News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 20) | US to Release Nonfarm Payrolls and Unemployment Rate; Ethereum Advances Post-Quantum Cryptography; LayerZero and KAITO Tokens Face Major Unlocks Today2Bitcoin charts flag $75K bottom, but analysts predict 40% rally before 2025 ends33 SOL data points suggest $130 was the bottom: Is it time for a return to range highs?

National Bitcoin Reserve Could Rock BTC Prices and Dollar Stability, Warns Crypto Executive

Cointribune·2025/09/28 18:09

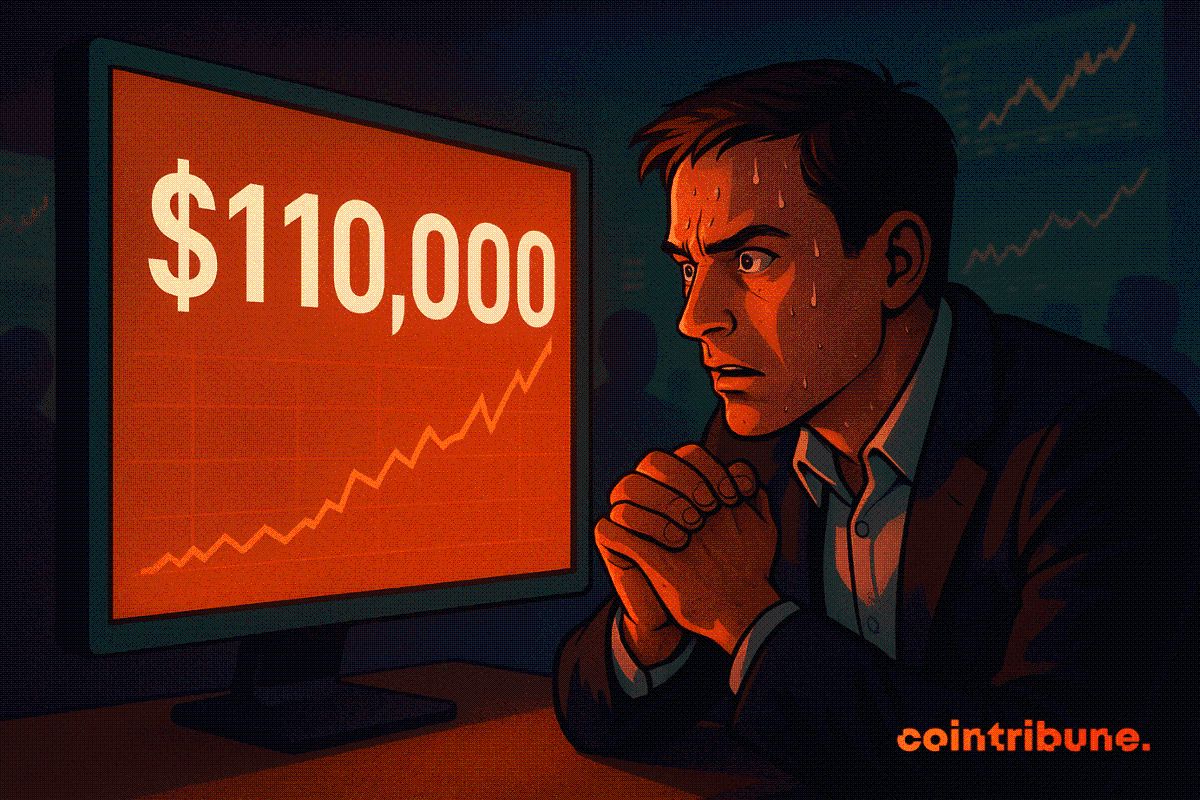

Bitcoin Derivatives Stay Active as $110K Resistance Shapes Market Sentiment

Cointribune·2025/09/28 18:09

Ethena (ENA) Slides Lower – Could This Emerging Pattern Spark a Bounce Back?

CoinsProbe·2025/09/28 18:03

Aster (ASTER) Holds Key Support – Will This Pattern Trigger an Upside Breakout?

