News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 3) | Trump Strongly Hints at Hassett as Next Fed Chair; Elon Musk Predicts a $38.3T “Crisis” Could Trigger a BTC Price Surge2Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise3BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

Crypto Ratio Breaks 0.35 as 2025 Projection Targets 1.20 Resistance

Cryptonewsland·2025/09/30 03:54

PEPE Chart Targets 401% Rally With Price Projection at $0.00003083

Cryptonewsland·2025/09/30 03:54

Pakistan PM Backs Crypto and AI as Future Tools

Pakistan's Prime Minister says crypto and AI are key tools for the country’s digital future.Crypto and AI Recognized at the TopA New Digital Vision for PakistanWhat It Means for Crypto in the Region

Coinomedia·2025/09/30 03:51

Powell is about to step down. Who will be the next "money-printing chief"?

From "Estée Lauder's son-in-law" to "Trump loyalist," how might the crypto stance of potential successors impact the market?

Chaincatcher·2025/09/30 03:37

Weekly News Preview | US to Release September Seasonally Adjusted Nonfarm Payrolls and Unemployment Rate Data

This week's key news highlights from September 29 to October 5.

Chaincatcher·2025/09/30 03:36

Institutional Demand and Firedancer Upgrade Fuel Solana Rally: Can SOL Hold $207 Support?

CryptoNewsNet·2025/09/30 03:36

SEC clears DePIN tokens as ‘fundamentally’ outside jurisdiction

CryptoNewsNet·2025/09/30 03:36

BitMine’s Lee calls ETH a ‘discount to the future,’ Bit Digital eyes $100M

CryptoNewsNet·2025/09/30 03:36

SEC Willing to Engage with Tokenized Asset Issuers, SEC’s Hester Peirce Says

CryptoNewsNet·2025/09/30 03:36

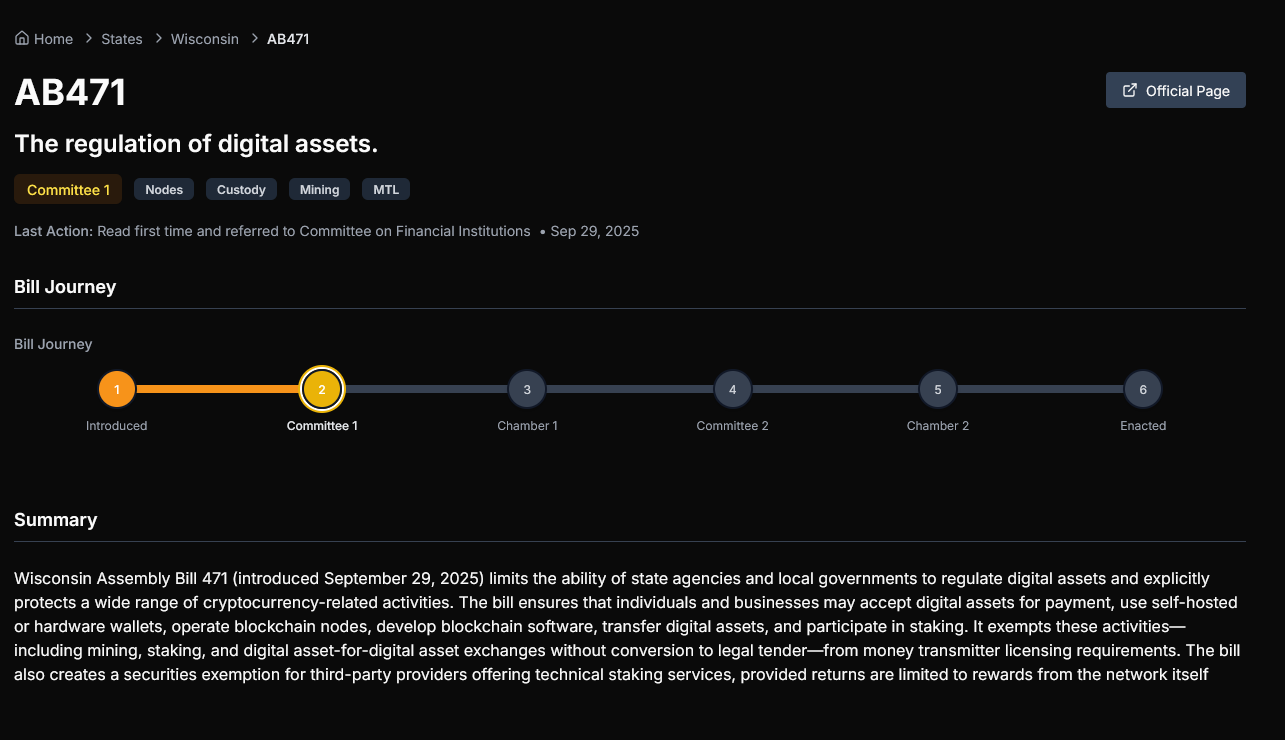

Wisconsin bill to exempt crypto businesses from money licenses

CryptoNewsNet·2025/09/30 03:36

Flash

- 19:25Bank of America predicts: the strong rally of the S&P 500 Index will fade in 2026Jinse Finance reported that Bank of America believes that after three consecutive years of double-digit returns, there is limited room for excess gains in the U.S. stock market in 2026. The bank predicts that the S&P 500 Index is likely to close at around 7,100 points in December next year, which is only about 4% higher than the closing price on Tuesday (December 2). Although U.S. companies are expected to achieve double-digit earnings growth, stock price returns will tend to be flat. Savita Subramanian, head of equity and quantitative strategy, believes there are risks, but does not anticipate a crash; compared to 2000, current investor equity allocations are lower, earnings growth supports returns, and enthusiasm for speculative stocks is not as extreme.

- 18:39Data: If ETH falls below $2,978, the cumulative long liquidation intensity on major CEXs will reach $1.44 billions.According to ChainCatcher, citing Coinglass data, if ETH falls below $2,978, the cumulative long liquidation volume on major CEXs will reach $1.44 billions. Conversely, if ETH breaks above $3,290, the cumulative short liquidation volume on major CEXs will reach $466 millions.

- 18:34Stable and Theo will jointly invest over 100 million USD in ULTRABlockBeats news, on December 3, stablecoin blockchain platform Stable and full-stack platform Theo announced a joint investment of over 100 millions USD in ULTRA, the only tokenized US Treasury strategy rated AAA by Particula. Institutional users will gain access to ULTRA investment opportunities through Theo's thBILL, which provides on-chain access to institutional-grade short-term US Treasuries, while ULTRA is supported by Libeara's compliant tokenization infrastructure.

News