News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.23)|Michael Selig Appointed as the 16th Chair of the CFTC; Powell Has Secured Three Rate Cuts; Strategy Adds $748M to Its Reserves2Bitget US Stock Daily Report | Gold Breaks $4,460; Tesla Approaches $500; Novo Nordisk Oral Drug Approved (December 23, 2025)3Bridgewater founder: Enormous risks from huge bubbles and vast wealth gaps

Why is Bitcoin falling? Global tension, withdrawals, and a banking crisis explain BTC's price drop

Portalcripto·2025/10/18 21:18

SEC Approves 21Shares Spot Solana ETF: Traders Point to $SOL Price Directions

Portalcripto·2025/10/18 21:18

Is Altseason 2025 Dead? Analyst Points to Three Signs of Altcoin Season's Return

Portalcripto·2025/10/18 21:18

Solana Blockchain Gets Faster with Alpenglow Update with SIP SIMD-0337

Portalcripto·2025/10/18 21:18

Cardano (ADA) Cryptocurrency Tests Key Supports, Investors Bet on Recovery

Portalcripto·2025/10/18 21:18

Crypto market price predictions: Zcash, Shiba Inu, Morpho

CryptoNewsNet·2025/10/18 21:15

Ethereum Price Outlook: Asian Investors Unite for $1B ETH Treasury

CryptoNewsNet·2025/10/18 21:15

Dogecoin Price Set To Go On A 2,000% Cyclical Surge To $4

CryptoNewsNet·2025/10/18 21:15

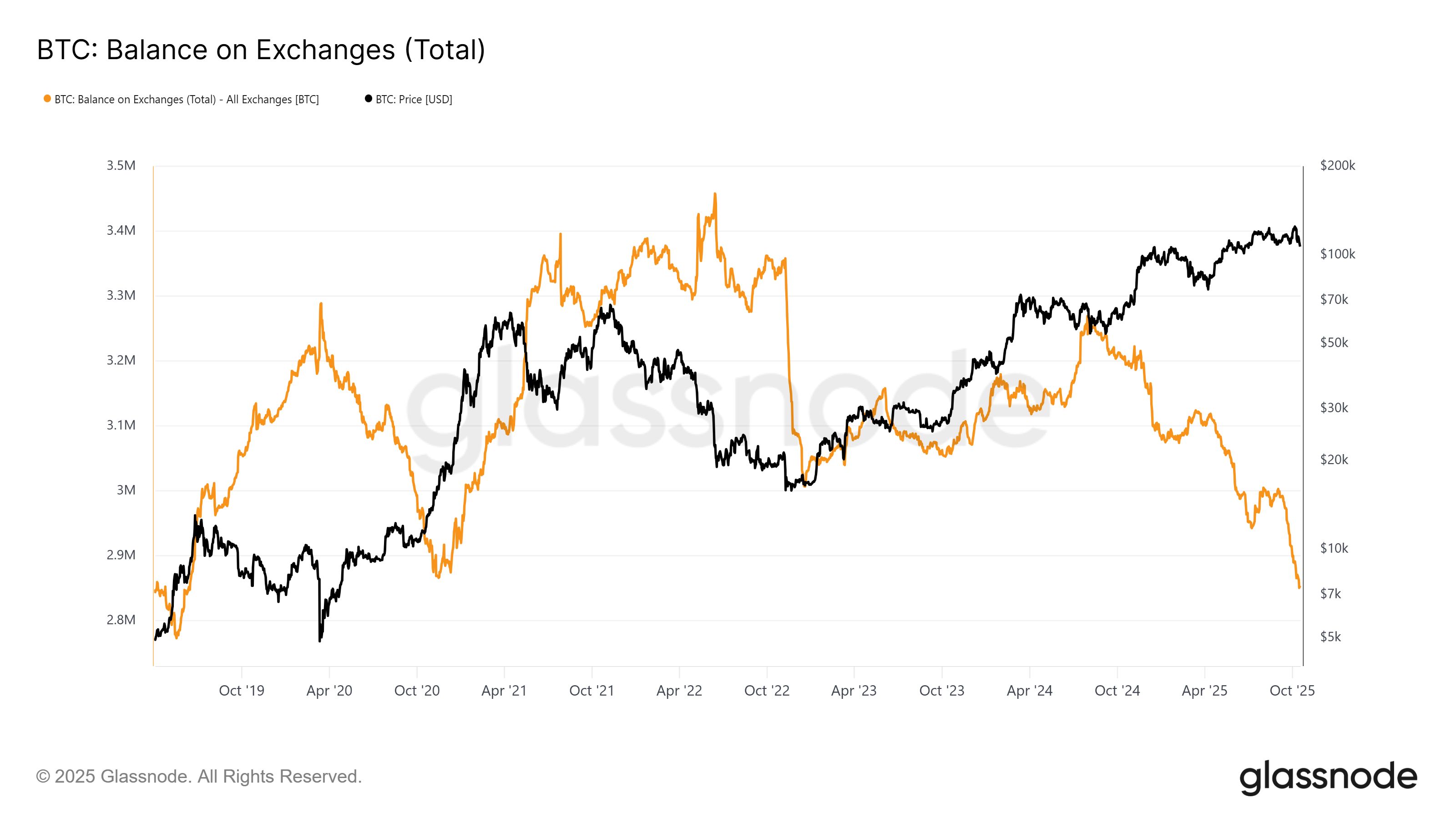

Bitcoin Exchange Supply Falls To 6-Year Low — A Signal To Buy The Dip?

