News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 20) | US to Release Nonfarm Payrolls and Unemployment Rate; Ethereum Advances Post-Quantum Cryptography; LayerZero and KAITO Tokens Face Major Unlocks Today2Bitcoin charts flag $75K bottom, but analysts predict 40% rally before 2025 ends33 SOL data points suggest $130 was the bottom: Is it time for a return to range highs?

Pi Network Struggles with Massive Sell Pressure and Mounting Trust Concerns

Cryptonewsland·2025/09/28 10:51

ADA Eyes Recovery as $18M Project Catalyst Funding Fuels Optimism

Cryptonewsland·2025/09/28 10:51

AVAX Pushes Toward $25 As Layer 1 Interest Rotates From SOL And ADA

Cryptonewsland·2025/09/28 10:51

XRP Price Prediction After October 2025 ETF Approvals

CryptoNewsNet·2025/09/28 10:39

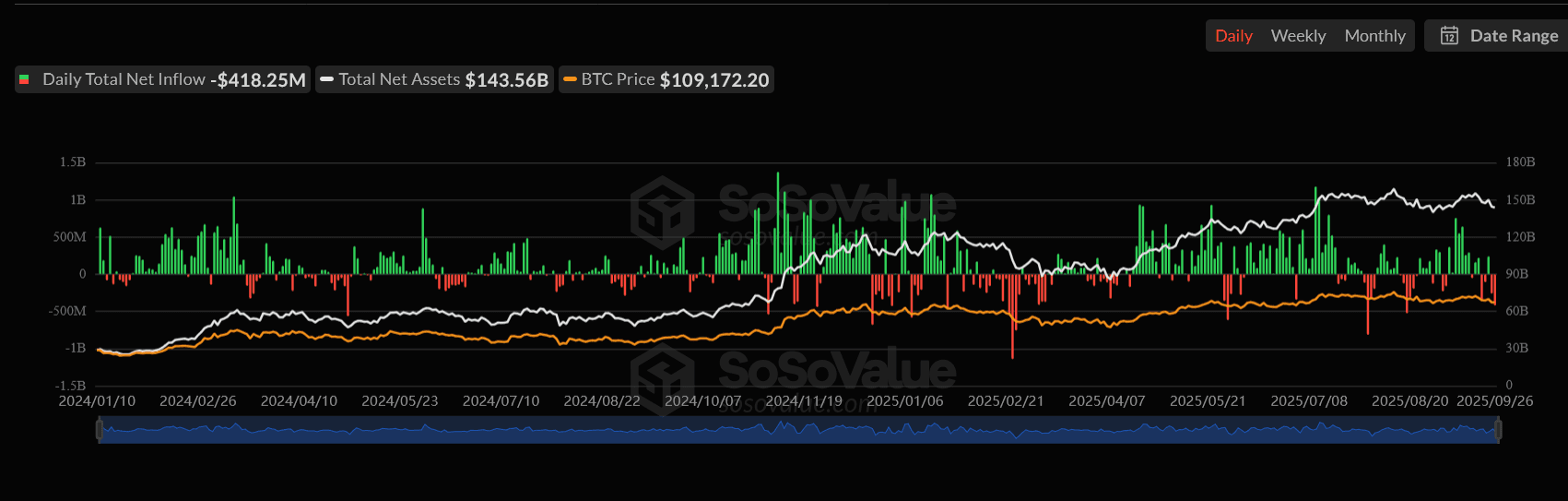

Crypto: Ethereum ETFs record five consecutive days of outflows

Cointribune·2025/09/28 10:33

Bitcoin’s New Era : Structured, Stable, And Strategic

Cointribune·2025/09/28 10:33

Pepe (PEPE) To Dip Further Before an Bullish Reversal? Key Fractal Setup Saying Yes!

CoinsProbe·2025/09/28 10:27

Ethereum and Bitcoin ETFs Just Had Their Worst Week Ever

Cryptoticker·2025/09/28 10:03

JPMorgan downgrades CleanSpark stock rating to neutral due to valuation concerns

PANews·2025/09/28 09:50

What To Expect From HBAR Price In October 2025

Hedera’s HBAR enters October 2025 under pressure after a weak September. Historical October volatility and bearish sentiment suggest caution ahead, with downside risks outweighing near-term recovery chances.

BeInCrypto·2025/09/28 08:30

Flash

- 12:17GAIB launches on Bitget CandyBomb, contract trading unlocks token airdropChainCatcher news, Bitget CandyBomb has launched the GAIB project, with a total prize pool of 90,000 GAIB. By completing specific contract trading volume tasks, an individual can earn up to 600 GAIB. Detailed rules have been published on the official Bitget platform. Users must click the "Join Now" button to register and participate in the event. The event ends at 16:00 on November 27 (UTC+8).

- 12:1621Shares launches six cryptocurrency ETPs on Nasdaq StockholmChainCatcher reported that cryptocurrency exchange-traded product (ETP) issuer 21shares has announced the launch of six cryptocurrency ETPs on the Nasdaq Stockholm Exchange. These are: Aave ETP, Cardano ETP, Chainlink ETP, Polkadot ETP, Crypto Basket Index ETP, and Crypto Basket 10 Core ETP.

- 12:11USDC Treasury minted an additional 250 millions USDC on the Solana chainAccording to ChainCatcher, Whale Alert monitoring shows that the USDC Treasury has newly minted 250 million USDC on the Solana chain.