CoinsProbe·2025/09/28 18:03

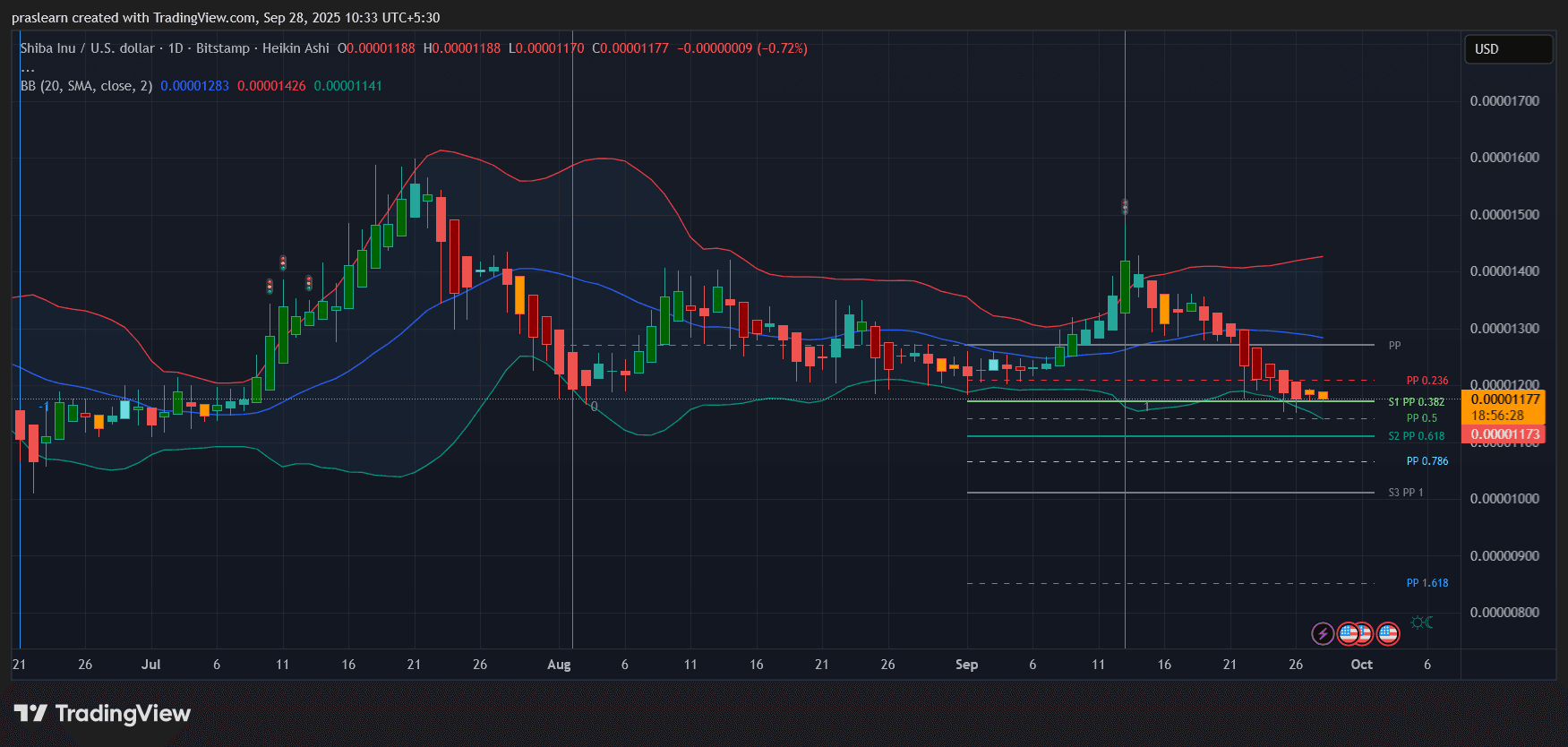

SHIB Price Meltdown: Why the Worst May Be Yet to Come?

Cryptoticker·2025/09/28 17:54

XRP Price Prediction: Break Above $3 Could Signal Start of a New Bull Run

Cryptoticker·2025/09/28 17:54

Cardano News: ADA Price Stuck Below $0.80 as Bears Test Key Supports

Cryptoticker·2025/09/28 17:54

Hypervault Deletes X Account Amid Alleged $3.6M Rug Pull

Coinlineup·2025/09/28 17:12

As Cardano Goes Sideways and HYPE Cools Off, BlockDAG Shatters Records With $410M+ Presale Momentum!

Coinlineup·2025/09/28 17:12

Disrupting Ethereum! Anoma aims to build a truly "decentralized operating system" so users no longer have to worry about cross-chain issues

Anoma co-founder Adrian shared his journey from academic research to founding Anoma. Anoma aims to break the current bottlenecks in Web3 by addressing fragmentation through an intent-centric, decentralized operating system, offering a hybrid consensus mechanism that is more decentralized than bitcoin and faster than solana. Summary generated by Mars AI. This summary is produced by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

MarsBit·2025/09/28 16:54

Flash

- 15:44Federal Reserve's Harker: Employment report is "somewhat steady," but also in line with expectationsJinse Finance reported that Federal Reserve's Harker stated that employment data appears to be mixed. The employment report is "slightly stable," but also in line with expectations; for the U.S. economy, high inflation remains a real issue.

- 15:32Hammack: Monetary policy needs to remain tight due to inflationChainCatcher News, according to Golden Ten Data, Federal Reserve's Harker stated that due to inflation factors, it is necessary to maintain a certain degree of monetary policy tightening.

- 15:32Hammack: The Non-Farm Payrolls Report Is Slightly Outdated but Meets ExpectationsAccording to Golden Ten Data, ChainCatcher reports that Federal Reserve official Harker stated that the non-farm payrolls report is somewhat outdated but in line with market expectations. He pointed out that the employment data presents a mixed picture, highlighting the challenges currently facing monetary policy.