CryptoNewsNet·2025/10/18 21:15

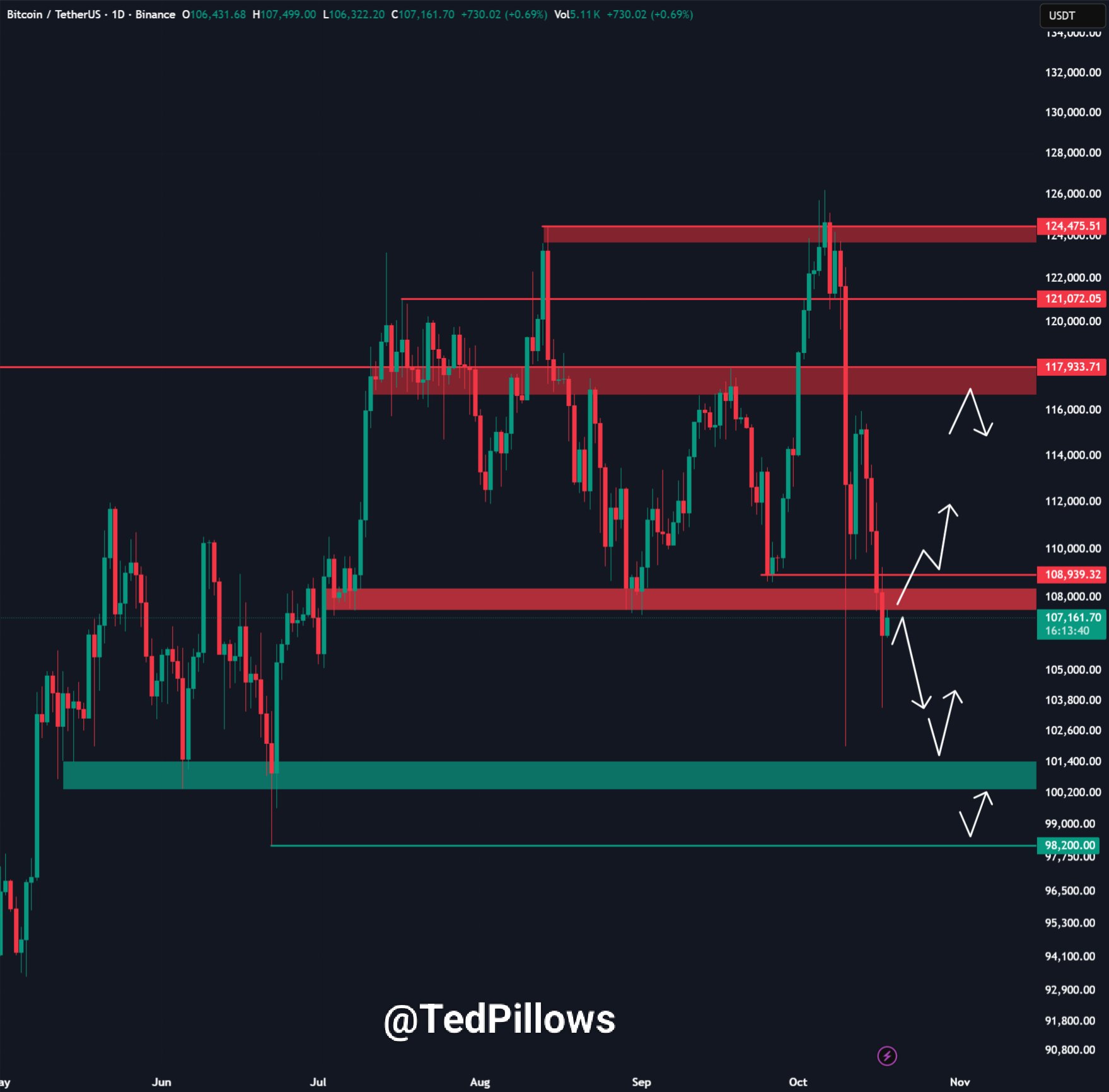

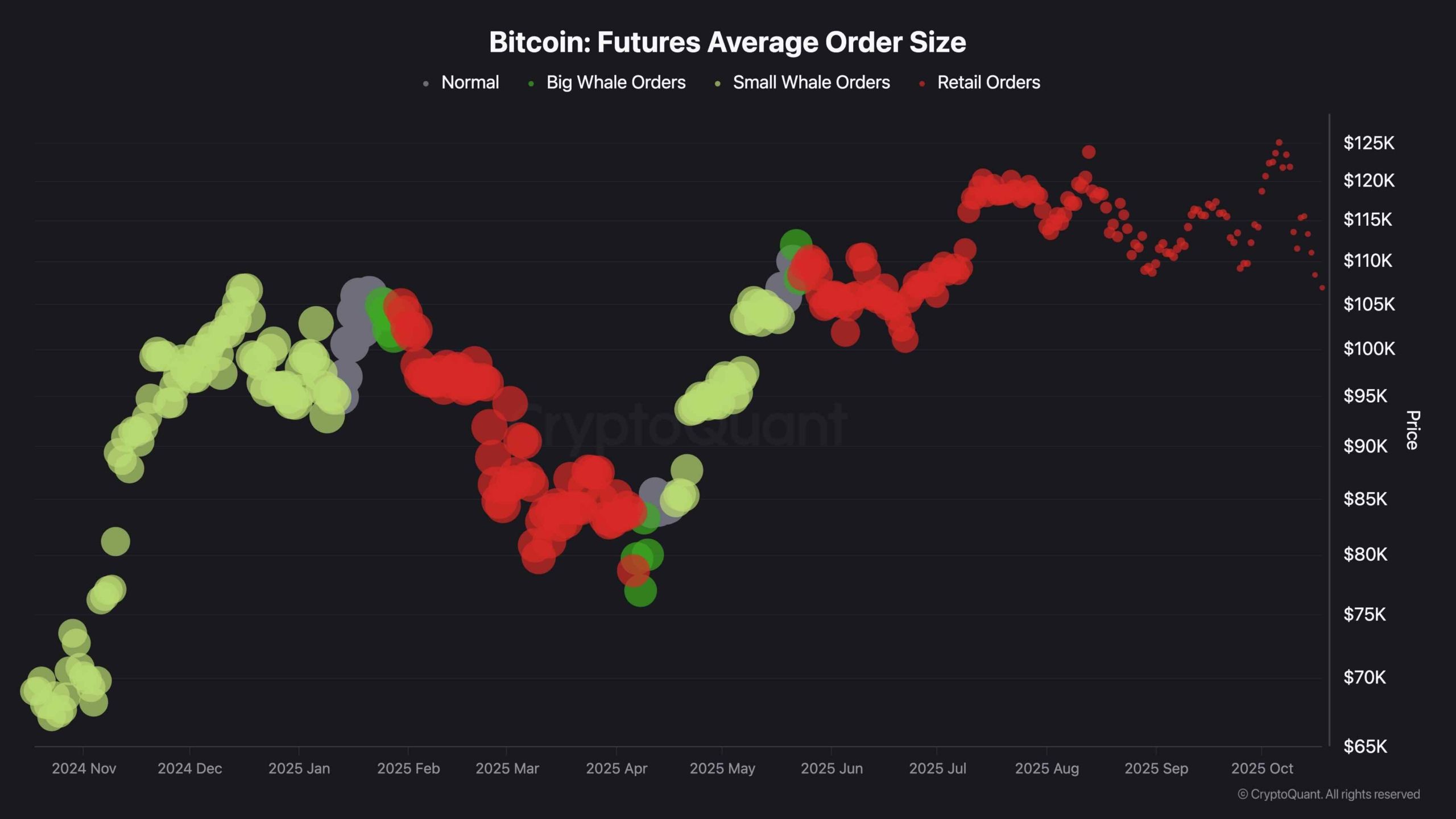

Bitcoin Price Analysis: First Bearish Signs Appear as BTC Falls by $20K From ATH

CryptoNewsNet·2025/10/18 21:15

Flash

13:28

Spot silver rises over 2% intraday, now trading at $70.40 per ounce.According to Odaily, spot silver has risen more than 2.00% intraday and is now quoted at $70.40 per ounce. New York silver futures have expanded their intraday gains to 3.00%, now quoted at $70.63 per ounce. (Golden Ten Data)

13:23

US ADP Weekly Employment Report: Private Sector Employer added an average of 11,500 employment positions per week in the periodBlockBeats News, December 23, U.S. ADP Weekly Employment Report: In the four weeks ending December 6, 2025, private-sector employers added an average of 11,500 jobs per week. (Golden Ten)

13:20

