News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

Bitcoin Demand Warning: CryptoQuant Signals Alarming Shift to Bear Market

Bitcoinworld·2025/12/19 10:57

Birth of a Parallel Financial System that Defied Institutions

Cryptotale·2025/12/19 10:51

Bitcoin rebounds on Japan rate hike as Arthur Hayes sees dollar at 200 yen

Cointime·2025/12/19 10:46

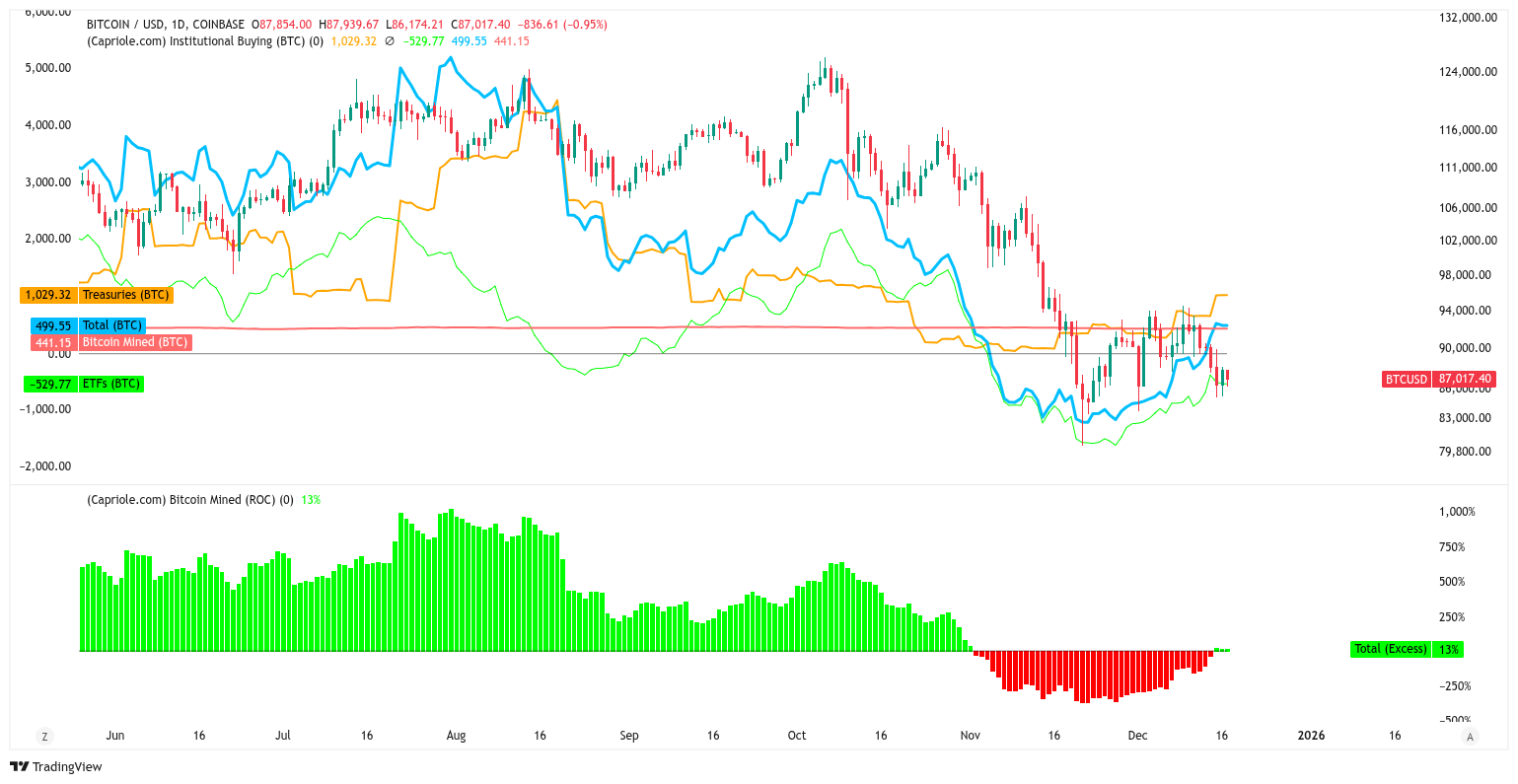

Bitcoin institutional buys flip new supply for the first time in 6 weeks

Cointime·2025/12/19 10:46

US Senate Confirms Michael Selig, Travis Hill to Lead CFTC and FDIC

Cryptotale·2025/12/19 10:30

Metaplanet ADR: A Strategic Gateway for US Investors to Access Bitcoin-Backed Assets

