News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

We are also keeping an eye on some emerging projects, such as Hyperliquid. This project is reminiscent of the early development stage of Solana.

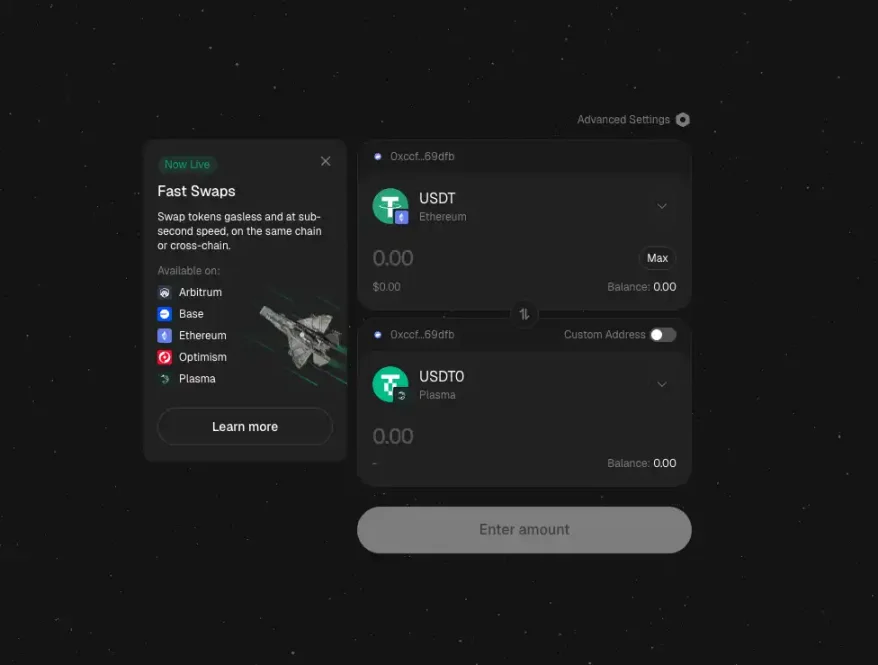

Plasma's subsidy of tens of millions of dollars.