Ultiland: 10% of ARToken trading fees will be continuously used to buy back and burn ARTXForesight News reported that Ultiland recently disclosed details of its platform-level economic mechanism. According to established rules, 10% of ARToken transaction fees will be used to repurchase ARTX on the secondary market and directly burn them. This allocation ratio has been written into the platform's issuance and settlement mechanism and will be continuously implemented as a long-term operational rule.ARToken is the core vehicle used by Ultiland for the issuance and trading of real-world assets (RWA), covering non-standard asset types such as artworks and cultural IP. Under this mechanism, the fees generated from asset issuance and trading on the platform will continuously drive the repurchase and reduction of ARTX, structurally linking the supply changes of sovereign assets to the platform's actual business activities.The official statement pointed out that the above repurchase and burn arrangement is not a phased incentive or a temporary adjustment, but a fundamental constraint structure within the platform's economic model. Its core logic is to build a sustainable and verifiable deflationary mechanism through the path of "cash flow generated from asset issuance and trading → cash flow used to repurchase and burn sovereign assets according to rules," rather than relying solely on market expectations. After the disclosure of this mechanism, the price of ARTX saw a significant increase, with cumulative gains at one point nearly doubling. Some market participants believe that the clarification of the continuous repurchase and burn rule may further bind ARTX's supply logic to the platform's real business cash flow, enhancing market recognition of its long-term value structure.

News