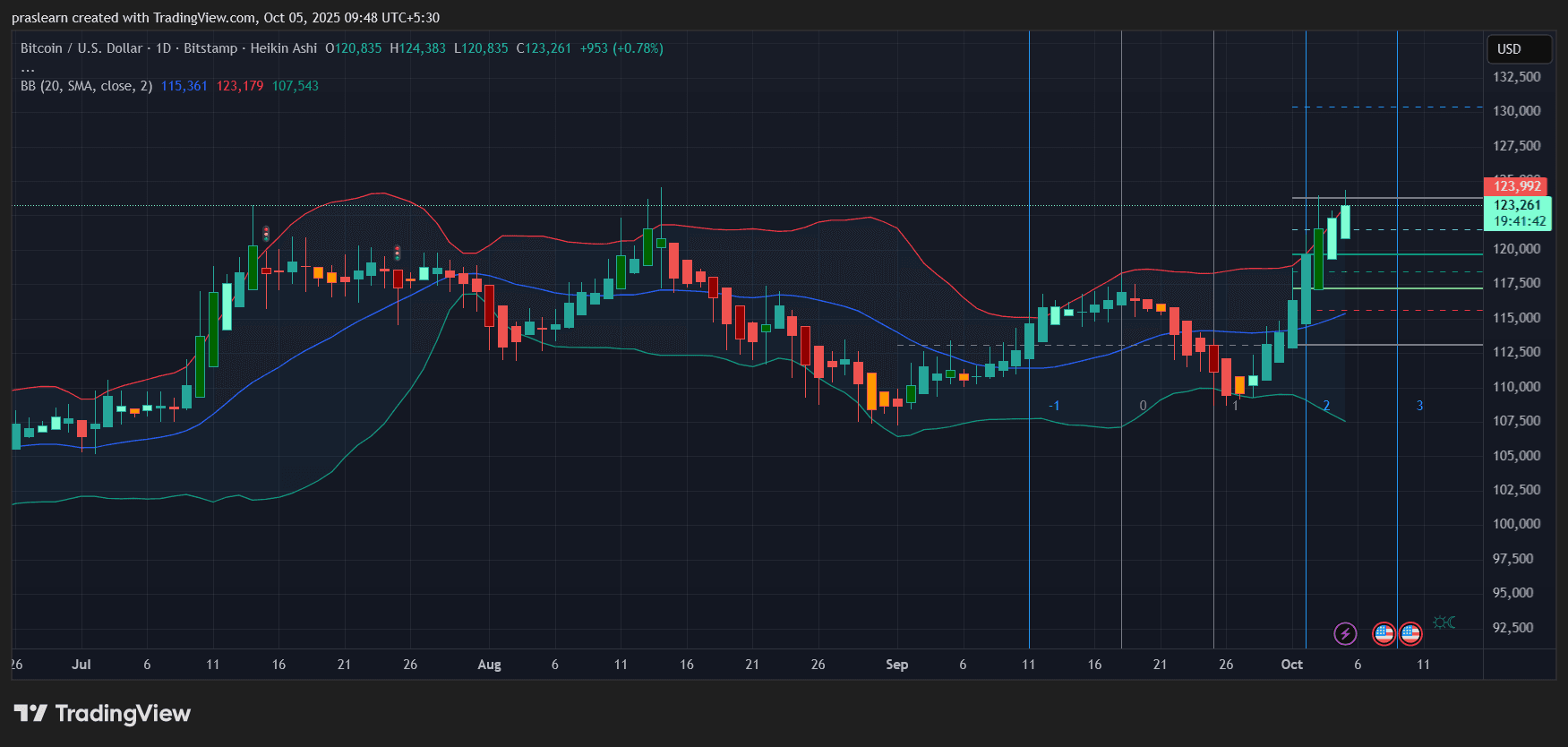

BREAKING: Bitcoin Price Hits $125,646 ATH, Here Are NEW BTC Targets

Cryptoticker·2025/10/05 10:51

Centralized Exchange Bitcoin Balances Hit Multi Year Low During Price Rally

BTCPEERS·2025/10/05 10:45

Ethereum Reaches $4,500 Amid Institutional Interest

Coinlineup·2025/10/05 10:00

Bitcoin Surpasses Amazon in Market Valuation

Coinlineup·2025/10/05 10:00

Ethereum Price Forecast — Analysts Eye $6K ETH as BitMine Purchases $961M in a Week

Coinlineup·2025/10/05 10:00

US Spot Bitcoin ETFs See $3.24 Billion Weekly Inflow as October Rally Begins

BTCPEERS·2025/10/05 09:45

The end of privacy in Europe? Germany’s shift on EU Chat Control raises alarm

CryptoSlate·2025/10/05 09:00

Flash

- 19:25Bank of America predicts: the strong rally of the S&P 500 Index will fade in 2026Jinse Finance reported that Bank of America believes that after three consecutive years of double-digit returns, there is limited room for excess gains in the U.S. stock market in 2026. The bank predicts that the S&P 500 Index is likely to close at around 7,100 points in December next year, which is only about 4% higher than the closing price on Tuesday (December 2). Although U.S. companies are expected to achieve double-digit earnings growth, stock price returns will tend to be flat. Savita Subramanian, head of equity and quantitative strategy, believes there are risks, but does not anticipate a crash; compared to 2000, current investor equity allocations are lower, earnings growth supports returns, and enthusiasm for speculative stocks is not as extreme.

- 18:39Data: If ETH falls below $2,978, the cumulative long liquidation intensity on major CEXs will reach $1.44 billions.According to ChainCatcher, citing Coinglass data, if ETH falls below $2,978, the cumulative long liquidation volume on major CEXs will reach $1.44 billions. Conversely, if ETH breaks above $3,290, the cumulative short liquidation volume on major CEXs will reach $466 millions.

- 18:34Stable and Theo will jointly invest over 100 million USD in ULTRABlockBeats news, on December 3, stablecoin blockchain platform Stable and full-stack platform Theo announced a joint investment of over 100 millions USD in ULTRA, the only tokenized US Treasury strategy rated AAA by Particula. Institutional users will gain access to ULTRA investment opportunities through Theo's thBILL, which provides on-chain access to institutional-grade short-term US Treasuries, while ULTRA is supported by Libeara's compliant tokenization infrastructure.

News