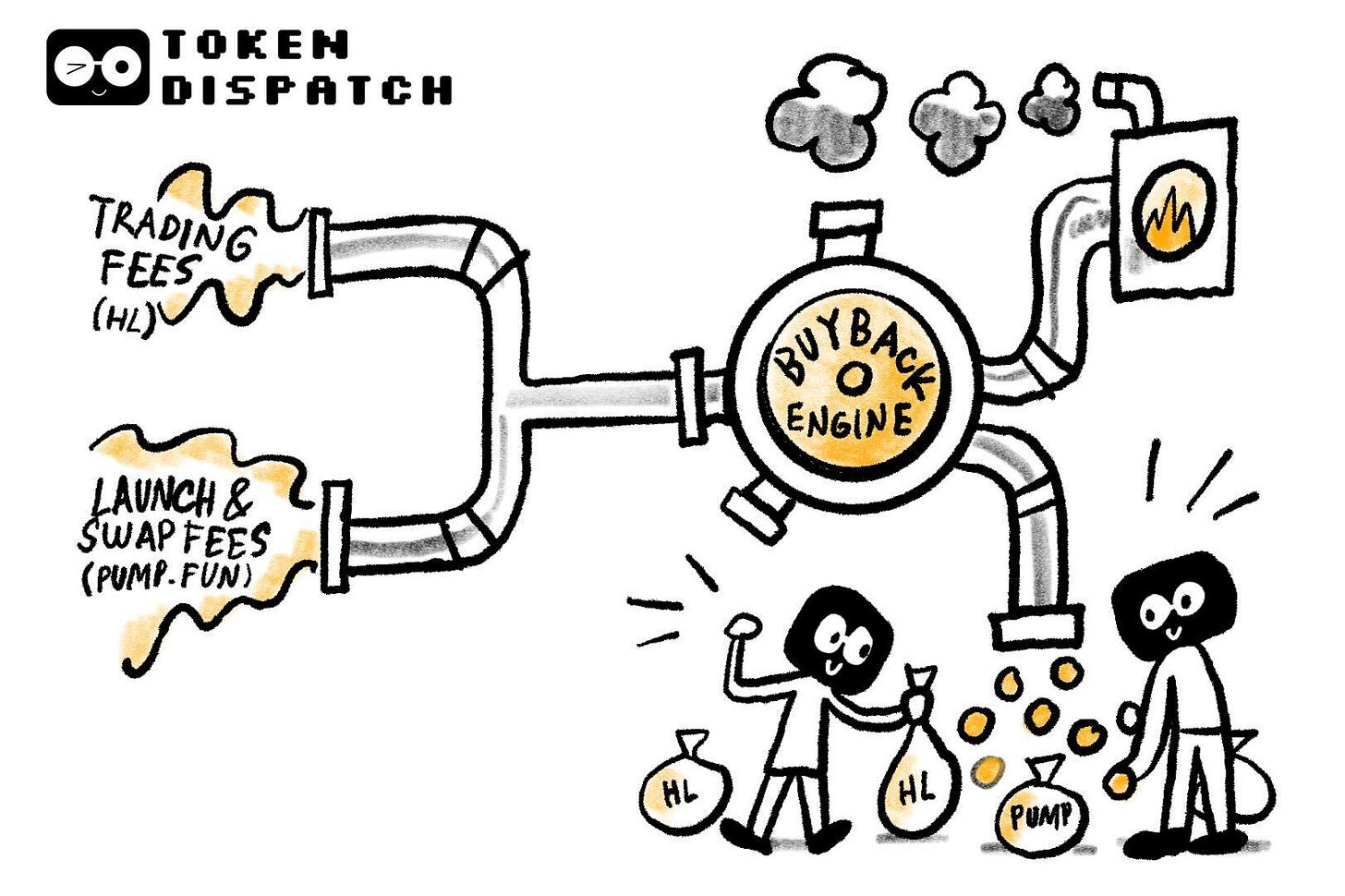

Exploring how Hyperliquid and Pump.fun leverage Apple’s buyback experience.

The BOB Gateway unlocks Bitcoin liquidity and earning opportunities for 11 major public blockchains by bridging native Bitcoin to LayerZero's wBTC-OFT standard.

As DeFi giants dominate and the efficiency of traditional financing models declines, can this full-stack trading ecosystem break the deadlock through innovative mechanisms?

The approval or rejection of Litecoin and SOL, which are the first to be decided, may determine subsequent market expectations.

- 09:05Data: A certain whale spent 10 million DAI to purchase 3,297 ETHAccording to ChainCatcher, monitored by Onchain Lens, a certain whale spent 10,000,000 USD in DAI to purchase 3,297 ETH at a buying price of 3,035 USD. Previously, this whale had bought 2,640 ETH for 10,790,000 USD and later sold them for 10,000,000 USD, incurring a loss of 790,000 USD. Currently, this whale's ETH holdings have increased by 657 ETH.

- 08:54Reuters: Strategy is in talks with the index provider regarding the possibility of being removed from MSCIJinse Finance reported, citing Reuters, that Strategy is in discussions with the index provider MSCI regarding the possibility of being removed from the MSCI index. The company's chairman, Michael Saylor, confirmed during an exchange event in Dubai, "We are participating in this process." MSCI will make a final decision on January 15. Strategy is currently a constituent of the MSCI USA Index and the MSCI World Index, and a large portion of its market capitalization is linked to benchmark indices through passive investment tools such as ETFs. JPMorgan pointed out in a report that being removed would raise questions about the company's future equity and debt financing costs and capabilities.

- 08:54Texas purchases approximately $5 million worth of BlackRock IBIT ETFJinse Finance reported, citing market sources: Texas has become the first state in the United States to allocate bitcoin exposure through a state government-managed investment fund—the state, under its newly established SB 21 bitcoin reserve framework, has purchased approximately $5 million worth of BlackRock IBIT ETF.