News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Chris Larsen’s XRP sales have now totaled more than $764 million in realized profits, according to analysts — a figure drawing renewed attention as his latest $120 million transfer coincides with continued market uncertainty.

The U.S. government shutdown continues, Bitcoin price rebounds; Meteora founder accused of token manipulation; Hyperliquid Strategies plans to raise 1 billion USD; Tesla’s Bitcoin holdings have yielded an 80 million USD profit; crypto industry leaders discuss regulatory legislation. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Investors have filed a U.S. class action lawsuit accusing Meteora co-founder Ben Chow of orchestrating a meme coin fraud tied to Melania Trump and Argentine President Javier Milei. Plaintiffs say the public figures were used as “props” in a liquidity trap, while Chow denies wrongdoing. The case highlights growing scrutiny of Solana’s meme coin market and regulators’ uncertain stance worldwide.

September was a busy month with RWA Summit, KBW, and Token2049 back-to-back. One point is clear: tokenized securities are here to stay, and the questions revolve around “how” and “when” instead of “what” and “why.” Below are five takeaways and what they signal for the next year. Defi’s Utility is Undercounted Because the Best Infrastructure

An era of conversation has begun, the era of confrontation has ended

Standard Chartered believes Bitcoin’s next move below $100K could be its last, with gold rotations, liquidity trends, and resilient technicals pointing to a historic entry point before a new rally begins.

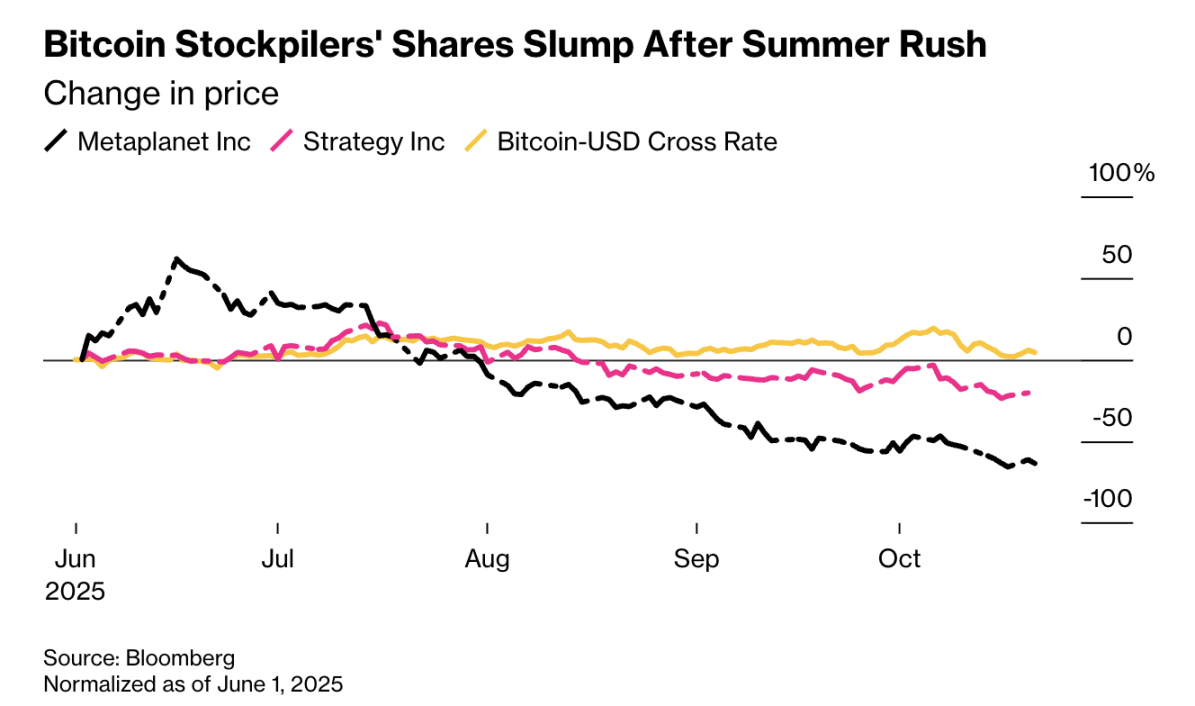

Several Asia-Pacific countries, including Hong Kong, India, Mumbai, and Australia, are resisting corporate hoarding of cryptocurrencies.

At this new historical starting point, the entire industry is working together to move toward a more open, interconnected, and efficient future.

A new report reveals North Korea stole $2.8B in crypto since 2024, using sophisticated nine-step laundering to convert assets into fiat via brokers in China and Russia.

Investing globally no longer requires a cross-border identity, just a Bitget account.