Bitcoinworld·2025/12/19 10:27

Analyst: The Most Hated XRP Rally Is About to Start. Here’s why

TimesTabloid·2025/12/19 10:24

Will the crypto industry be doing well in 2026?

BlockBeats·2025/12/19 10:11

What Is DOGEBALL? Inside the New Crypto Presale and Why Everyone Is Racing to Join the Whitelist

BlockchainReporter·2025/12/19 10:03

Matrixport Research: Four-Year Cycle Turning Signal Emerges, Bitcoin Enters Structural Adjustment Phase

Odaily星球日报·2025/12/19 10:02

Flash

19:51

Institutions Exit During Christmas Holiday, Spot Bitcoin ETF Sees Net Outflow of $782 MillionBlockBeats News, December 29 — Data shows that during Christmas week, US-listed spot bitcoin ETFs experienced large-scale capital outflows, with a cumulative net outflow of approximately $782 million. Among them, Friday saw a single-day net outflow of $276 million, marking the peak outflow during the holiday period. Specifically, BlackRock IBIT had a single-day outflow of nearly $193 million, Fidelity FBTC saw an outflow of about $74 million, and Grayscale GBTC continued its modest but persistent redemptions. As a result, the total assets under management of spot bitcoin ETFs dropped to around $113.5 billion, lower than the more than $120 billion seen earlier in December. It is worth noting that despite the capital outflows, the price of bitcoin has remained around $87,000, indicating that this round of withdrawals is more likely due to year-end asset rebalancing and reduced holiday liquidity, rather than market panic. Analysis points out that this marks the sixth consecutive trading day of net outflows for spot bitcoin ETFs, with cumulative outflows exceeding $1.1 billion, making it the longest outflow cycle since this autumn. However, institutional sources believe that holiday outflows are not uncommon, and as trading resumes in January, institutional funds may flow back in, making ETF capital trends more meaningful at that time.

19:50

Christmas Holiday Exodus Sees Spot Bitcoin ETF Outflows of $782 MillionBlockBeats News, December 29th, data shows that during the Christmas period, the listed U.S. spot Bitcoin ETF experienced large-scale fund outflows, with a cumulative net outflow of approximately $782 million. Among them, the single-day net outflow on Friday reached $276 million, the peak of outflows during the holiday season.

Specifically, BlackRock's BITO saw a single-day outflow of nearly $193 million, Fidelity's FBTC saw an outflow of about $74 million, and Grayscale's GBTC saw a slight but continuous fund redemption. As a result, the total assets under management of Bitcoin spot ETFs dropped to around $113.5 billion, below the $120 billion mark earlier in December.

It is worth noting that despite the fund outflows, the Bitcoin price still held around $87,000, indicating that this fund withdrawal was more likely due to year-end asset rebalancing and reduced holiday liquidity rather than market panic.

Analysis points out that this is the sixth consecutive trading day of net outflows for the spot Bitcoin ETF, with total outflows exceeding $1.1 billion, marking the longest outflow period since the fall. However, institutional professionals believe that holiday outflows are not uncommon, and as trading resumes in January, institutional funds may flow back, making the ETF fund flow direction more significant.

18:31

A certain whale sold 100,000 HYPE, then went long on 500,000 LIT using TWAP.According to ChainCatcher, MLM monitoring shows that about one hour ago, a certain wallet address sold 100,000 HYPE (approximately $2.5 million), then transferred the funds to another wallet, and initiated a 5-hour TWAP to long 500,000 LIT (approximately $1.73 million)—so far, 77,000 LIT (about $266,000) have been traded.

News