News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Ripple (XRP) price broke above $2.60 on Saturday as trader James Wynn’s bullish comments fueled renewed market interest.

Rumble unveiled a Bitcoin tipping feature at Switzerland’s Lugano PlanB conference, marking a major step in blockchain-based creator monetization.

Quick Take Rumble, the video streaming platform significantly backed by stablecoin giant Tether, announced that its 51 million monthly active users will be able to tip creators in Bitcoin, USDT, and Tether Gold starting in mid-December. Tether CEO Paolo Ardoino also previously said Tether would promote adoption of its U.S.-compliant stablecoin USAT through Rumble.

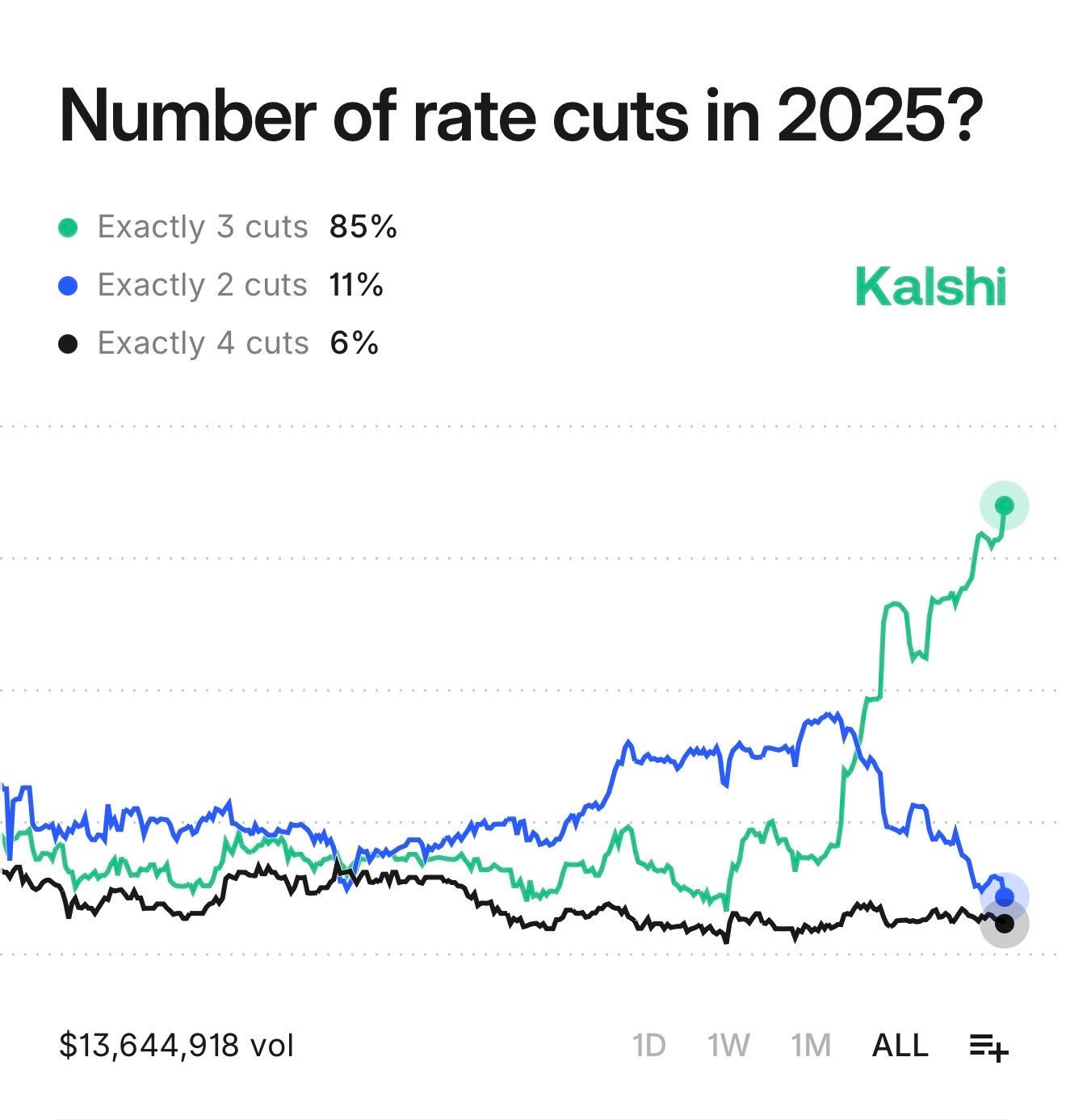

Analysts see parallels between potential Fed pivot now and the Aug 2019 QT halt that preceded 2021 altseason. Anticipated end of QT plus expected rate cuts could inject significant liquidity into altcoins. Bitcoin dominance chart shows potential breakdown, a classic technical signal favoring altcoins.