News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

BNB’s steady growth and strong network fundamentals are reigniting comparisons with Ethereum. While ETH’s ecosystem remains unmatched, BNB’s rising on-chain activity and user engagement hint at a growing challenge to the market’s long-standing hierarchy.

A brutal "Squid Game".

USDe withstood the test during a record-breaking liquidation day in October, and remains safe unless multiple "black swan events" occur simultaneously.

Inveniam Capital Partners (“Inveniam”), a global leader in decentralized data infrastructure for private market assets, and MANTRA, a Layer 1 blockchain specializing in real world asset (RWA) tokenization, today unveiled Inveniam Chain, a purpose-built Layer 2 blockchain aimed at advancing the management and utilization of private real estate assets in an agentic future, beginning with

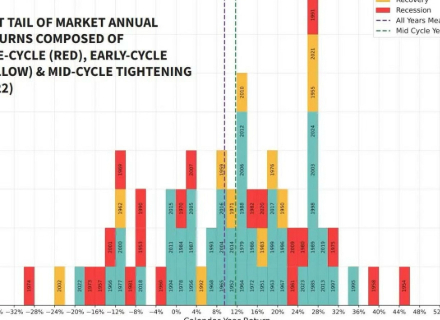

The global economy faces risks from feedback loops among policy, leverage, and confidence. Technology supports growth, but fiscal populism is on the rise and trust in currency is gradually eroding. Trade protectionism and speculative AI-driven finance are intensifying market volatility. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved.

Ethereum price remains trapped below $4,000 as selling from whales and weak accumulation weigh on momentum. Heavy resistance around $3,955 and $4,340 continues to block recovery, but a breakout above these zones could open the path to $4,520 and even $4,960 — aligning with hidden bullish signals on RSI.